On the roof of Luxent Hotel, the staff of ETM Tax Agent Office, after a successful lecture/training on how to handle a Deficiency VAT Assessment, took time to make a 'selfie'. For the past 30 years, ETM had chronicled the PRE-DETERMINED deficiency VAT assessment that all the Revenue Officers of the Bureau of Internal Revenue are using all over the Philippines. Do you want to know the legal/true approach to reproach them? Call now to register. TWENTY SEATS ONLY. INVESTMENT FEE P20,000/pax, plus 12% VAT.

On the roof of Luxent Hotel, the staff of ETM Tax Agent Office, after a successful lecture/training on how to handle a Deficiency VAT Assessment, took time to make a 'selfie'. For the past 30 years, ETM had chronicled the PRE-DETERMINED deficiency VAT assessment that all the Revenue Officers of the Bureau of Internal Revenue are using all over the Philippines. Do you want to know the legal/true approach to reproach them? Call now to register. TWENTY SEATS ONLY. INVESTMENT FEE P20,000/pax, plus 12% VAT.Ignorance is the basic foundation of graft and corruption. The BIR-corrupt brigade is maximizing its full potential and profitability. Fishes find strength, courage and competence in numbers. They had conquered their predators/enemies by grouping together in order to make them bigger than their enemies. You too can become bigger than the fear that lingered in your minds and hearts. Join 'JuanTALKS' now and share your knowledge and experiences to other Filipinos.

Thursday 31 July 2014

Deficiency VAT Assessment, How to legally/truly reproach it? - Emelino T Maestro

On the roof of Luxent Hotel, the staff of ETM Tax Agent Office, after a successful lecture/training on how to handle a Deficiency VAT Assessment, took time to make a 'selfie'. For the past 30 years, ETM had chronicled the PRE-DETERMINED deficiency VAT assessment that all the Revenue Officers of the Bureau of Internal Revenue are using all over the Philippines. Do you want to know the legal/true approach to reproach them? Call now to register. TWENTY SEATS ONLY. INVESTMENT FEE P20,000/pax, plus 12% VAT.

On the roof of Luxent Hotel, the staff of ETM Tax Agent Office, after a successful lecture/training on how to handle a Deficiency VAT Assessment, took time to make a 'selfie'. For the past 30 years, ETM had chronicled the PRE-DETERMINED deficiency VAT assessment that all the Revenue Officers of the Bureau of Internal Revenue are using all over the Philippines. Do you want to know the legal/true approach to reproach them? Call now to register. TWENTY SEATS ONLY. INVESTMENT FEE P20,000/pax, plus 12% VAT.Wednesday 30 July 2014

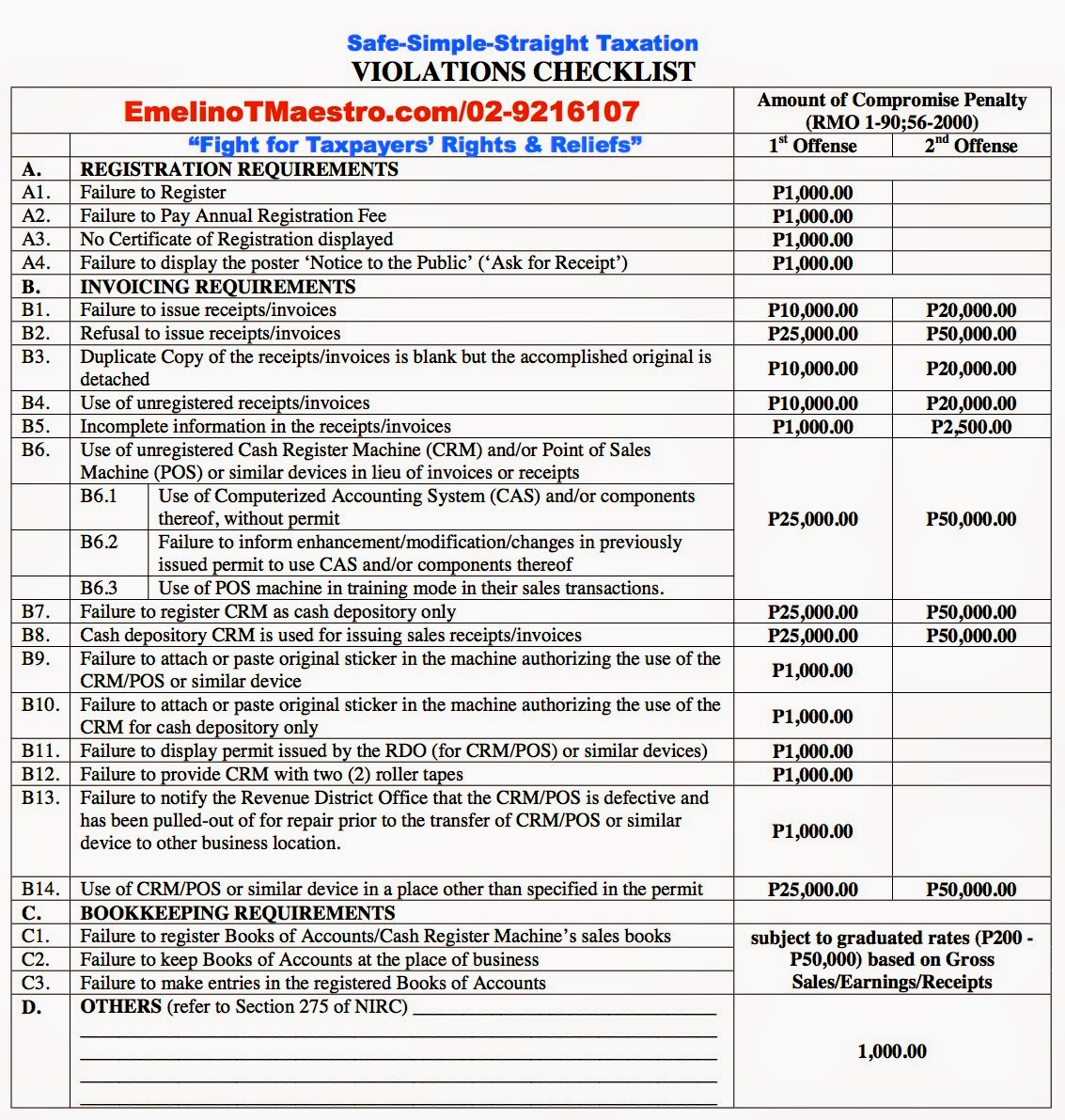

BIR's Violation Checklist, the Tax Mapping Problems -Emelino T Maestro 09989793922

BIR's Violation Checklist, the Tax Mapping Problems

BIR's Violation Checklist, the Tax Mapping Problems-Emelino T Maestro 09989793922

The picture depicts the possible penalties that you may be charged of when a BIR-tax mapping activity has been concluded. Although, many Tax Mappers would disagree that the amount of penalties/fines stated therein is final and executory. The NIRC/law doesn't agree with their position.

The question is, 'What would you do when you received the attached Violation Checklist?' Many answered that they would just pay the fines stated therein in order not to antagonise the revenue officers. Some would go beyond what the laws say that is to bride them is the easiest way.

To know the true/legal ways of handling this scenario, please ask Sonia at 439 3918 and she may teach you how to go around it by way of paying a reduced amount as compared to the said Violation Checklist and not bribing any BIR's tax mapper.

FYI, many taxpayers whose businesses are located in the provinces, are paying P5,000 for a tax mapping sticker so that the Tax Mappers would no longer visit their stores, businesses and offices at the times of a tax mapping activity. You're invited to attend the following important events of your lives, viz;

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

RELEVANT WARNING...

DISAPPOINTING/DISGUSTING TO SEE/LEARN THAT THE PRIORITY OF SOME OF THE MEMBERS OF A CPA ORGANISATION IS TO GET A PICTURE-OPPORTUNITY WITH BIR OFFICIALS HAVING QUESTIONABLE CHARACTER/BEHAVIOUR. Meaning, these CPAs have also a selfish and an unhealthy motive/character/behaviour so beware and be aware who are these CPAs. Don't associate yourselves with them. LEARN THE TAX CODE. TRUST BUT VERIFY.

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

Monday 28 July 2014

Did Corruption Increase in the Philippines? - Emelino T Maestro

Dumami ang Kurap?

