IMPORTANT: If you want to market any event of Emelino T Maestro, please do so. You will receive a 5% commission for each attendee who paid and attended it. To avoid other to claim your commission, please email the name, mobile and email address of your potential attendees as often as it is convenient to you because the basis of releasing the said commission is to the first person who emailed the said information to go@taxaccountingguru.com.

OTHER INCENTIVE: If you reached 250 or more attendees, you are entitled to a 5-day, 4-night stay at Marriot Hotel, Osaka Japan, 3 CebuPac-tickets (Manila-Osaka-Manila) and 60,000 yen pocket money. (Get your passport and Japan's Visa now)

Saan po puedeng magtanong? Ito po ang mga numero ni Emelino T Maestro 0922-801 0922, 0998-979 3922, 02-921 6107, at 02-439 3918

Ano po ba ang pinaka importante kong tatandaan? At dahil gusto mong makapunta at mamasyal sa Japan, ikaw at ang iyong kasama o kasamahan, by way of applying to this set up, ay buong puso at pagtitika na sumasampalataya at sumasang-ayon sa mga alituntunin, decision, order, resolution, policy and procedure na nailathala na o ilalathala pa lamang ni Emelino T Maestro. Pati na rin sa pagiging superior ng kanyang mga alituntunin, decision, order, resolution, policy and procedure na nailathala na o ilalathal pa lamang sa mga alituntunin, decision, order, resolution, policy and procedure ng ibang third party.

Thank you.

Ignorance is the basic foundation of graft and corruption. The BIR-corrupt brigade is maximizing its full potential and profitability. Fishes find strength, courage and competence in numbers. They had conquered their predators/enemies by grouping together in order to make them bigger than their enemies. You too can become bigger than the fear that lingered in your minds and hearts. Join 'JuanTALKS' now and share your knowledge and experiences to other Filipinos.

Saturday 25 July 2015

Free Trip to Tokyo, Japan and Osaka, Japan by Emelino T Maestro

5-day and 4-night stay in Tokyo and Osaka, Japan for two (2) people

EXPENSES NA SAGOT NI EMELINO T MAESTRO

1. Stay for 2 nights at The Royal Park Hotel, Tokyo, Japan

2. Stay for 2 nights at The Marriot Hotel, Osaka, Japan

3. A pocket money of 60,000 Japanese Yen

4. CebuPac tickets for two (2) from Manila, Phils. to Tokyo, Japan

5. CebuPac tickets for two (2) from Osaka, Japan to Manila, Phils

Am I qualified to join? Yes, any person whose age is from two (2) to ninety two (92) is qualified to visit and stay to Tokyo/Osaka, Japan for the period of 5 days and 4 nights.

Is this a contest or sales promo? Neither, you don't have to purchase anything nor accomplish and send coupons to get a chance for a 5-day, 4-night stay in Tokyo/Osaka, Japan.

What should I do to get a free trip to Tokyo/Osaka, Japan? Follow these two (2) steps

1. Send your name, home-address, TIN, mobile number and email-address to go@taxaccountingguru.com

2. Wait for either a call, text or email message from EmelinoTMaestro's Monitoring Officer who will explain to you the mechanics of getting your FREE TRIP TO TOKYO AND OSAKA, JAPAN.

EXPENSES NA SAGOT NI EMELINO T MAESTRO

1. Stay for 2 nights at The Royal Park Hotel, Tokyo, Japan

2. Stay for 2 nights at The Marriot Hotel, Osaka, Japan

3. A pocket money of 60,000 Japanese Yen

4. CebuPac tickets for two (2) from Manila, Phils. to Tokyo, Japan

5. CebuPac tickets for two (2) from Osaka, Japan to Manila, Phils

Am I qualified to join? Yes, any person whose age is from two (2) to ninety two (92) is qualified to visit and stay to Tokyo/Osaka, Japan for the period of 5 days and 4 nights.

Is this a contest or sales promo? Neither, you don't have to purchase anything nor accomplish and send coupons to get a chance for a 5-day, 4-night stay in Tokyo/Osaka, Japan.

