NOT ALL THE ACCOUNTING SYSTEMS ARE CREATED EQUAL

taxaccountinguru.com *go@taxaccountingguru.com

taxaccountinguru.com *go@taxaccountingguru.com

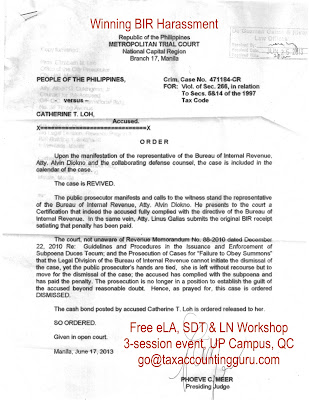

If you feel that you are paying too much taxes or wondering why you are a frequent recipient of BIR’s subpoena, mission order, electronic letter of authority, letter notice, questionable assessment notice, and sometimes, warrant of arrest, you NEED to change your existing accounting system because it does not suit your REAL AND TRUE NEED.

There are so many types of accounting systems in the world but the most common and popular among them are the FINANCIAL, TAX and MANAGERIAL accounting.

These three accounting methods or systems have their own specific purposes and uses.

If you want to (a) imprint good impressions to, (b) want praises and admirations from or (c) attract the interests of the outsiders such as the creditors and investors, yo use the financial accounting

If you want to assist the insiders of a company in crafting a very confidential decision that will make or break your business, you use the managerial accounting.

Will you give your boss an accounting report for the regional sales when he is asking for a salesmen's report? Of course, you will not because the regional sales report is not what he needs. Similarly, the BIR is not interested in your financial or managerial accounting but it will use them against you if they will yield a higher deficiency tax assessment. Do you want this scenario to happen again and again?

Unlike the financial accounting and managerial accounting, you use TAX accounting to EXTINGUISH YOUR TAX OBLIGATIONS and to MAXIMISE YOUR TAX BENEFITS.

Extinguishing a tax obligation means to AVOID BIR’s imposable civil and administrative liabilities and criminal prosecution as well as to reduce your tax dues legally.

FREE

TAX ACCOUNTING

SEMINAR WORKSHOP

3-session event

TAX ACCOUNTING

SEMINAR WORKSHOP

3-session event

To register, email the email account first above-written

Thanks for reading this and sharing to those who needed this most.

Call Nica 0998 979 3922

Thanks for reading this and sharing to those who needed this most.

Call Nica 0998 979 3922