Ipinalalabas sa mga TV, Radio, internet at dyaryo na dumami ang mga Kurap. Totoo iyon, from 90 million people in the Philippines, eh naging 100 million na tayo... therefore, talagang dadami ang kurap kasi iyong mga anak ng Kurap ay naging Kurap na rin. Iyong nakatagong Kurap ay nailantad na... So mas marami na tayong nakikita, naririnig, nababasa at nai-internet na Kurap. Sa BIR, mabilis ng makilatis ang Kurap basta lagi lang gamitin ang apat na batayan ... Acronym "MIND" - Malfeasance (di pagsunod sa Batas), Incompetence (bobo sa raw 4), Negligence (pagpapabaya sa trabaho at responsibilidad), Delinquency (tahasang di pagsunod at paggawa ng tama sa panahong kinakailangan ito)

Divide and Conquer ang ginagawa ng BIR.... Mga Katax, mag-unite tayo at labanan natin ng sabay-sabay ang Kurapsyon sa BIR... For your information, ang tools ng mga Kurap sa BIR ay gumagamit din ng eLetter of Authority, Letter Notice, Subpeona Duces Tecum, Oplan Kandado, Tax Mapping, etc.....

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

Ipinalalabas sa mga TV, Radio, internet at dyaryo na dumami ang mga Kurap. Totoo iyon, from 90 million people in the Philippines, eh naging 100 million na tayo... therefore, talagang dadami ang kurap kasi iyong mga anak ng Kurap ay naging Kurap na rin. Iyong nakatagong Kurap ay nailantad na... So mas marami na tayong nakikita, naririnig, nababasa at nai-internet na Kurap. Sa BIR, mabilis ng makilatis ang Kurap basta lagi lang gamitin ang apat na batayan ... Acronym "MIND" - Malfeasance (di pagsunod sa Batas), Incompetence (bobo sa raw 4), Negligence (pagpapabaya sa trabaho at responsibilidad), Delinquency (tahasang di pagsunod at paggawa ng tama sa panahong kinakailangan ito)

Divide and Conquer ang ginagawa ng BIR.... Mga Katax, mag-unite tayo at labanan natin ng sabay-sabay ang Kurapsyon sa BIR... For your information, ang tools ng mga Kurap sa BIR ay gumagamit din ng eLetter of Authority, Letter Notice, Subpeona Duces Tecum, Oplan Kandado, Tax Mapping, etc.....

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

Friday 25 July 2014

BIR FILED 7 TAX EVASION CASES INCLUDING PUNONGBAYAN & ARAULLO's CPA-AUDITOR

BIR FILED 7 TAX EVASION CASES INCLUDING

PUNONGBAYAN & ARAULLO's CPA-AUDITOR

Commissioner Kim S. Jacinto-Henares, together with DCIR

Estela V. Sales and DOJ Undersecretary Francisco F. Baraan

III, briefs members of tri-media on the seven (7) cases filed

by the BIR during the regular RATE Press Briefing con-

ducted last July 17 at the DOJ Forum Building Executive

Lounge. Four (4) taxpayers were charged with tax evasion

for questionable related-transactions during taxable year

2010. CANDENSE UNLIMITED, INC., together with its

President LEONARDO D. DE PAZ, and GLOBAL HILLS

PHILIPPINES, including its President RENE B. BELARMINO

and Treasurer AMADO B. ULBANO, were slapped with a P 199.52 Million and P 82.96 Million tax evasion case, respectively, after investigators discovered that they failed to declare with the BIR income payments received in 2010 from TRIDHARMA MARKETING CORPORATION (TMC), as evidenced by checks issued by TMC amounting to P 309.33 Million (net of P 37.12 Million VAT) and P 128.62 Million (net of P 15.43 Million VAT), respectively. CARLOS ADRAQUE CHING, sole proprietor of ETHERIA TRADING, was sued for tax evasion with an aggregate tax liability covering taxable years 2009 and 2010 amounting to P 5.28 Billion. He received income payments from TMC amounting to P 1.8 Billion in 2009 and P 4.94 Billion in 2010. CHING, however, substantially under-declared his correct taxable sales by P 1.8 Billion (100%) in 2009 and by P 4.94 Billion (100%) in 2010 for Income Tax. He likewise grossly under-declared his sales by P 1.8 Billion (100%) in 2009 and by P 1.45 Billion (59%) in 2010 for VAT. TMC, its President RENE D. DELA CALZADA, Treasurer MICHAEL U. LU, General Manager RAMONA MARIE C. TAN and CPA MAILENE SIGUE-BISNAR were found to have violated the Tax Code. TMC and its responsible corporate officers were charged with a P 4.47 Billion tax evasion case after an analysis of the documents gathered by investigators, which included the Summary List of Purchases filed by TMC for 2010 with the BIR showing purchases it made from ETHERIA TRADING amounting to P 4.94 Billion, invoices from its big ticket supplier, ETHERIA TRADING and Import Entry documents, revealed that TMC managed to defeat payment of its correct taxes by under-declaring its income (Per Audit - P 7.097 Billion : Per TMC Report - P 6.966 Billion) and by overstating its expenses (Per Audit - P 1.801 Billion : Per TMC Report - P 6.755 Billion) in 2010. BISNAR, on the other hand, was included in the charge sheet for signing and certifying the 2010 audited financial statements of respondent TMC despite the essential misstatement of facts therein as well as the clear omission therein with respect to TMC’s actual taxable income. Three (3) more delinquent individual and corporate taxpayers from Revenue Region (RR) No. 7-Quezon City and RR No. 8- Makati City were charged with “Willful Failure to Pay Taxes.” Quezon City taxpayers RICARDO LLORENTE VISBE of BAY SPECIALIST TRADING and SEA TRADERS LOGISTICS & WARE- HOUSING CENTER CORP. and its responsible corporate officers - President ALEX CHUA and Treasurer CLARA FE DELOS REYES - were found liable for long overdue deficiency taxes amounting to P 94.12 Million (2004) and P 70.08 Million (2006), respectively, while Makati City taxpayer PALADIN PROTECTIVE & SECURITY SERVICES, INC., including its President DOMINADOR LIM and Managing Director ANTONIO Z. HENSON JR., owed the government deficiency taxes for the fiscal year ended June 30, 2010 amounting to P 48.26 Million. (BIR Weekender Briefs)

IMPORTANT ANNOUNCEMENT

If you want to have

1. an Appetising curriculum vitae (CV)

2. an Enviable experiences and skills

3. a High-paying work

4. an Owned and controlled business that's making profit

To all the undergraduates of any course from PLM, PUP or other schools, be an APPRENTICE of Emelino T Maestro and know the Ecosystem of his Negosyo, --Tax Accounting Office and/or Tax Consulting Enterprise. Let's talk about your potentials that would place you in the radar/map of the high-paying employers. Or, best, an owner of your own Tax Accounting Office or Tax Consulting Enterprise.

BENEFITS.

For the chosen few, ETM shall

(1) pay for their matriculation fee/s

(2) shoulder their uniform (up to P4,000) expense/s

(3) provide a P2,000 monthly stipend

A REAL COMPETITION

THAT ONLY THE FEW SHALL SURVIVE AND SUCCEED

FIRST CHALLENGE. Send your CV to the email shown in the picture or call Dhen at 09228010922. This Offer is valid only up to August 15, 2014 5 pm. Successful applicants shall receive an email or text message from ETM himself.

SECOND CHALLENGE. Share, email, broadcast, announce and advertise this Competition to all the undergraduates from any school/university/college.

This is not for everyone or for the Losers.

This is for the Winners, Survivors who ETM believes to be you.

