How to Draft a Judicial Affidavit FOR LIBEL.

PRIVILEGED COMMUNICATION

The person examining me is Attorney with law office address at unit 419 Corporate 101 Mother Ignacia Quezon City. The examination is being undertaken at the same office address.

I am fully aware that my answers to my counsel’s questions are made under the penalty of perjury.

The pronoun ‘I, my, mine and me’ shall refer to the Accused.

OFFER OF TESTIMONY:

That my testimony is being offered:

(a) To establish the identity of the person who is the subjected of herein criminal complaint;

(b) To identify a documentary evidence that is material and relevant in herein case;

(c) To prove that at the time of preparing, signing, and filing of the Legal Petition Notice dated July 11, 1903, the accused has no evil intention and sick-motives to knowingly dishonour/discredit the image, character and reputation of the complainant;

(e) To demonstrate that the objective of Legal Petition Notice dated July 11, 1903 (as stated in its Preamble) is to bring justice, fair-play and transparency as well as expose, express and explain the malfeasant, misfeasant and nonfeasant actions knowingly executed by the concerned BIR Officials; and

(f) To confirm that the use of Legal Petition Notice dated July 11, 1903 as the primal evidence of the private complainant is contrary to law, public order, good moral and public policy.

DIRECT TESTIMONY:

The ensuing questions and answers shall constitute my direct testimonies in herein proceedings, thus:

QUESTION (Q; ATTORNEY): In what dialect would you like to be asked?

ANSWER (A; EMELINO T MAESTRO): In English language, Sir.

Q: Will you please state before this Honorable Court your name and other pertinent circumstances?

A: I am Mister Emelino T Maestro, of legal age, Filipino citizen, married and with postal address at Unit 419, Corporate 101, Mother Ignacia, Quezon City. I am a Certified Public Accountant, an author of various tax books, a resource speaker, lecturer, management and financial adviser, tax consultant and professor. Moreover, I am also the Founder of Tax Accounting Society and Auditor Ng Bayan (an Ombudsman-accredited Corruption Prevention Unit) which are now both inactive.

Q: Do you recall why you visited the Regional Director’s Office, Region No. 09228010922, Bureau of Internal Revenue, Quezon City; the Office of the Commissioner, National Office, Bureau of Internal Revenue, Quezon City; and the Office of the Ombudsman, Quezon City, on July 20, 2009 and the office of the private complainant (SUPER NGUSO) which is the Legal Division, Region No. 09228010922, Bureau of Internal Revenue, Quezon City on July 23, 2009?