What should I do to get a free trip to Tokyo/Osaka, Japan? Follow these two (2) steps

1. Send your name, home-address, TIN, mobile number and email-address to go@taxaccountingguru.com

2. Wait for either a call, text or email message from EmelinoTMaestro's Monitoring Officer who will explain to you the mechanics of getting your FREE TRIP TO TOKYO AND OSAKA, JAPAN.

Thursday 16 July 2015

BIR Citizen Charter (Updated)

TAXPAYERS' RIGHTS TO SWIFT AND CORRECT PROCESSES

TAXPAYERS' RIGHTS TO SWIFT AND CORRECT PROCESSESYou alone can prevent a revenue officer from abusing, bullying and corrupting (ABC) you. The first approach in freeing yourself and pocket from disaster is to download the NEW UPDATED CITIZEN CHARTER V. 2015.. Share this info to others... Fight abuses. Reclaim your privileges. Click the link to download a copy of your prescribed rights

https://www.dropbox.com/s/k6f2p8gn6xb8ot7/ETM%20BIR%20Updated%20Citizen%27s%20Charter.pdf?dl=0

Saturday 11 July 2015

RMC 38-2013 (LPN)

Kim Henares' Allegations, No Legal and Factual Basis (RMC 38-2013)

The Truth About the Legal Petition Notice (LPN)

Kim: ON THE AUDIT/INVESTIGATION PURSUANT TO ISSUED LETTERS OF AUTHORITY. The normal process and/or procedures related to audit/investigation arising from eLA issued will not be suspended notwithstanding the receipt of LPN pertaining to the case. Moreover, the National Office shall no longer entertain any LPN questioning the validity and enforceability of the eLA duly issued by the concerned Regional Director for the audit of taxpayer within the region inasmuch as the issue has already been clarified under RMC No. 6-2013. Thus, there shall be no impediment on the investigation of the taxpayer’s internal revenue tax liabilities and the eventual recommendation for an issuance of SDT, if warranted, in accordance with Revenue Memorandum Order (RMO) Nos. 45-2010 and 88-2010.

ETM: I don't know why Kim and her associates are so fearful and afraid of the LPN. Notwithstanding that the LPN was invented or the brainchild of EmelinoTMaestro (ETM). The BIR's acts that are executed against the prohibitory and mandatory law are either void ab initio or cancellable at the option of the person of interest. One of such action is the issuance of electronic Letter of Authority without a valid and established AUDIT PROGRAM AND SELECTION CRITERIA which is required by the law (Revenue Administrative Order No. 10-2000). I only want to help and assist the BIR because so many eLAs were issued without complying with the stated law so that the criminal and civil cases that it would pursue against all the erring taxpayers may have a change of winning. I have no intention, whether in my dreams or in the reality, to deprive any revenue officer to extinguish his legal obligation to the Republic of the Philippines as well as to the taxpayers.. BEAR THAT IN MIND.

Kim: ON THE ISSUANCE OF PRELIMINARY ASSESSMENT NOTICE (PAN), FORMAL LETTER OF DEMAND (FLD) AND FINAL ASSESSMENT NOTICE (FAN). Correspondingly, upon receipt of the PAN or FLD and FAN, the taxpayer is given fifteen (15) or thirty (30) days, as the case may be, to rebut the assessment upon his compliance with the requirements of filing a protest pursuant to Revenue Regulations (RR) No. 12-99. Thus, any LPN, declaration or any similar document protesting the assessment addressed to the Commissioner or any official in the National Office without the issuance of a Final Decision on Disputed Assessment (FDDA) from the regional office shall be considered premature and invalid.