PUNONGBAYAN & ARAULLO's CPA-AUDITOR

Commissioner Kim S. Jacinto-Henares, together with DCIR

Estela V. Sales and DOJ Undersecretary Francisco F. Baraan

III, briefs members of tri-media on the seven (7) cases filed

by the BIR during the regular RATE Press Briefing con-

ducted last July 17 at the DOJ Forum Building Executive

Lounge. Four (4) taxpayers were charged with tax evasion

for questionable related-transactions during taxable year

2010. CANDENSE UNLIMITED, INC., together with its

President LEONARDO D. DE PAZ, and GLOBAL HILLS

PHILIPPINES, including its President RENE B. BELARMINO

and Treasurer AMADO B. ULBANO, were slapped with a P 199.52 Million and P 82.96 Million tax evasion case, respectively, after investigators discovered that they failed to declare with the BIR income payments received in 2010 from TRIDHARMA MARKETING CORPORATION (TMC), as evidenced by checks issued by TMC amounting to P 309.33 Million (net of P 37.12 Million VAT) and P 128.62 Million (net of P 15.43 Million VAT), respectively. CARLOS ADRAQUE CHING, sole proprietor of ETHERIA TRADING, was sued for tax evasion with an aggregate tax liability covering taxable years 2009 and 2010 amounting to P 5.28 Billion. He received income payments from TMC amounting to P 1.8 Billion in 2009 and P 4.94 Billion in 2010. CHING, however, substantially under-declared his correct taxable sales by P 1.8 Billion (100%) in 2009 and by P 4.94 Billion (100%) in 2010 for Income Tax. He likewise grossly under-declared his sales by P 1.8 Billion (100%) in 2009 and by P 1.45 Billion (59%) in 2010 for VAT. TMC, its President RENE D. DELA CALZADA, Treasurer MICHAEL U. LU, General Manager RAMONA MARIE C. TAN and CPA MAILENE SIGUE-BISNAR were found to have violated the Tax Code. TMC and its responsible corporate officers were charged with a P 4.47 Billion tax evasion case after an analysis of the documents gathered by investigators, which included the Summary List of Purchases filed by TMC for 2010 with the BIR showing purchases it made from ETHERIA TRADING amounting to P 4.94 Billion, invoices from its big ticket supplier, ETHERIA TRADING and Import Entry documents, revealed that TMC managed to defeat payment of its correct taxes by under-declaring its income (Per Audit - P 7.097 Billion : Per TMC Report - P 6.966 Billion) and by overstating its expenses (Per Audit - P 1.801 Billion : Per TMC Report - P 6.755 Billion) in 2010. BISNAR, on the other hand, was included in the charge sheet for signing and certifying the 2010 audited financial statements of respondent TMC despite the essential misstatement of facts therein as well as the clear omission therein with respect to TMC’s actual taxable income. Three (3) more delinquent individual and corporate taxpayers from Revenue Region (RR) No. 7-Quezon City and RR No. 8- Makati City were charged with “Willful Failure to Pay Taxes.” Quezon City taxpayers RICARDO LLORENTE VISBE of BAY SPECIALIST TRADING and SEA TRADERS LOGISTICS & WARE- HOUSING CENTER CORP. and its responsible corporate officers - President ALEX CHUA and Treasurer CLARA FE DELOS REYES - were found liable for long overdue deficiency taxes amounting to P 94.12 Million (2004) and P 70.08 Million (2006), respectively, while Makati City taxpayer PALADIN PROTECTIVE & SECURITY SERVICES, INC., including its President DOMINADOR LIM and Managing Director ANTONIO Z. HENSON JR., owed the government deficiency taxes for the fiscal year ended June 30, 2010 amounting to P 48.26 Million. (BIR Weekender Briefs)

IMPORTANT ANNOUNCEMENT

If you want to have

1. an Appetising curriculum vitae (CV)

2. an Enviable experiences and skills

3. a High-paying work

4. an Owned and controlled business that's making profit

To all the undergraduates of any course from PLM, PUP or other schools, be an APPRENTICE of Emelino T Maestro and know the Ecosystem of his Negosyo, --Tax Accounting Office and/or Tax Consulting Enterprise. Let's talk about your potentials that would place you in the radar/map of the high-paying employers. Or, best, an owner of your own Tax Accounting Office or Tax Consulting Enterprise.

BENEFITS.

For the chosen few, ETM shall

(1) pay for their matriculation fee/s

(2) shoulder their uniform (up to P4,000) expense/s

(3) provide a P2,000 monthly stipend

A REAL COMPETITION

THAT ONLY THE FEW SHALL SURVIVE AND SUCCEED

FIRST CHALLENGE. Send your CV to the email shown in the picture or call Dhen at 09228010922. This Offer is valid only up to August 15, 2014 5 pm. Successful applicants shall receive an email or text message from ETM himself.

SECOND CHALLENGE. Share, email, broadcast, announce and advertise this Competition to all the undergraduates from any school/university/college.

This is not for everyone or for the Losers.

This is for the Winners, Survivors who ETM believes to be you.

Pamantasan ng Lungsod ng Maynila at Polytechnic University of the Philippines - Emelino T Maestro (02-9216107)

If you want to have

1. an Appetising curriculum vitae (CV)

2. an Enviable experiences and skills

3. a High-paying work

4. an Owned and controlled business that's making profit

To all the undergraduates of any course from PLM, PUP or other schools, be an APPRENTICE of Emelino T Maestro and know the Ecosystem of his Negosyo, --Tax Accounting Office and/or Tax Consulting Enterprise. Let's talk about your potentials that would place you in the radar/map of the high-paying employers. Or, best, an owner of your own Tax Accounting Office or Tax Consulting Enterprise.

BENEFITS.

For the chosen few, ETM shall

(1) pay for their matriculation fee/s

(2) shoulder their uniform (up to P4,000) expense/s

(3) provide a P2,000 monthly stipend

A REAL COMPETITION

THAT ONLY THE FEW SHALL SURVIVE AND SUCCEED

FIRST CHALLENGE. Send your CV at 09989793922@MaestroTaxation.org or call Dhen at 09228010922. This Offer is valid only up to August 15, 2014 5 pm. Successful applicants shall receive an email/text message from ETM himself.

SECOND CHALLENGE. Share, email, broadcast, announce and advertise this Competition to all the undergraduates from any school/university/college.

This is not for everyone or for the Losers.

This is for the Winners, Survivors who ETM believes to be you.

1. an Appetising curriculum vitae (CV)

2. an Enviable experiences and skills

3. a High-paying work

4. an Owned and controlled business that's making profit

To all the undergraduates of any course from PLM, PUP or other schools, be an APPRENTICE of Emelino T Maestro and know the Ecosystem of his Negosyo, --Tax Accounting Office and/or Tax Consulting Enterprise. Let's talk about your potentials that would place you in the radar/map of the high-paying employers. Or, best, an owner of your own Tax Accounting Office or Tax Consulting Enterprise.

BENEFITS.

For the chosen few, ETM shall

(1) pay for their matriculation fee/s

(2) shoulder their uniform (up to P4,000) expense/s

(3) provide a P2,000 monthly stipend

A REAL COMPETITION

THAT ONLY THE FEW SHALL SURVIVE AND SUCCEED

FIRST CHALLENGE. Send your CV at 09989793922@MaestroTaxation.org or call Dhen at 09228010922. This Offer is valid only up to August 15, 2014 5 pm. Successful applicants shall receive an email/text message from ETM himself.

SECOND CHALLENGE. Share, email, broadcast, announce and advertise this Competition to all the undergraduates from any school/university/college.

This is not for everyone or for the Losers.

This is for the Winners, Survivors who ETM believes to be you.

BIR-SDT, Reason of Hospitalisation - Emelino T Maestro (02-439 3918)

BIR-SDT, Reason of Hospitalisation

www.Facebook.com/Kataxpayer

Recently, several taxpayers have been hospitalised either due to hypertension, mental anguish, unbearable stress or unknown/imaginary diseases. When asked when these discomforts occurred, 'At the time a Bureau of Internal Revenue (BIR) had served them a Subpoena Duces Tecum (SDT).'

So what does it mean when you received a BIR SDT? For the past 30 years of ETM practice as a TAXNOCRAT, a BIR SDT means that the assigned Revenue Officer (RO), Group Supervisor (GS) and Revenue District Officer (RDO) (1) have given up their claim to push you to bribe them and (2) are avoiding the tedious work of determining your true/correct amount of taxes.

In other language, their plan is to issue you a DEFICIENCY TAX ASSESSMENT BASED ON THE BEST EVIDENCE OBTAINABLE RULE (Jeopardy Assessment) which for all legal purposes and intent, is GOOD FOR YOU. Meanwhile, the Legal Division Chief became a depository/repository of your books and other accounting records. He/She is just a Record Custodian - nothing more, nothing less. So YOU SHOULD NOT BE AFRAID OR MUST REJOICE WHENEVER A BIR SDT IS BEING SERVED OR ALREADY IN YOUR POSSESSION.

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

www.Facebook.com/Kataxpayer

Recently, several taxpayers have been hospitalised either due to hypertension, mental anguish, unbearable stress or unknown/imaginary diseases. When asked when these discomforts occurred, 'At the time a Bureau of Internal Revenue (BIR) had served them a Subpoena Duces Tecum (SDT).'

So what does it mean when you received a BIR SDT? For the past 30 years of ETM practice as a TAXNOCRAT, a BIR SDT means that the assigned Revenue Officer (RO), Group Supervisor (GS) and Revenue District Officer (RDO) (1) have given up their claim to push you to bribe them and (2) are avoiding the tedious work of determining your true/correct amount of taxes.

In other language, their plan is to issue you a DEFICIENCY TAX ASSESSMENT BASED ON THE BEST EVIDENCE OBTAINABLE RULE (Jeopardy Assessment) which for all legal purposes and intent, is GOOD FOR YOU. Meanwhile, the Legal Division Chief became a depository/repository of your books and other accounting records. He/She is just a Record Custodian - nothing more, nothing less. So YOU SHOULD NOT BE AFRAID OR MUST REJOICE WHENEVER A BIR SDT IS BEING SERVED OR ALREADY IN YOUR POSSESSION.