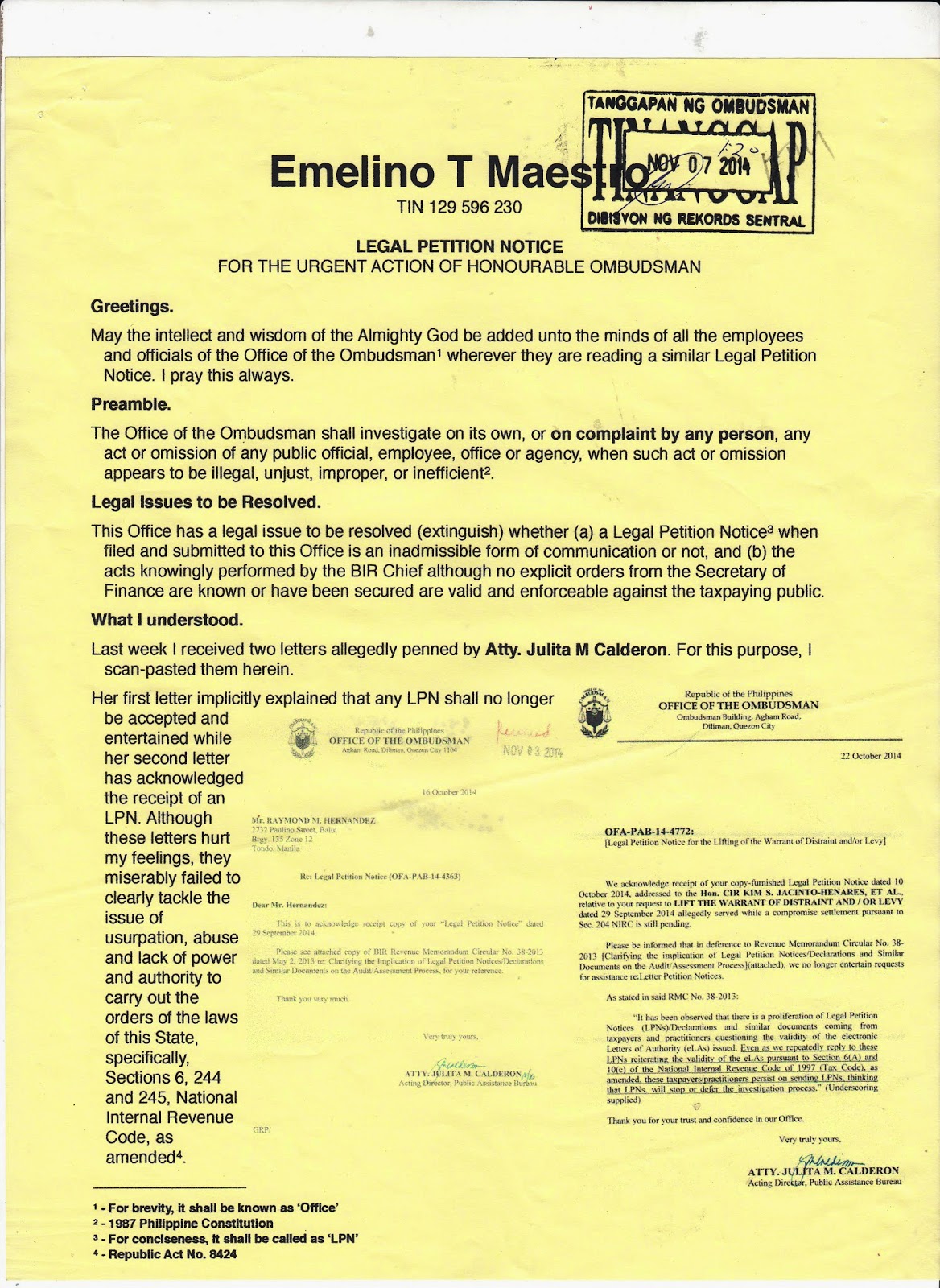

A: I knowingly visited the Regional Director’s Office and the Office of the Commissioner of the Bureau of Internal Revenue and the Office of the Ombudsman on July 20, 2009 in order to extinguish my legal obligations to my then-client, ETM TAX AGENT OFFICE Asia Phils, Inc. (ETM TAX AGENT OFFICE) and moreover, to comply with the mandate of the laws of the State that is to inform the higher ups of the private complainant and the Ombudsman of what is perceived to be the malicious acts of concerned BIR officials. Finally, I, after consciously considering the right of the private complainant to have access to the contents of my Legal Petition Notice dated July 11, 1903 (Annex 1), also visited his office and filed it thereat on July 23, 2013.

Q: Aside from serving personally your Legal Petition Notice dated July 11, 1903 to the Office of the Ombudsman, Office of the Commissioner of Internal Revenue, Office of the Regional Director, BIR Region No. 09228010922, Quezon City and Office of the Chief Legal Division, BIR Region No. 09228010922, Quezon City, had somebody else received directly from you a copy of your Legal Petition Notice dated July 11, 1903?

A: I did not furnish, neither supply, anyone other than the Offices of the persons that you mentioned.

Q: Why did you not personally provide the (1) Ombudsman, (2) Commissioner of Internal Revenue, (3) Regional Director of BIR Region No. 09228010922, Quezon City and (4) Chief Legal Division of BIR Region No. 09228010922, Quezon City a copy of your Legal Petition Notice dated July 11, 1903?