ETM: Well-said. However, the very reason why the LPN is directly addressed to the BIR Chief is in compliance with Section 6(A), National Internal Revenue Code (NIRC). In the said law, only the Commissioner of Internal Revenue (CIR) has the power and authority to audit investigate a taxpayer. However, such power may, at the option of the CIR, delegate to an inferior officer such as the revenue officers (Section 7, NIRC). To evade the legal obligation vested by the CIR to the said revenue officers, many of them knowingly failed and refused to receive documents, papers, evidences and the likes from the concerned taxpayers. In order to avoid this repeated nonfeasance, it is proper and appropriate that the CIR must be provided with all the LPNs including their supporting evidences. However, a news had come to my attention that certain Larry Barcelo from the CIR's office is allegedly acting as a CIR by way of refusing to receive such LPNs and their supporting documentations. If the same will happen to you, the readers hereof, please use the power of Republic Act Nos. 9485 and 6713 and send the erring revenue officers to jail/suspension.

Kim: RESPONSIBILITY OF TAXPAYERS ON THEIR LPN. As stated in Section 9 of RR No. 11-2006, as amended, and clarified in RMC No.6-2013, the BIR can refuse to transact official business with tax agents/practitioners who are not accredited before it. Therefore, the responsibility is on taxpayers to ensure that the tax agents/practitioners whom they choose to engage are accredited with the BIR.

Aside from knowing whether consultants are accredited or not, taxpayers are forewarned to be more circumspect in scrutinizing the credibility and competence of the consultants and the veracity of the contents of the LPN/Declaration or any document before affixing their signature therein since these documents will not gain merit and may lead to adverse consequences, such as the filing of the necessary charges in court.

ETM: Well said. However, under the New Civil Code and numerous SC-jurisprudence, a taxpayer or any person may be represented by another person via special power of attorney (SPA) or notarised Board Resolution. Thus, it is not only that the BIR's accredited tax agent may represent a taxpayer before its revenue officers. Also, it is commonly accepted that the tax laws are the waterloo of so many taxpayers due to no comprehensive curriculum had been in use in any university and college. And, most of the trainings and seminars being offered to the public are not designed and developed to empower a taxpayer but to institute a very big fear into their hearts and many more questions into their minds. I am disappointed to read a legal threat which is usually the recourse of many public officials - so disgusting (Pwe!). The LPN was conceptualised, designed and developed using the legal parameters and proceedings set forth by the BIR itself and the established jurisprudence. These parameters and proceedings are required to be observed and obeyed by every revenue officer without mental reservation and purpose of evasion and keep the taxpayer away from the harassment and abuses of so many revenue officers. The LPN is the only way and available defence that can shield a taxpayer from further attacks via malfeasance, misfeasance and nonfeasance. Get's mo..

Free TAX ACCOUNTING SEMINAR WORKSHOP @ University of the Philippines, YourRegistration is only possible via go@taxaccountingguru.com... What you will learn therefrom will empower you and give you additional business...FREE sharing and liking is encouraged. Thanks a lot.

0922 801 0922

The Truth About the Legal Petition Notice (LPN)

Kim: ON THE AUDIT/INVESTIGATION PURSUANT TO ISSUED LETTERS OF AUTHORITY. The normal process and/or procedures related to audit/investigation arising from eLA issued will not be suspended notwithstanding the receipt of LPN pertaining to the case. Moreover, the National Office shall no longer entertain any LPN questioning the validity and enforceability of the eLA duly issued by the concerned Regional Director for the audit of taxpayer within the region inasmuch as the issue has already been clarified under RMC No. 6-2013. Thus, there shall be no impediment on the investigation of the taxpayer’s internal revenue tax liabilities and the eventual recommendation for an issuance of SDT, if warranted, in accordance with Revenue Memorandum Order (RMO) Nos. 45-2010 and 88-2010.

ETM: I don't know why Kim and her associates are so fearful and afraid of the LPN. Notwithstanding that the LPN was invented or the brainchild of EmelinoTMaestro (ETM). The BIR's acts that are executed against the prohibitory and mandatory law are either void ab initio or cancellable at the option of the person of interest. One of such action is the issuance of electronic Letter of Authority without a valid and established AUDIT PROGRAM AND SELECTION CRITERIA which is required by the law (Revenue Administrative Order No. 10-2000). I only want to help and assist the BIR because so many eLAs were issued without complying with the stated law so that the criminal and civil cases that it would pursue against all the erring taxpayers may have a change of winning. I have no intention, whether in my dreams or in the reality, to deprive any revenue officer to extinguish his legal obligation to the Republic of the Philippines as well as to the taxpayers.. BEAR THAT IN MIND.