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

Wednesday 23 July 2014

INSURANCE BROKERS/AGENTS ARE WELCOME - EMELINO T MAESTRO

We are brothers and sisters as far as taxation is concerned. Our enemy is the BIR-corruption. Its Spear is OUR IGNORANCE. Let’s Shield one another.

ETM is so sorry to report that for this year, the Bureau of Internal Revenue will continue to devastate your smooth-sailing business operations. Ending, it would eat a chunk of your hard-earned cash.

As a leader, you can make a big difference by way of encouraging your fellow leaders, brothers and sisters to empower themselves with the true/correct knowledge on how to successfully survive and properly supervise the BIR’s interferences. You can also make your TaxBookkeeping Straight, Safe and Simple by way of USING THE COMPUTER-BASED ACCOUNTING SOFTWARE THAT ETM DESIGNED & DEVELOPED. This offer is NOT FOR EVERYONE but only to those who are committed to value their life, livelihood and success. ETM believes that person is you.

For TAX-BASIS software, All persistent Agents/Brokers are welcome.

Call ETM now at 02-439 3918/921 6107.

www.Facebook.com/Kataxpayer

ETM is so sorry to report that for this year, the Bureau of Internal Revenue will continue to devastate your smooth-sailing business operations. Ending, it would eat a chunk of your hard-earned cash.

As a leader, you can make a big difference by way of encouraging your fellow leaders, brothers and sisters to empower themselves with the true/correct knowledge on how to successfully survive and properly supervise the BIR’s interferences. You can also make your TaxBookkeeping Straight, Safe and Simple by way of USING THE COMPUTER-BASED ACCOUNTING SOFTWARE THAT ETM DESIGNED & DEVELOPED. This offer is NOT FOR EVERYONE but only to those who are committed to value their life, livelihood and success. ETM believes that person is you.

For TAX-BASIS software, All persistent Agents/Brokers are welcome.

Call ETM now at 02-439 3918/921 6107.

www.Facebook.com/Kataxpayer

CTA TKOed PACMAN, Again (July 22, 2014) - EMELINO T MAESTRO

CTA TKOed PACMAN, Again (July 22, 2014)

According to the Philippine Inquirer, the Court of Tax Appeals has ordered Manny 'PacMan' Pacquiao to either post a CASH Bond of 3.2 billion pesos or pay P419,000,000 to a Surety Bond Corporation so that the BIR-issued Warrant of Garnishment/Levy/Distraint shall be lifted. "A VERY EXPENSIVE ORDER FOR A VERY SMALL BENEFIT"

Mga Kwentuhan sa Barberya...

Barbero: Yan talaga ang mangyayari kapag ala kang alam kundi pagbobosing.

Tindero: Kasi iniaasa na lang sa mga CPAs at lawyers ang paghawak sa kaso. Talaga bang may mga alam sa batas ang mga CPAs at lawyers na ito?

Barbero: Sana di na lang dinala sa CTA. Eh di wala sanang babayaran na P3,200,000,000 o P419,000,000. May commission kaya sila doon?

Tindero: Dapat talaga na ang asahan natin ay ang ating mga sarili at huwag kung sino-sino. Huwag makinig sa kanila. Sabi ni Taxnocrat ETM "Trust but Verify" and mag-aral ng tunay na taxation. Hindi sa mga libreng seminars na tinatawagan ka na at tinatakot ka pa para lang umattend ka. Sa huli, sayang kasi ala namang matutunan.

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

According to the Philippine Inquirer, the Court of Tax Appeals has ordered Manny 'PacMan' Pacquiao to either post a CASH Bond of 3.2 billion pesos or pay P419,000,000 to a Surety Bond Corporation so that the BIR-issued Warrant of Garnishment/Levy/Distraint shall be lifted. "A VERY EXPENSIVE ORDER FOR A VERY SMALL BENEFIT"

Mga Kwentuhan sa Barberya...

Barbero: Yan talaga ang mangyayari kapag ala kang alam kundi pagbobosing.

Tindero: Kasi iniaasa na lang sa mga CPAs at lawyers ang paghawak sa kaso. Talaga bang may mga alam sa batas ang mga CPAs at lawyers na ito?

Barbero: Sana di na lang dinala sa CTA. Eh di wala sanang babayaran na P3,200,000,000 o P419,000,000. May commission kaya sila doon?

Tindero: Dapat talaga na ang asahan natin ay ang ating mga sarili at huwag kung sino-sino. Huwag makinig sa kanila. Sabi ni Taxnocrat ETM "Trust but Verify" and mag-aral ng tunay na taxation. Hindi sa mga libreng seminars na tinatawagan ka na at tinatakot ka pa para lang umattend ka. Sa huli, sayang kasi ala namang matutunan.

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

SCHOLARSHIP GRANTS TO UNDERGRADUATES FROM ANY UNIVERSITY/SCHOOL/COLLEGE - EMELINO T MAESTRO

If you want to have

1. an Appetising curriculum vitae (CV)

2. an Enviable experiences and skills

3. a High-paying work

4. an Owned and controlled business that's making profit

To all the undergraduates of any course from PLM, PUP or other schools, be an APPRENTICE of Emelino T Maestro and know the Ecosystem of his Negosyo, --Tax Accounting Office and/or Tax Consulting Enterprise. Let's talk about your potentials that would place you in the radar/map of the high-paying employers. Or, best, an owner of your own Tax Accounting Office or Tax Consulting Enterprise.

BENEFITS.

For the chosen few, ETM shall

(1) pay for their matriculation fee/s

(2) shoulder their uniform (up to P4,000) expense/s

(3) provide a P2,000 monthly stipend

A REAL COMPETITION

THAT ONLY THE FEW SHALL SURVIVE AND SUCCEED

FIRST CHALLENGE. Send your CV at 09989793922@MaestroTaxation.org or call Dhen at 09228010922. This Offer is valid only up to August 15, 2014 5 pm. Successful applicants shall receive an email/text message from ETM himself.

SECOND CHALLENGE. Share, email, broadcast, announce and advertise this Competition to all the undergraduates from any school/university/college.

This is not for everyone or for the Losers.

This is for the Winners, Survivors who ETM believes to be you.

1. an Appetising curriculum vitae (CV)

|

| EMELINO T MAESTRO, TAX GURU |

3. a High-paying work

4. an Owned and controlled business that's making profit

To all the undergraduates of any course from PLM, PUP or other schools, be an APPRENTICE of Emelino T Maestro and know the Ecosystem of his Negosyo, --Tax Accounting Office and/or Tax Consulting Enterprise. Let's talk about your potentials that would place you in the radar/map of the high-paying employers. Or, best, an owner of your own Tax Accounting Office or Tax Consulting Enterprise.

BENEFITS.

For the chosen few, ETM shall

(1) pay for their matriculation fee/s

(2) shoulder their uniform (up to P4,000) expense/s

(3) provide a P2,000 monthly stipend

A REAL COMPETITION

THAT ONLY THE FEW SHALL SURVIVE AND SUCCEED

FIRST CHALLENGE. Send your CV at 09989793922@MaestroTaxation.org or call Dhen at 09228010922. This Offer is valid only up to August 15, 2014 5 pm. Successful applicants shall receive an email/text message from ETM himself.

SECOND CHALLENGE. Share, email, broadcast, announce and advertise this Competition to all the undergraduates from any school/university/college.

This is not for everyone or for the Losers.

This is for the Winners, Survivors who ETM believes to be you.

BIR-SDT, Reason of Hospitalisation.... www.Facebook.com/Kataxpayer

BIR-SDT, Reason of Hospitalisation

www.Facebook.com/Kataxpayer - EMELINO T MAESTRO

Recently, several taxpayers have been hospitalised either due to hypertension, mental anguish, unbearable stress or unknown/imaginary diseases. When asked when these discomforts occurred, 'At the time a Bureau of Internal Revenue (BIR) had served them a Subpoena Duces Tecum (SDT).'

So what does it mean when you received a BIR SDT? For the past 30 years of ETM practice as a TAXNOCRAT, a BIR SDT means that the assigned Revenue Officer (RO), Group Supervisor (GS) and Revenue District Officer (RDO) (1) have given up their claim to push you to bribe them and (2) are avoiding the tedious work of determining your true/correct amount of taxes.

In other language, their plan is to issue you a DEFICIENCY TAX ASSESSMENT BASED ON THE BEST EVIDENCE OBTAINABLE RULE (Jeopardy Assessment) which for all legal purposes and intent, is GOOD FOR YOU. Meanwhile, the Legal Division Chief became a depository/repository of your books and other accounting records. He/She is just a Record Custodian - nothing more, nothing less. So YOU SHOULD NOT BE AFRAID OR MUST REJOICE WHENEVER A BIR SDT IS BEING SERVED OR ALREADY IN YOUR POSSESSION.