A: Because of the bureaucratic complexities, their respective Offices had assigned a regular employee whose regular and legal obligation is to accept and receive all the letters, protests, petitions, etc that are being filed/submitted by the taxpaying public/persons. The said employee would not allow you to have such letters, protest, petitions, etc to be filed to and accepted/received by their respective superiors/bosses for they would be charged of DERELICTION OF DUTY. Thus, to follow their Office’s prescribed procedures, I have to bring my communications directly to the person whose official duty is to accept and receive the same.

Q: You stated that you prepared, signed and filed the Legal Petition Notice dated July 11, 1903 in extinguishing your legal obligations to ETM TAX AGENT OFFICE and in complying with the laws of the State, would you please state what are these obligations and what laws of the State are you referring to?

A: According to my contract with ETM TAX AGENT OFFICE (Annex 2), the following are my obligations to it, thus.. (1) To cancel the subject matter [BIR Letter of Authority Numbered 43823 dated January 16, 2007 TY 2014] or (1) To verify the veracity of BIR assessments if such conforms with the procedural due process and are supported by laws and facts, (2) To gather information and evidences through legal researches in order to support the company’s factual and legal position on matters related to the subject, (3) To represent the company before the BIR on matters pertaining to the subject, and (4) To make ourselves available for routine consultation on matter related to the subject. Furthermore, Republic Acts No. 6770, 6713, 9485, and 8424, 1987 Administrative Code and New Civil Code are encouraging and enjoining the inhabitants of the Republic of the Philippines to inform and involve the superiors of errant and enterprising tax officials so that these superior officers may act on time and correct the acts of those errant and enterprising tax officials. Finally, I just followed the order of the Philippine Supreme Court in preparing, signing and filing my Legal Petition Notice dated July 11, 1903 to the already mentioned offices as I quote its wisdom “Tax laws are civil in nature. Under our Civil Code, acts executed against the mandatory provision of law are void, except when the law itself authorizes the validity of those acts. Failure to comply with Section 228 [NIRC] does not render the assessment void, but also finds no validation in any provision in the Tax Code. We cannot condone errant or enterprising tax officials, as they are expected to be vigilant and law-abiding.”

Q: So based on your written contract with ETM TAX AGENT OFFICE, you represented ETM TAX AGENT OFFICE before the BIR?

A: Because contracts, if their provisions are not contrary to the laws of the State and would not create damages to any party, form part of the legal system of the Republic of the Philippines, I am obliged to represent ETM TAX AGENT OFFICE before the BIR. I have no choice to speak of. Yes, Sir.

Q: Because of the Philippine Supreme Court’s order that says, “We cannot condone errant or enterprising tax officials, as they are expected to be vigilant and law-abiding.”, you prepared, signed and filed your Legal Petition Notice dated July 11, 1903 to the first-mentioned offices?

A: Yes, Sir.

Q: What is/are your purpose/s in preparing and signing your Legal Petition Notice dated July 11, 1903?

A: I made it clear to its recipients that my objective is “The essence is to bring justice, fair-play and transparency as well as expose, express and explain the malfeasant, misfeasant and nonfeasant actions knowingly executed by the concerned BIR Officials.” as the same is shown in its Preamble, 1st page. For this purpose and for the record, I quote the statement that can be found on page 948, Criminal Law, Book Two, 16th edition, 2006, Luis B. Reyes, “In Libel, it is essential that the intention of the offender in publishing the libellous matter was to discredit or dishonour the person allegedly libelled. If the matter charges as libellous is only an incident in an act which has another objective, the crime is not Libel.”

Q: Are you a BIR-accredited Tax Agent?

A: It is my conviction and belief that from 2001 up to the time that the BIR implemented the new procedural requirements of accrediting Tax Agents, yes, Sir.

Q: What is/are your basis/bases of being a BIR-accredited Tax Agent?