Kim: ON THE ISSUANCE OF PRELIMINARY ASSESSMENT NOTICE (PAN), FORMAL LETTER OF DEMAND (FLD) AND FINAL ASSESSMENT NOTICE (FAN). Correspondingly, upon receipt of the PAN or FLD and FAN, the taxpayer is given fifteen (15) or thirty (30) days, as the case may be, to rebut the assessment upon his compliance with the requirements of filing a protest pursuant to Revenue Regulations (RR) No. 12-99. Thus, any LPN, declaration or any similar document protesting the assessment addressed to the Commissioner or any official in the National Office without the issuance of a Final Decision on Disputed Assessment (FDDA) from the regional office shall be considered premature and invalid.

ETM: Well-said. However, the very reason why the LPN is directly addressed to the BIR Chief is in compliance with Section 6(A), National Internal Revenue Code (NIRC). In the said law, only the Commissioner of Internal Revenue (CIR) has the power and authority to audit investigate a taxpayer. However, such power may, at the option of the CIR, delegate to an inferior officer such as the revenue officers (Section 7, NIRC). To evade the legal obligation vested by the CIR to the said revenue officers, many of them knowingly failed and refused to receive documents, papers, evidences and the likes from the concerned taxpayers. In order to avoid this repeated nonfeasance, it is proper and appropriate that the CIR must be provided with all the LPNs including their supporting evidences. However, a news had come to my attention that certain Larry Barcelo from the CIR's office is allegedly acting as a CIR by way of refusing to receive such LPNs and their supporting documentations. If the same will happen to you, the readers hereof, please use the power of Republic Act Nos. 9485 and 6713 and send the erring revenue officers to jail/suspension.

Kim: RESPONSIBILITY OF TAXPAYERS ON THEIR LPN. As stated in Section 9 of RR No. 11-2006, as amended, and clarified in RMC No.6-2013, the BIR can refuse to transact official business with tax agents/practitioners who are not accredited before it. Therefore, the responsibility is on taxpayers to ensure that the tax agents/practitioners whom they choose to engage are accredited with the BIR.

Aside from knowing whether consultants are accredited or not, taxpayers are forewarned to be more circumspect in scrutinizing the credibility and competence of the consultants and the veracity of the contents of the LPN/Declaration or any document before affixing their signature therein since these documents will not gain merit and may lead to adverse consequences, such as the filing of the necessary charges in court.

ETM: Well said. However, under the New Civil Code and numerous SC-jurisprudence, a taxpayer or any person may be represented by another person via special power of attorney (SPA) or notarised Board Resolution. Thus, it is not only that the BIR's accredited tax agent may represent a taxpayer before its revenue officers. Also, it is commonly accepted that the tax laws are the waterloo of so many taxpayers due to no comprehensive curriculum had been in use in any university and college. And, most of the trainings and seminars being offered to the public are not designed and developed to empower a taxpayer but to institute a very big fear into their hearts and many more questions into their minds. I am disappointed to read a legal threat which is usually the recourse of many public officials - so disgusting (Pwe!). The LPN was conceptualised, designed and developed using the legal parameters and proceedings set forth by the BIR itself and the established jurisprudence. These parameters and proceedings are required to be observed and obeyed by every revenue officer without mental reservation and purpose of evasion and keep the taxpayer away from the harassment and abuses of so many revenue officers. The LPN is the only way and available defence that can shield a taxpayer from further attacks via malfeasance, misfeasance and nonfeasance. Get's mo..

Free TAX ACCOUNTING SEMINAR WORKSHOP @ University of the Philippines, YourRegistration is only possible via go@taxaccountingguru.com... What you will learn therefrom will empower you and give you additional business...FREE sharing and liking is encouraged. Thanks a lot.