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

www.Facebook.com/Kataxpayer - EMELINO T MAESTRO

Recently, several taxpayers have been hospitalised either due to hypertension, mental anguish, unbearable stress or unknown/imaginary diseases. When asked when these discomforts occurred, 'At the time a Bureau of Internal Revenue (BIR) had served them a Subpoena Duces Tecum (SDT).'

So what does it mean when you received a BIR SDT? For the past 30 years of ETM practice as a TAXNOCRAT, a BIR SDT means that the assigned Revenue Officer (RO), Group Supervisor (GS) and Revenue District Officer (RDO) (1) have given up their claim to push you to bribe them and (2) are avoiding the tedious work of determining your true/correct amount of taxes.

In other language, their plan is to issue you a DEFICIENCY TAX ASSESSMENT BASED ON THE BEST EVIDENCE OBTAINABLE RULE (Jeopardy Assessment) which for all legal purposes and intent, is GOOD FOR YOU. Meanwhile, the Legal Division Chief became a depository/repository of your books and other accounting records. He/She is just a Record Custodian - nothing more, nothing less. So YOU SHOULD NOT BE AFRAID OR MUST REJOICE WHENEVER A BIR SDT IS BEING SERVED OR ALREADY IN YOUR POSSESSION.

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

INCOMPLETE INFORMATION IN THE RECEIPTS/INVOICES -EMELINO T MAESTRO

INCOMPLETE INFORMATION IN THE RECEIPTS/INVOICES

-EMELINO T MAESTRO

According to the BIR REGULATIONS (RMO 1-90, RMO 56-2000 & RMO 19-2007), if you failed to write down in any of your Official Receipt (sales of services) or Sales Invoice (sales of goods/properties) the required information, the initial penalty is P5,000 while for the second offence, the penalty is P10,000. Should there be a third and succeeding repetitions, a criminal complaint against you shall be filed at the Department of Justice.

So what are the required information? Pursuant to Sections 113, 237 and 238, National Internal Revenue Code, the three, but not encompassing, basic information that must be written in every Official Receipt and Sales Invoice are (1) the Name of the Buyer/Purchaser, (2) his/her/its complete name and (3) his/her/its complete address.

So what you should do if your Buyer/Purchaser failed/refused to supply the above information? The answer shall be revealed to you via email if you shall do two things, viz; (1) place your email address at the Comment space hereof and (2) share this to your friends via email. Failure to do these two things would disqualify you to get the LEGAL/CORRECT ANSWER. This Offer is valid until August 31, 2014, 5 pm. Answer-emailing will start on September 5, 2014.

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

RELEVANT WARNING...

DISAPPOINTING/DISGUSTING TO SEE/LEARN THAT THE PRIORITY OF SOME OF THE MEMBERS OF A CPA ORGANISATION IS TO GET A PICTURE-OPPORTUNITY WITH BIR OFFICIALS HAVING QUESTIONABLE CHARACTER/BEHAVIOUR. Meaning, these CPAs have also selfish and unhealthy motives/character/behaviour so beware and be aware who are these CPAs. Don't associate yourselves with them. LEARN THE TAX CODE. TRUST BUT VERIFY.

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

-EMELINO T MAESTRO

According to the BIR REGULATIONS (RMO 1-90, RMO 56-2000 & RMO 19-2007), if you failed to write down in any of your Official Receipt (sales of services) or Sales Invoice (sales of goods/properties) the required information, the initial penalty is P5,000 while for the second offence, the penalty is P10,000. Should there be a third and succeeding repetitions, a criminal complaint against you shall be filed at the Department of Justice.

So what are the required information? Pursuant to Sections 113, 237 and 238, National Internal Revenue Code, the three, but not encompassing, basic information that must be written in every Official Receipt and Sales Invoice are (1) the Name of the Buyer/Purchaser, (2) his/her/its complete name and (3) his/her/its complete address.

So what you should do if your Buyer/Purchaser failed/refused to supply the above information? The answer shall be revealed to you via email if you shall do two things, viz; (1) place your email address at the Comment space hereof and (2) share this to your friends via email. Failure to do these two things would disqualify you to get the LEGAL/CORRECT ANSWER. This Offer is valid until August 31, 2014, 5 pm. Answer-emailing will start on September 5, 2014.

IMPORTANT TOPIC

eLetter of Authority, Letter Notice & Subpoena Duces Tecum

RELEVANT DATES "Aug 14-15, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Mapping, Benchmarking & Oplan Kandado

RELEVANT DATES "Aug 18 & 19, 2014, RCBC Plaza, Makati"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprisess

RELEVANT DATES "Aug 21-22, 2014, Luxent Hotel, QC"

IMPORTANT TOPIC

Estate Planning/Wealth Protection

RELEVANT DATES "Aug 25, 27 & 29, 2017, Luxent Hotel, QC"

IMPORTANT TOPIC

Tax Accounting Course for VAT-reg. Small & Medium Enterprises

RELEVANT DATES "Sep 25-26, 2014, SEDA, Davao City"

RELEVANT WARNING...

DISAPPOINTING/DISGUSTING TO SEE/LEARN THAT THE PRIORITY OF SOME OF THE MEMBERS OF A CPA ORGANISATION IS TO GET A PICTURE-OPPORTUNITY WITH BIR OFFICIALS HAVING QUESTIONABLE CHARACTER/BEHAVIOUR. Meaning, these CPAs have also selfish and unhealthy motives/character/behaviour so beware and be aware who are these CPAs. Don't associate yourselves with them. LEARN THE TAX CODE. TRUST BUT VERIFY.

www.Facebook.com/Kataxpayer

0989793922@MaestroTaxation.Org

Saturday 19 July 2014

Correct Waiver of Stature of Limitations (Compromise/Abatement) -Emelino T Maestro.com

WAIVER OF THE DEFENSE OF THE STATUTE OF LIMITATIONS OF THE NATIONAL INTERNAL REVENUE CODE

09989793922@MaestroTaxation.org, if your lawyers resulted in bribing the BIR instead of solving your tax problems legally

I,___________________________

204(A) and (B),

and

223 of the National Internal Revenue Code of 1997, as amended, and consent to the collection of the tax or taxes due, including the delinquency increments, for the said years which may be found due after approval of its/my request for compromise settlement/abatement of penalties at any time before or after the lapse of the period of limitations fixed by said sections of the Tax Code, but not after

December 31, 2014

.

The intent and purpose of this waiver is to afford the Commissioner of Internal Revenue ample time to carefully consider the instant request of the undersigned taxpayer against the aforesaid liabilities. It is understood, however, that the undersigned taxpayer neither, by the execution of this waiver, admit in advance the correctness of the assessments made for the year/s above mentioned nor waive the right to use any of the legal remedies

accorded by the law pursuant to the applicable provisions of the Tax Code, as amended

and/or forego its/my legal actions against the incompetence, malfeasance, misfeasance and nonfeasance that the assigned Revenue Officer/s had previously/knowingly perpetuated.

Executed this day of , 20 in the City of , Philippines.

___________________________

Taxpayer or Authorized Representative

Accepted:

___________________________

Commissioner of Internal Revenue

(Signature over Printed Name)

Date: _______________, 20___

BIR Penalty for Giving Cash Advances/Deposits -Emelino T Maestro.com

REVENUE MEMORANDUM CIRCULAR NO. 16-2013

SUBJECT : Clarifying the Tax Implications and Recording of Deposits/Advances for Expenses Received by Taxpayers not covered by Revenue Memorandum Circular No. 89-2012

TO : All Internal Revenue Officers and Others Concerned

visit www.Facebook.com/Kataxpayer to know more about your tax rights and how to handle BIR letter of authority, BIR letter notice and BIR subpoena duces mecum

call ETM Tax Agent Office 439 3918 or 921 6107

This Circular is being issued to provide guidelines to be observed in accounting and recording of deposits/advances for the payment of the pertinent expenses received by taxpayers other than General Professional Partnerships (GPP) covered by Revenue Memorandum Circular (RMC) No. 89-2012 dated December 28, 2012.

I. Policies and Guidelines

Deposits/Advances Part of Gross Receipts

When cash deposits or advances are received by taxpayers other than GPP covered by RMC 89-2012 from the Client/Customer, a corresponding Official Receipt shall be issued. The amount received shall be booked as Income and shall form part of the Gross Receipts and subject to Value-added Tax (VAT) or Percentage Tax (Gross Receipt Tax), if applicable, and shall in turn be deductible as expense by the Client/Customer provided that it is duly substantiated by Official Receipts pursuant to Section 34 (A) (1) of the Tax Code.