A: I can no longer locate my Tax Agent application form and its attachments but I offer the original letter of Atty Mario A Saldevar, Chief, Legal Division, Region No. 6, Bureau of Internal Revenue, Manila City dated February 27, 2009 stating among others that he signed my application and referred it to the National Accreditation Board (Annex 3). Accordingly, I explained in my Legal Petition Notice dated July 11, 1903 that there are two laws which would support my contention, namely... (1) Section 18, Book VII, Non Expiration of License, 1987 Administrative Code. -Where the licensee has made timely and sufficient application for the renewal of a license with reference to any activity of a continuing nature, the existing license shall not expire until the application shall have been finally determined by the agency, and (2) Section 9, Automatic Extension of Permits and Licenses, Republic Act No. 9485. -If a government office or agency fails to act on an application and/or request for renewal of a license, permit or authority subject for renewal within a prescribed period, said permit, license or authority shall automatically be extended until a decision is rendered on the application for renewal. Provided, That the automatic extension shall not apply when the permit, license, or authority covers activities which pose danger to public, health, public safety, public morals or to public policy including, but not limited to, natural resource extraction activities. These are my legal justifications for claiming that before the new BIR policies on accrediting Tax Agents have been implemented (by the generosity of the laws of the State), I was once a BIR-accredited Tax Agent. Finally as far as Tax-Agent-perjury is concerned, the Department of Justice per its Resolution to XV-03-INV-091-08725 had already acquitted me, viz; “Nonetheless, respondent’s Legal Petition Notice does not contain any allegation that he is in fact accredited. He only propose that based on the documents he submitted to the BIR, he should be considered accredited. A condition of law, hence, not per se perjurious.”

Q: Do you know the private complainant, Mr. SUPER NGUSO?

A: I don’t know him personally, Sir.

Q: As far as you know, what are the official duties and legal obligations of the private complainant?

A: I know him as the Chief, Legal Division of Region No. 09228010922, Bureau of Internal Revenue and among his duties are inscribed in Section 11, National Internal Revenue Code, as amended (NIRC). -It shall be the duty of every Revenue District Officer or other internal revenue officers and employees to ensure that all laws, and rules and regulations affecting national internal revenue are faithfully executed and complied with, and to aid in the prevention, detection and punishment of frauds of delinquencies in connection therewith and in Section 228, NIRC. -The taxpayers shall be informed in writing of the law and the facts on which the assessment is made; otherwise, the assessment shall be void. Accordingly, the Secretary of Finance, upon the recommendation of the Commissioner of Internal Revenue, specifically and strictly obliged him, pursuant to Revenue Administrative Order No. 10-2000 (Annex 4), to do/extinguish the following, viz; “(1) Administer regional plans, activities, standards, and other measure necessary to implement the legal prescribed by the National Office; (2) Ensure the uniform application of tax laws, regulation and court decisions; (3) Prepared and issue legal opinions based on established precedents and elevate to Legal Services cases for rulings or opinions which involve national policies or where there are no established precedents; (4) Process claims for tax credits/refund within its jurisdiction involving erroneous or illegal collection of taxes and protests involving questions of law and recommend appropriate action for approval of the Commissioner or duly authorized representative; (5) Evaluate offers of compromise settlement of assessments involving legal issues within its jurisdiction and make recommendations for approval of the Regional Evaluation Board; and (6) Assist in the conduct of hearing of administrative charges involving illegal enrichment cases against regional personnel and violation of Anti-Graft and Corrupt Practices Act

Q: Having said so, is it safe to say that he has no power and authority to assess and collect any internal revenue tax?

A: That is an understatement, Sir. He is playing a very material and relevant role in the assessment and collection of internal revenue taxes. As you already know, Sir, the Philippine Constitution has already stated that THE RULE OF TAXATION MUST BE UNIFORM AND EQUITABLE which in my own understanding is that there must be a written-uniform rule before an assessment and collection of taxes shall knowingly be pursued. Since my Legal Petition Notice dated July 11, 1903 raised factual and legal issues, I am engaging and enjoining him and his Office to resolve the said legal issues. These legal issues are (1) the irregularity of the BIR-letter of authority wherein the power to assess a tax originated and (2) the request for him to provide and supply not me but through me, the ETM TAX AGENT OFFICE, the legal basis in assessing and collecting 2014 withholding taxes. These acts/things are within the armpits/jurisdiction of the Legal Division. Regional Offices, Bureau of Internal Revenue. He is there, pursuant to Revenue Administrative Order No. 10-2000, to be the last resort of a taxpayer in cases that the latter feels and thinks that an abuse of power/authority in the assessment and collection of taxes has consciously been performed.