0922 801 0922

Legal Petition Notice (LPN)

The biggest crime of all is not the crime that is being broadcasted in every TV station, website, podcast, radio and newspaper because it is too small in scope and scale. To explain it further, the alleged crime of the Napoles Family and the alleged corruption of the Binay Family have so much commercial value. Such value attracts so many advertisers and sponsors while the petty crime of a revenue officer may pass unnoticed because it is insignificant to affect the profitability of the media industry.

A grain of rice is so insignificant because it can't feed your family. However, a kilo of which is enough to feed several people. From this point of view, the petty crime that is being committed daily by most of the 12 thousand revenue officers is bigger than the crime that is committed by their bosses.

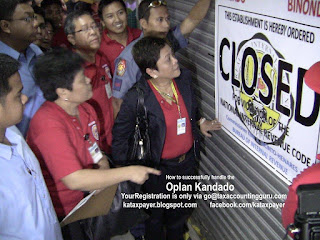

In one of the unheralded news, a BIR top official pocketed 50 million pesos in exchange for sparing an area in the Visayas region from the Oplan Kandado and Tax Mapping activities. At a glance, the amount of 50 million pesos is so big but it is also too small when compared to the cut and corruption being perpetuated by the small time revenue officers. For example, the 120 revenue district offices have 120 registration units. Each unit has a corrupt revenue officer who is intentionally delaying the processing of taxpayers' returns and applications. The catastrophic result for these taxpayers is also a delay in doing business and earning a decent profit. However, in exchange for 3 thousand pesos, a taxpayer can get what he needs in 30 minutes. So multiply at least 10 victims a day, 200 days a year, the 3 thousand pesos for each victim and 120 revenue district offices, will give you -720 million pesos which is higher than the 50 million kickback presented above. This is only a unit and there are several units per RDO.

The Ehem, Aha promises that any lead that a taxpayer/concerned citizen will provide to the Office of the Ombudsman will be pursued without any delay, purpose of evasion and mental reservation are being undermined. Now, it seemed that its promises will remain, as all the promises from the past went through, a broken promise.

The purpose of all the Legal Petition Notices that are being filed to the Office of the Ombudsman is to inform it that a petty crime is once again being perpetuated knowingly by a revenue officer. However, it is becoming so apparent that some of the officials of the Office of the Ombudsman are becoming allies of corruption, malfeasance, misfeasance and nonfeasance.

More importantly, it is not the intention of the LPN to delay or prevent the Bureau of Internal Revenue and its officials from doing what is legal. In other words, the LPN is exposing an act that is being done in contrary to the mandatory and prohibitory law. The very good public official will act on it decisively. The prevention and proliferation of illegal acts from the 12 thousand revenue officers must be the first priority of the Office of the Ombudsman because such directly affects the lives of every taxpayer.

Please remember that the biggest crime of all is the petty crimes being perpetuated knowingly nationwide.

Give my LPN a chance…

Free electronic Letter of Authority, Subpoena Duces Tecum and Letter Notice Workshop at the University of the Philippines, Diliman, Quezon City (3 continual sessions, 2-4 pm)... YourRegistration is only possible via go@taxaccountingguru.com.

Friday 10 July 2015

Authorised Agent Banks Are Refusing to Accept Tax Payments from Taxpayers

The BIR rules mandate taxpayers to pay their taxes through an authorised agent bank having jurisdiction over their place of business (BIR-AAB). However, due to some confusion and instructions of several revenue officers, the tellers of these BIR-AABs are refusing to accept and process the tax payments coming from a taxpayer who may either be paying a deficiency tax or is not a depositor thereof.

According to Bank Bulletin No. 2014-08, all the BIR-AABs shall

1. accept tax payments from taxpayers who are already within the banks' premises by the close of the banking hours

2. accept tax returns with check payments after the bank's cut-off/clearing time

3. equally treat all the taxpayers whether or not they are regular depositors or clients of the receiving bank's branch

4. not to accept tax payments that are outside the bank's jurisdiction

5. accept tax returns either with cash and check payments or more than one check payments.