Claim for Deduction of Expenses

Receipts incurred, paid for and issued in the name of the taxpayer shall be recorded as its own expenses for income tax purposes. These expenses shall be claimed as deductions from gross income provided these are duly substantiated by Official Receipts/Invoices issued by third-party establishments.

SUBJECT : Clarifying the Tax Implications and Recording of Deposits/Advances for Expenses Received by Taxpayers not covered by Revenue Memorandum Circular No. 89-2012

TO : All Internal Revenue Officers and Others Concerned

visit www.Facebook.com/Kataxpayer to know more about your tax rights and how to handle BIR letter of authority, BIR letter notice and BIR subpoena duces mecum

call ETM Tax Agent Office 439 3918 or 921 6107

This Circular is being issued to provide guidelines to be observed in accounting and recording of deposits/advances for the payment of the pertinent expenses received by taxpayers other than General Professional Partnerships (GPP) covered by Revenue Memorandum Circular (RMC) No. 89-2012 dated December 28, 2012.

I. Policies and Guidelines

Deposits/Advances Part of Gross Receipts

When cash deposits or advances are received by taxpayers other than GPP covered by RMC 89-2012 from the Client/Customer, a corresponding Official Receipt shall be issued. The amount received shall be booked as Income and shall form part of the Gross Receipts and subject to Value-added Tax (VAT) or Percentage Tax (Gross Receipt Tax), if applicable, and shall in turn be deductible as expense by the Client/Customer provided that it is duly substantiated by Official Receipts pursuant to Section 34 (A) (1) of the Tax Code.

Claim for Deduction of Expenses

Receipts incurred, paid for and issued in the name of the taxpayer shall be recorded as its own expenses for income tax purposes. These expenses shall be claimed as deductions from gross income provided these are duly substantiated by Official Receipts/Invoices issued by third-party establishments.

February 8, 2013

1

Income Payments are subject to appropriate Withholding Taxes

All Client/Customer shall, upon payment of deposits/advances, withhold tax at the rate prescribed in Revenue Regulations No. (RR) 2-98, as amended, which shall be remitted/paid on or before the 10th day of the following month using the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) [BIR Form No. 1601E] except for taxes withheld for the month of December of each year, which shall be filed on or before January 15 of the following year pursuant to RR 2-98, as amended. For those filing using the Electronic Filing and Payment System (EFPS), the regulations pertaining to EFPS filers shall apply.

Issuing Official Receipts for the Deposit and Advances

An Official Receipt shall be issued for every deposit and advances pursuant to Section 113 of the Tax Code. The Official Receipt shall cover the entire amount which the Client/Customer pays.

For VAT Taxpayers, the VAT Official Receipt will constitute the Output Tax for taxpayers other than GPP and in turn, the input tax of its client/customer.

II. PRO-FORMA ENTRIES

Upon receipt of the deposit/advances, the same shall be treated and recorded as outright Income.

Accounting entries in the Books of the Taxpayer other than GPP

All Client/Customer shall, upon payment of deposits/advances, withhold tax at the rate prescribed in Revenue Regulations No. (RR) 2-98, as amended, which shall be remitted/paid on or before the 10th day of the following month using the Monthly Remittance Return of Creditable Income Taxes Withheld (Expanded) [BIR Form No. 1601E] except for taxes withheld for the month of December of each year, which shall be filed on or before January 15 of the following year pursuant to RR 2-98, as amended. For those filing using the Electronic Filing and Payment System (EFPS), the regulations pertaining to EFPS filers shall apply.

Issuing Official Receipts for the Deposit and Advances

An Official Receipt shall be issued for every deposit and advances pursuant to Section 113 of the Tax Code. The Official Receipt shall cover the entire amount which the Client/Customer pays.

For VAT Taxpayers, the VAT Official Receipt will constitute the Output Tax for taxpayers other than GPP and in turn, the input tax of its client/customer.

II. PRO-FORMA ENTRIES

Upon receipt of the deposit/advances, the same shall be treated and recorded as outright Income.

Accounting entries in the Books of the Taxpayer other than GPP

-

For VAT Taxpayers

Cash

Prepaid Income Tax (Creditable)

Income Output VAT

-

For Non-VAT Taxpayers

Cash

Prepaid Income Tax (Creditable)

Income

Dr.

xxx

xxx

Cr.

xxx xxx

xxx xxx

Dr.

xxx

xxx

Cr.

xxx

xxx

2

In turn, upon making deposit/advances for the necessary expenses, the

Client/Customer shall treat such deposit/advances as an outright expense.

Accounting entries in the Books of the Client/Customer

Accounting entries in the Books of the Client/Customer

-

For VAT Taxpayers

Expense Input VAT

Cash

Withholding Tax Payable

-

For Non-VAT Taxpayers

Expense Cash

Withholding Tax Payable

Dr. Cr.

xxx

xxx

xxx xxx

Dr. Cr. xxx

xxx xxx

xxx

xxx xxx

Dr. Cr. xxx

xxx xxx

All revenue officials and employees are enjoined to give this Revenue

Memorandum Circular as wide a publicity as possible.

This Circular shall take effect immediately.

This Circular shall take effect immediately.

REVENUE REGULATIONS NO. 12-99 -DUE PROCESS OF ASSESSING DEFICIENCY TAXES - EMELINO T MAESTRO.COM

REVENUE REGULATIONS NO. 12-99

www.Facebook.com/Kataxpayer

LET US FIGHT THE BIR HARASSMENT AND ILLEGAL ASSESSMENT OF DEFICIENCY TAXES SUCH AS FRINGE BENEFIT TAX, INCOME TAX, VALUE ADDED TAX AND WITHHOLDING TAX ON COMPENSATION

EMAIL YOUR TAX PROBLEMS TO 09228010922@MAESTROTAXATION.ORG AND 09989793922@MAESTROTAXATION.ORG OR CALL 4393918 AND 9216107

Implementing the Provisions of the National Internal Revenue Code of

1997 Governing the Rules on Assessment of National Internal Revenue

Taxes, Civil Penalties and Interest and the Extra judicial Settlement of a

Taxpayer’s Criminal Violation of the Code through Payment of a

Suggested Compromise Penalty.

All Internal Revenue Officers and Others Concerned.

All Internal Revenue Officers and Others Concerned.

SECTION 1. Scope. – Pursuant to the provisions of Section 244, in relation to Section

245 of the National Internal Revenue Code of 1997, these Regulations are hereby promulgated to

implement the provisions of Sections 6, 7, 204, 228, 247, 248 and 249 on assessment of national

internal revenue taxes, fees and charges and to provide the rules governing the extra-judicial

settlement of a taxpayer’s criminal violation of the said Code or any of its implementing

Regulations through payment of a suggested compromise penalty.

SECTION 2. General Principles. –

2.1 The surcharge and/or interest herein prescribed shall apply to all taxes, fees and charges imposed under the Code which shall be collected at the same time, in the same manner, and as part of the tax.

2.2 In case the tax due from a taxpayer is paid on a partial or instalment basis, the interest on the deficiency tax or on the delinquency tax liability of the taxpayer shall be imposed from due date to the tax until full payment thereof. The interest shall be computed based on the diminishing balance of the tax, inclusive of interests.

SECTION 3. Due process requirement in the issuance of a deficiency tax assessment. –

3.1 Mode of procedures in the issuance of a deficiency tax assessment:

SECTION 2. General Principles. –

2.1 The surcharge and/or interest herein prescribed shall apply to all taxes, fees and charges imposed under the Code which shall be collected at the same time, in the same manner, and as part of the tax.

2.2 In case the tax due from a taxpayer is paid on a partial or instalment basis, the interest on the deficiency tax or on the delinquency tax liability of the taxpayer shall be imposed from due date to the tax until full payment thereof. The interest shall be computed based on the diminishing balance of the tax, inclusive of interests.

SECTION 3. Due process requirement in the issuance of a deficiency tax assessment. –

3.1 Mode of procedures in the issuance of a deficiency tax assessment:

3.1.1 Notice for informal conference. – The Revenue Officer who audited the

taxpayer’s records shall, among others, state in his report whether or not the taxpayer agress with

his findings that the taxpayers is liable for deficiency tax or taxes. If the taxpayer is not

amenable, based on the said Officer’s submitted report of investigation, the taxpayer shall be

informed, in writing, by the Revenue District Office or by the Special Investigation Division, as

the case may be (in the case Revenue Regional Offices) or by the Chief Division concerned (in

the case of the BIR National Office) of the discrepancy or discrepancies in the taxpayer’s

payment of his internal revenue taxes, for the purpose of “Informal Conference,” in order to

afford the taxpayer with an opportunity to present his side of the case. If the taxpayer fails to

respond within fifteen (15) days from date of receipt of the notice for informal conference, he

shall be considered in default, in which case, the Revenue District Officer or the Chief of the

Special Investigation Division of the Revenue Regional Office, or the Chief of Division in the

National Office, as the case may be, shall endorse the case with the least possible delay to the

Assessment Division of the Revenue Regional Office or the Commissioner or his duly

authorized representative, as the case may be, for appropriate review and issuance of a deficiency

tax assessment, if warranted.