Q: What does the acronym ‘CLD’ refer to?

A: Chief Legal Division, Sir.

Q: Does it refer to the private complainant, Mr. SUPER NGUSO?

A: Generally speaking, Sir, it refers to all Chiefs Legal Division and not exclusively to the private complainant. However, in my Legal Petition Notice dated July 11, 1903, there are two (2) CLDs, namely SUPER NGUSO and NARROW HEADED.

Q: In your statement ‘Evidences on records showed that the RDO, GS, RO, CLD, CAD and RD had no official orders from the SOF which expressed and explained that the 2014 withholding taxes presumably determined using the jeopardy assessment is not included in the immunities provided by RA 9480’, is the term CLD referred to the private complainant?

A: No, Sir. It refers to CLD NARROW HEADED as I stated in item 5, IV. PROPOSED CONCLUSION, my Legal Petition Notice dated July 11, 1903.

Q: In your statement, ‘Clearly, the 2014 withholding deficiency tax assessment is unacceptable and illegal because it failed not only to follow the above jurisprudence but also, most importantly, the acts of RO, GS, RD, RDO, CAD and CLD violated the BIR internal rules and guidelines as shown below: a.] RMC 48-90 - Issuance of a deficiency tax assessment without verification of the taxpayer’s records is illegal and b.] RMO 16-80 - Jeopardy or table assessment should never be resorted to and report of investigation should be supported by documentary evidences and authorities.’, is the acronym ‘CLD’ meant for the private complainant?

A: No, Sir. It refers to CLD NARROW HEADED as I stated in item 5, IV. PROPOSED CONCLUSION, my Legal Petition Notice dated July 11, 1903.

Q: What do you consider your Legal Petition Notice dated July 11, 1903?

A: It is an official document intended for the use of the Bureau of Internal Revenue.

Q: What does the term ‘official document’ mean?

A: According to Revenue Memorandum Order No. 53-98 (Annex 5), in relation to Section 270, NIRC, all official document may not be removed or used for personal purposes without securing first the written approval form the proper authority. For conveniency, I copy-pasted Section 15, RMO 53-98, viz; “A. All records and documents in the custody of revenue officers and employees are in their custody for official purposes only. It is unlawful to remove or conceal, alter, mutilate, obliterate, or destroy records or documents or to remove with intent of performing any of the above action. Employees must not remove records and documents from official files without approval from proper authority. Working papers, copies of reports and other official records and documents shall be promptly sent to file when no longer needed for official purposes. Disposal or destruction of records and documents is to be made in accordance with established requirements, and b. Employees shall be held responsible for the loss, disappearance, or theft of official documents when attributable to negligence or carelessness. Employees are cautioned against leaving official documents unprotected in automobiles, leaving them in public conveyances, in rest rooms, in taxpayer’s offices, etc. Recovery of documents may no necessarily be a mitigating circumstance after the loss.

Q: The term ‘proper authority’ refers to whom?

A: According to Section 7, NIRC, the term ‘proper authority’ refers to the Honorable Commissioner of Internal Revenue

Q: Okay. If the official documents such as your Legal Petition Notice dated July 11, 1903 was used other than for official purposes only, what would happen to the documents?

A: The unlawful use of a public/official document that is for personal purposes shall make the said document spurious or illegally acquired. Because private complainant used a BIR’s official document for personal purposes, then, it may be concluded that his primal evidence is unlawful.

Q: What was really your intention when you wrote and submitted the subject communication to the Office of the Ombudsman?

A: I wrote and submitted my Legal Petition Notice dated July 11, 1903 to the Office of the Ombudsman in compliance with Republic Act No. 6770 and the National Policy ‘Magsumbong sa Ombudsman” as well as to double check if the specified and prescribed procedures of the Bureau of Internal Revenue are being diligently applied by the concerned revenue officers. Moreover, it is written on the face of the said communication my objective that is “The essence is to bring justice, fair-play and transparency as well as expose, express and explain the malfeasant, misfeasant and nonfeasant actions knowingly executed by the concerned BIR Officials.”

Q: What was really your intention when you wrote and submitted the subject communication to the Bureau of Internal Revenue?

A: I wrote and submitted my Legal Petition Notice dated July 11, 1903 to the following offices, namely (a) Office of the Regional Director, BIR Region No. 09228010922 (b) Legal Division, of BIR Region No. 09228010922 and (c) Office of the Commissioner of Internal Revenue, BIR National Office to propagate the following, viz; “The essence is to bring justice, fair-play and transparency as well as expose, express and explain the malfeasant, misfeasant and nonfeasant actions knowingly executed by the concerned BIR Officials.” which is clearly and completely stated on the face of the said communication.

Q: In your Legal Petition Notice dated July 11, 1903, you mentioned, ‘The Respondent, being rumored to be one of the brightest legal minds in the BIR, had shown ‘dense and dull’ in this instant case.’, what does the term “dense and dull’ mean to you?

A: I invented the word “dense and dull’ by combining the words ‘dense’, ‘and’ and ‘dull’ and enclosing them with open and close quotations. This word ‘dense and dull’ means “PUNUNG PUNO NG INIISIP KAYA NAHIRAPANG UMUNAWA.”

Q: How did the complainant arrive in thinking and describing the term ‘dense and dull’ as similar to the term ‘stupid’?

A: From the surrounding circumstances, I believe, this is how SUPER NGUSO arrive at his definition for the term ‘dense and dull’, viz;

1. First, he divided the term ‘dense and dull’ into ‘dense’ and ‘dull’ (two terms)

2. Second, for the term ‘dense’, using a computer and its internet connection, he googled it

3. Third, from the millions of websites that offer numerous synonyms for the term ‘dense’, he chose ‘

http://thinkexist.com/dictionary/meaning/dense/“

4. From the said website, he picked up its synonyms, viz;

having the constituent parts massed or crowded together;

(a) close;

(b) compact;

(c) thick;

(d) containing much matter in a small space;

(e) heavy;

(f) opaque;

(g) as, a dense crowd;

(h) a dense forest;

(i) a dense fog.

(j) stupid;

(k) gross;

(l) crass;

(m) as, dense ignorance.

5. Fourth, from the above list of possible meanings of the term ‘dense’ he picked up what he thinks and believes would benefit him that is the term “stupid” which is in the eleventh (11th) place from its nearest common meaning.

Q: Do you have proof that would support your contention?

A: For this purpose, I used a computer and its internet connection. Then I typed on its browser the term ‘dense definition’. Then, twenty two million one hundred thousand (22,100,000) websites appeared. All of these websites offered a definition for the term ‘dense’.

Q: What does your exercise mean?

A: It means that the complainant, SUPER NGUSO, did not know the common meaning of the term ‘dense’. In fact, in his Judicial Affidavit notarised in February 29, 2055, he affirmed and confirmed that he only learned its meaning from the Merriam-Webster’s Dictionary of Synonyms.

Q: Have you tried to look for the meaning of the term ‘dense’ in the same dictionary?

A: Yes, in fact, I tried the same research techniques that he usually does. I got a computer in order to connect to the website of Merriam-Webster’s Dictionary of Synonyms. Then, I found out that the synonyms for the term ‘dense’ do not include the word ‘stupid’, viz;

(a) compact

(b) crowded

(c) close

(d) jam-packed

(e) packed

(f) serried

(g) thick

(h) tight

Q: What can you say about that?