3.1.2 Preliminary Assessment Notice (PAN). – If after review and evaluation by the Assessment Division or by the Commissioner or his duly authorized representative, as the case may be, it is determined that there exists sufficient basis to assess the taxpayer for any deficiency tax or taxes, the said Office shall issue to the taxpayer, at least by registered mail, a Preliminary Assessment Notice (PAN) for the proposed assessment, showing in detail, the facts and the law, rules and regulations, or jurisprudence on which the proposed assessment is based (see illustration in ANNEX A hereof). If the taxpayer fails to respond within fifteen (15) days from date of receipt of the PAN, he shall be considered in default, in which case, a formal letter of demand and assessment notice shall be caused to be issued by the said Office, calling for payment of the taxpayer’s deficiency tax liability, inclusive of the applicable penalties.

3.1.3 Exceptions to Prior Notice of the Assessment. – The notice for informal conference and the preliminary assessment notice shall not be required in any of the following cases, in which case, issuance of the formal assessment notice for the payment of the taxpayer’s deficiency tax liability shall be sufficient:

(i) When the finding for any deficiency tax is the result of mathematical error in the computation of the tax appearing on the face of the tax return filed by the taxpayer; or

(ii) When a discrepancy has been determined between the tax withheld and the amount actually remitted by the withholding agent; or

(iii) When a taxpayer who opted to claim a refund or tax credit of excess creditable withholding tax for a taxable period was determined to have carried over and automatically applied the same amount claimed against the estimated tax liabilities for the taxable quarter or quarters of the succeeding taxable year; or

(iv) When the excise tax due on excisable articles has not been paid; or

3.1.2 Preliminary Assessment Notice (PAN). – If after review and evaluation by the Assessment Division or by the Commissioner or his duly authorized representative, as the case may be, it is determined that there exists sufficient basis to assess the taxpayer for any deficiency tax or taxes, the said Office shall issue to the taxpayer, at least by registered mail, a Preliminary Assessment Notice (PAN) for the proposed assessment, showing in detail, the facts and the law, rules and regulations, or jurisprudence on which the proposed assessment is based (see illustration in ANNEX A hereof). If the taxpayer fails to respond within fifteen (15) days from date of receipt of the PAN, he shall be considered in default, in which case, a formal letter of demand and assessment notice shall be caused to be issued by the said Office, calling for payment of the taxpayer’s deficiency tax liability, inclusive of the applicable penalties.

3.1.3 Exceptions to Prior Notice of the Assessment. – The notice for informal conference and the preliminary assessment notice shall not be required in any of the following cases, in which case, issuance of the formal assessment notice for the payment of the taxpayer’s deficiency tax liability shall be sufficient:

(i) When the finding for any deficiency tax is the result of mathematical error in the computation of the tax appearing on the face of the tax return filed by the taxpayer; or

(ii) When a discrepancy has been determined between the tax withheld and the amount actually remitted by the withholding agent; or

(iii) When a taxpayer who opted to claim a refund or tax credit of excess creditable withholding tax for a taxable period was determined to have carried over and automatically applied the same amount claimed against the estimated tax liabilities for the taxable quarter or quarters of the succeeding taxable year; or

(iv) When the excise tax due on excisable articles has not been paid; or

(v) When an article locally purchased or imported by an exempt person, such as, but

not limited to, vehicles, capital equipment, machineries and spare parts, has been sold, traded or

transferred to non-exempt persons.

3.1.4 Formal Letter of Demand and Assessment Notice. – The formal letter of demand and assessment notice shall be issued by the Commissioner or his duly authorized representative. The letter of demand calling for payment of the taxpayer’s deficiency tax or taxes shall state the facts, the law, rules and regulations, or jurisprudence on which the assessment is based, otherwise, the formal letter of demand and assessment notice shall be void (see illustration in ANNEX B hereof). The same shall be sent to the taxpayer only by registered mail or by personal delivery. If sent by personal delivery, the taxpayer or his duly authorized representative shall be acknowledge receipt thereof in the duplicate copy of the letter of demand, showing the following: (a) His name; (b) signature; (c) designation and authority to act for and in behalf of the taxpayer, if acknowledged received by a person other than the taxpayer himself; and (d) date of receipt thereof.

3.1.5 Disputed Assessment. – The taxpayer or his duly authorized representative may protest administratively against the aforesaid formal letter of demand and assessment notice within thirty (30) days from the date of receipt thereof. If there are several issues involved in the formal letter of demand and assessment notice but the taxpayer only disputes or protests against the validity of the some of the issues raised, the taxpayer shall required to pay the deficiency tax or taxes attributable to the undisputed issues, in which case, a collection letter shall be issued to the taxpayer calling for payment of the said deficiency tax, inclusive of the applicable surcharge and/or interest. No action shall be taken on the taxpayer’s disputed issues until the taxpayer has paid the deficiency tax or taxes attributable to the said undisputed issues. The prescriptive period for assessment or collection of the tax or taxes attributable to the disputed issues shall be suspended.

The taxpayer shall state the facts, the applicable law, rules and regulations, or jurisprudence on which his protest is based, otherwise, his protest shall be considered void and without force and effect. If there are several issues involved in the disputed assessment and taxpayer fails to state the facts, the applicable law, rules and regulations, or jurisprudence in support of his protest against some of the several issues on which the assessment is based, the same shall be considered undisputed issue or issues, in which case, the taxpayer shall be required to pay the corresponding deficiency tax or taxes attributable thereto.

The taxpayer shall submit the required documents in support of his protest within sixty (60) days from the date of filing of his letter of protest, otherwise, the assessment shall become final, executor and demandable. The phrase “submit the required documents” includes submission or presentation of the pertinent documents for scrutiny and evaluation by the Revenue Officer conducting the audit. The said Revenue Officer shall state this fact in his report of investigation.

If the taxpayer fails to file a valid protest against the formal letter of demand and assessment notice within thirty (30) days from the date of receipt thereof, the assessment shall become final, executory and demandable.

3.1.4 Formal Letter of Demand and Assessment Notice. – The formal letter of demand and assessment notice shall be issued by the Commissioner or his duly authorized representative. The letter of demand calling for payment of the taxpayer’s deficiency tax or taxes shall state the facts, the law, rules and regulations, or jurisprudence on which the assessment is based, otherwise, the formal letter of demand and assessment notice shall be void (see illustration in ANNEX B hereof). The same shall be sent to the taxpayer only by registered mail or by personal delivery. If sent by personal delivery, the taxpayer or his duly authorized representative shall be acknowledge receipt thereof in the duplicate copy of the letter of demand, showing the following: (a) His name; (b) signature; (c) designation and authority to act for and in behalf of the taxpayer, if acknowledged received by a person other than the taxpayer himself; and (d) date of receipt thereof.

3.1.5 Disputed Assessment. – The taxpayer or his duly authorized representative may protest administratively against the aforesaid formal letter of demand and assessment notice within thirty (30) days from the date of receipt thereof. If there are several issues involved in the formal letter of demand and assessment notice but the taxpayer only disputes or protests against the validity of the some of the issues raised, the taxpayer shall required to pay the deficiency tax or taxes attributable to the undisputed issues, in which case, a collection letter shall be issued to the taxpayer calling for payment of the said deficiency tax, inclusive of the applicable surcharge and/or interest. No action shall be taken on the taxpayer’s disputed issues until the taxpayer has paid the deficiency tax or taxes attributable to the said undisputed issues. The prescriptive period for assessment or collection of the tax or taxes attributable to the disputed issues shall be suspended.

The taxpayer shall state the facts, the applicable law, rules and regulations, or jurisprudence on which his protest is based, otherwise, his protest shall be considered void and without force and effect. If there are several issues involved in the disputed assessment and taxpayer fails to state the facts, the applicable law, rules and regulations, or jurisprudence in support of his protest against some of the several issues on which the assessment is based, the same shall be considered undisputed issue or issues, in which case, the taxpayer shall be required to pay the corresponding deficiency tax or taxes attributable thereto.

The taxpayer shall submit the required documents in support of his protest within sixty (60) days from the date of filing of his letter of protest, otherwise, the assessment shall become final, executor and demandable. The phrase “submit the required documents” includes submission or presentation of the pertinent documents for scrutiny and evaluation by the Revenue Officer conducting the audit. The said Revenue Officer shall state this fact in his report of investigation.