A: The word ‘stupid’ does not really the perceived and common meaning of the term ‘dense’. And, the twenty two million one hundred thousand (22,100,000) websites that offer a meaning or definition for the term ‘dense’ are very relevant and material evidences which tell the reader hereof that the common people, in their daily lives, do not associate the term ‘dense’ to the word ‘stupid’. It is only the complainant who is so intense to equate the term “dense” to the word “stupid”. In a democratic country, just like the Philippines, the majority shall always the winner.

Q: Before going to the other issue, do you have something to add?

A: Yes, as the Annex 6 would affirm, the website ‘

http://thinkexist.com/dictionary/meaning/dense/“ cannot be located from the top three (3) pages of the Google’s search engine. This would mean that the complainant, SUPER NGUSO, consciously had chosen a website that would suit his intriguing intentions. In my mind, this is so malicious.

Q: For the term ‘dull’, how did the complainant arrive in thinking and believing that it is synonymous with the word ‘stupid’?

A: This is how SUPER NGUSO arrive at his definition for the term ‘dull’, viz;

1. First, using a computer and its internet connection, he googled it

2. Second, from the twelve million two hundred thousand (12,200,000) websites that offer numerous synonyms for the term ‘dull’, he chose ‘

http://ardictionary.com/Dull/10165' (Annex 9)

3. From the said website, he picked up its synonyms, viz;

(a) slow of understanding

(b) wanting readiness of appreciation

(c) stupid

(d) doltish

(d) blockish

4. Third, from the above list of possible meanings of the term ‘dull’ he picked up what he thinks and believes would benefit him that is the term “stupid” which is in the third (3rd) place from the perceived and common meaning of the term “dull”.

Q: What can you say about that?

A: If the complainant is truly an agent of the law because he is a lawyer, he would do the best two (2) things, viz;

1. First, he would go to the Philippine Supreme Court’s website and not to any types of websites in order to search for the the term ‘dense and dull’ and not for the terms ‘dense’ and ‘dull’.

2. Lastly, he should only use one website for clarity and consistency and would not use three (3) types of websites, viz;

(a) ‘

http://thinkexist.com/dictionary/meaning/dense/“

(b) ‘

http://ardictionary.com/Dull/10165'

(c) ‘website of Merriam-Webster’s Dictionary of Synonyms’

3. Most importantly, the use of three (3) websites to locate the best-definition of the terms ‘dense’ and ‘dull’ that would suit an intriguing and personal interest is a manifestation that their meanings are not really ‘stupid’ because the perceived, standard and common meaning of a term that is usually used by Filipinos in their daily lives does not need a simple dictionary to know/apply its intended meaning.

In fact, in his Judicial Affidavit notarised in February 29, 2055, he affirmed and confirmed that he only learned its meaning from Merriam-Webster’s Dictionary of Synonyms.

Q: Have you tried to look for the meaning of the term ‘dull’ in the same dictionary?

A: Yes, in fact, I tried the same research techniques that he usually does (Annex 8). I got a computer in order to connect to the website of Merriam-Webster’s Dictionary of Synonyms. Then, I found out that the synonyms for the term ‘dull’ do not include the word ‘stupid’, viz;

(a) blunt

(b) blunted

(c) dullied

(d) obtuse

Q: How would it affect the case at bar?

A: The Annex 9 would affirm that the website ‘

http://ardictionary.com/Dull/10165' cannot be located from the top three (3) pages of the Google’s search engine. This would mean that the complainant, SUPER NGUSO, consciously had chosen a website that would suit his intriguing intentions. In my mind, this is so vengeful.

Q: Do you have anything to add?

A: Yes, this Judicial Affidavit is knowingly prepared, signed and released to amend, modify, revoke and repeal all my previously released statements that directly contradict the statements hereof as well as to support and supplement other statements that may help me to bring justice in the process. To reiterate, “In Libel, it is essential that the intention of the offender in publishing the libellous matter was to discredit or dishonour the person allegedly libelled. If the matter charges as libellous is only an incident in an act which has another objective, the crime is not Libel. (page 948, Criminal Law, Book Two, 16th edition, 2006, Luis B. Reyes)”

Attorney: That is all for the witness, Your Honor.