If the taxpayer fails to file a valid protest against the formal letter of demand and assessment notice within thirty (30) days from the date of receipt thereof, the assessment shall become final, executory and demandable.

If the protest is denied, in whole or in part, by the Commissioner, the taxpayer may

appeal to the Court of Tax Appeals within thirty (30) days from the date of receipt of the said

decision, otherwise, the assessment shall become final, executory and demandable.

In general, if the protest is denied, in whole or in part, by the Commissioner or his duly authorized representative, the taxpayer may appeal to the Court of Tax Appeals within thirty (30) days from date of receipt of the said decision, otherwise, the assessment shall become final, executory and demandable: Provided, however, that if the taxpayer elevates his protest to the Commissioner within thirty (30) days from date of receipt of the final decision of the Commissioner’s duly authorized representative, the latter’s decision shall not be considered final, executory and demandable, in which case, the protest shall be decided by the Commissioner.

If the Commissioner or his duly authorized representative fails to act on the taxpayer’s protest within one hundred eighty (180) days from date of submission, by the taxpayers, of the required documents in support of his protest, the taxpayer may appeal to the Court of Tax Appeals within thirty (30) days from the lapse of the said 180-day period, otherwise, the assessment shall become final, executory and demandable.

3.1.6 Administrative Decision on a Disputed Assessment. – The decision of the Commissioner or his duly authorized representative shall (a) state the facts, the applicable law, rules and regulations, or jurisprudence on which such decision is based, otherwise, the decision shall be void (see illustration in ANNEX C hereof), in which case, the same shall not be considered a decision on a disputed assessment; and (b) that the same is his final decision.

3.1.7 Constructive Service. – If the notice to the taxpayer herein required is served by registered mail, and no response is received from the taxpayer within the prescribed period from date of the posting thereof in the mail, the same shall be considered actually or constructively received by the taxpayer. If the same is personally served on the taxpayer or his duly authorized representative who, however, refused to acknowledge receipt thereof, the same shall be constructively served on the taxpayer. Constructive service thereof shall be considered effected by leaving the same in the premises of the taxpayer and this fact of constructive service is attested to, witnessed and signed by at least two (2) revenue officers other than the revenue officer who constructively served the same. The revenue officer who constructively served the same shall make a written report of this matter which shall form part of the docket of this case (see illustration in ANNEX D hereof).

SECTION 4. Civil Penalties:

4.1 Twenty-Five Percent (25%) Surcharge. – There shall be imposed, in addition to the basic tax required to be paid, a penalty equivalent to twenty-five percent (25%) thereof, in any the following cases:

4.1.1 Failure to file any return and pay the tax due thereon as required under the provisions of this Code or rules and regulations on the date prescribed; or

In general, if the protest is denied, in whole or in part, by the Commissioner or his duly authorized representative, the taxpayer may appeal to the Court of Tax Appeals within thirty (30) days from date of receipt of the said decision, otherwise, the assessment shall become final, executory and demandable: Provided, however, that if the taxpayer elevates his protest to the Commissioner within thirty (30) days from date of receipt of the final decision of the Commissioner’s duly authorized representative, the latter’s decision shall not be considered final, executory and demandable, in which case, the protest shall be decided by the Commissioner.

If the Commissioner or his duly authorized representative fails to act on the taxpayer’s protest within one hundred eighty (180) days from date of submission, by the taxpayers, of the required documents in support of his protest, the taxpayer may appeal to the Court of Tax Appeals within thirty (30) days from the lapse of the said 180-day period, otherwise, the assessment shall become final, executory and demandable.

3.1.6 Administrative Decision on a Disputed Assessment. – The decision of the Commissioner or his duly authorized representative shall (a) state the facts, the applicable law, rules and regulations, or jurisprudence on which such decision is based, otherwise, the decision shall be void (see illustration in ANNEX C hereof), in which case, the same shall not be considered a decision on a disputed assessment; and (b) that the same is his final decision.

3.1.7 Constructive Service. – If the notice to the taxpayer herein required is served by registered mail, and no response is received from the taxpayer within the prescribed period from date of the posting thereof in the mail, the same shall be considered actually or constructively received by the taxpayer. If the same is personally served on the taxpayer or his duly authorized representative who, however, refused to acknowledge receipt thereof, the same shall be constructively served on the taxpayer. Constructive service thereof shall be considered effected by leaving the same in the premises of the taxpayer and this fact of constructive service is attested to, witnessed and signed by at least two (2) revenue officers other than the revenue officer who constructively served the same. The revenue officer who constructively served the same shall make a written report of this matter which shall form part of the docket of this case (see illustration in ANNEX D hereof).

SECTION 4. Civil Penalties:

4.1 Twenty-Five Percent (25%) Surcharge. – There shall be imposed, in addition to the basic tax required to be paid, a penalty equivalent to twenty-five percent (25%) thereof, in any the following cases:

4.1.1 Failure to file any return and pay the tax due thereon as required under the provisions of this Code or rules and regulations on the date prescribed; or

4.1.2 Unless otherwise authorized by the Commissioner, filing a return with an

internal revenue officer other than those with whom the return is required to be filed; or

4.1.3 Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment; or

4.1.4 Failure to pay the full or part of the amount of tax shown on any return required to be filed under the provisions of this Code or rules and regulations, or the full amount of tax due for which no return is required to be filed, on or before the date prescribed for its payment.

4.2 Fifty percent (50%) Surcharge:

4.2.1 In case of willful neglect to file the return within the period prescribed by the Code, or in case a false or fraudulent return is willfully made, the penalty to be imposed shall be fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made on the basis of such return before the discovery of the falsity or fraud: Provided, That a substantial underdeclaration of taxable sales, receipts or income, or a substantial overstatement of deductions, as determined by the Commissioner or his duly authorized representative, shall constitute prima facie evidence of a false or fraudulent return: Provided, further, That failure to report sales, receipts or income in an amount exceeding thirty percent (30%) of that declared per return, and a claim of deductions in an amount exceeding thirty percent (30%) of actual deductions, shall render the taxpayer liable for substantial underdeclaration of sales, receipts or income or for overstatement of deductions, as mentioned herein: Provided, further, that the term “willful neglect to file the return within the period prescribed by the Code” shall not apply in case the taxpayer, without notice from the Commissioner or his authorized representative, voluntary files the said return, in which case, only 25% surcharge shall be imposed for late filing and late payment of the tax in lieu of the above 50% surcharge. Conversely, the 50% surcharge shall be imposed in case the taxpayer files the return only after prior notice in writing from the Commissioner or his duly authorized representative.

4.2.2 Section 6 (A) of the Code provides that any tax return filed by a taxpayer “may be modified, changed or amended” by the taxpayer “within three (3) years from date of such filing” provided, however, that “no notice for audit or investigation of such return, statement or declaration has, in the meantime, been actually served upon the taxpayer.” Thus, if upon investigation, it is determined that the taxpayer’s originally filed tax return is false or fraudulent, such taxpayer shall remain liable to the 50% civil penalty regardless that the taxpayer has filed his amended tax return, if the said amended tax return, however, has been filed only after issuance of the Letter of Authority for the investigation of the taxpayer’s tax return or such amendment has been made in the course of the said investigation.

4.1.3 Failure to pay the deficiency tax within the time prescribed for its payment in the notice of assessment; or

4.1.4 Failure to pay the full or part of the amount of tax shown on any return required to be filed under the provisions of this Code or rules and regulations, or the full amount of tax due for which no return is required to be filed, on or before the date prescribed for its payment.

4.2 Fifty percent (50%) Surcharge:

4.2.1 In case of willful neglect to file the return within the period prescribed by the Code, or in case a false or fraudulent return is willfully made, the penalty to be imposed shall be fifty percent (50%) of the tax or of the deficiency tax, in case any payment has been made on the basis of such return before the discovery of the falsity or fraud: Provided, That a substantial underdeclaration of taxable sales, receipts or income, or a substantial overstatement of deductions, as determined by the Commissioner or his duly authorized representative, shall constitute prima facie evidence of a false or fraudulent return: Provided, further, That failure to report sales, receipts or income in an amount exceeding thirty percent (30%) of that declared per return, and a claim of deductions in an amount exceeding thirty percent (30%) of actual deductions, shall render the taxpayer liable for substantial underdeclaration of sales, receipts or income or for overstatement of deductions, as mentioned herein: Provided, further, that the term “willful neglect to file the return within the period prescribed by the Code” shall not apply in case the taxpayer, without notice from the Commissioner or his authorized representative, voluntary files the said return, in which case, only 25% surcharge shall be imposed for late filing and late payment of the tax in lieu of the above 50% surcharge. Conversely, the 50% surcharge shall be imposed in case the taxpayer files the return only after prior notice in writing from the Commissioner or his duly authorized representative.