There is no written regulations that require a taxpayer to secure a signature or approval of any revenue officer before a late payment of taxes or the payment of deficiency taxes shall be accepted. Please report to ETM Tax Agent Office (ETM-TAO), Inc. the name of the teller and the bank, branch and address and other circumstances and informations so that it can file a complaint against such teller to the proper authority for and on your behalf. Text 0922 8010922 or email maestromarice@gmail.com

To attend the FREE TAX ACCOUNTING SEMINAR WORKSHOP (3-continual session), please feel free to email go@taxaccountingguru.com to know its upcoming schedules.

As a payment for the services of ETM, please copy-paste all the data shown herein and post it in your FACEBOOK account. Then, screen-shot the same and send the jpg file to go@taxaccountingguru.com

Thanks for reading this.

According to Bank Bulletin No. 2014-08, all the BIR-AABs shall

1. accept tax payments from taxpayers who are already within the banks' premises by the close of the banking hours

2. accept tax returns with check payments after the bank's cut-off/clearing time

3. equally treat all the taxpayers whether or not they are regular depositors or clients of the receiving bank's branch

4. not to accept tax payments that are outside the bank's jurisdiction

5. accept tax returns either with cash and check payments or more than one check payments.

There is no written regulations that require a taxpayer to secure a signature or approval of any revenue officer before a late payment of taxes or the payment of deficiency taxes shall be accepted. Please report to ETM Tax Agent Office (ETM-TAO), Inc. the name of the teller and the bank, branch and address and other circumstances and informations so that it can file a complaint against such teller to the proper authority for and on your behalf. Text 0922 8010922 or email maestromarice@gmail.com

To attend the FREE TAX ACCOUNTING SEMINAR WORKSHOP (3-continual session), please feel free to email go@taxaccountingguru.com to know its upcoming schedules.

As a payment for the services of ETM, please copy-paste all the data shown herein and post it in your FACEBOOK account. Then, screen-shot the same and send the jpg file to go@taxaccountingguru.com

Thanks for reading this.

How to Win a BIR Criminal Charge at the Court?

Although you might find yourself being criminally prosecuted by some maliciously minded revenue attorneys because they knowingly imputing in the minds of the third parties that you failed and refused and still fail and refuse to submit your books of accounts and other accounting records. Thus, you failed to comply with the requirements and orders of the so-called 'BIR's subpoena duces tecum'.

DON'T WORRY because the Court will act favourable if you will follow the instructions in the Order shown herein.

DON'T BRIBE because the new rule of the BIR has stripped all the revenue attorneys, including the Chiefs Legal Division, Chief Prosecution Division and Regional Directors either to withdraw your case via Affidavit of Desistance or render a decision on your case. Meaning, the decision to dismiss or not to dismiss your case is either vested on the shoulders of the Department of Justice's prosecutor or the competent court, as the case dictates.

To get the complete knowledge regarding the issues and questions you have about the electronic Letter of Authority, Subpoena Duces Tecum and Letter Notice, please feel free to email go@taxaccountingguru.com to learn the procedures on how to get a free seat on the upcoming 3-continual sessions about the eLA, SDT and LN at the University of the Philippines, Diliman, Quezon City. Again, you may get a FREE SEATS if you will email EmelinoTMaestro, right now.

As a payment to this generous act, please copy-paste all the information and image herein shown and post everything in your FACEBOOK ACCOUNT. You must screen-shot the said posting and them email the jpg file to go@taxaccountingguru.com.

For contact details, please visit the site 'TaxAccountingGuru.com'.

DON'T WORRY because the Court will act favourable if you will follow the instructions in the Order shown herein.

DON'T BRIBE because the new rule of the BIR has stripped all the revenue attorneys, including the Chiefs Legal Division, Chief Prosecution Division and Regional Directors either to withdraw your case via Affidavit of Desistance or render a decision on your case. Meaning, the decision to dismiss or not to dismiss your case is either vested on the shoulders of the Department of Justice's prosecutor or the competent court, as the case dictates.

To get the complete knowledge regarding the issues and questions you have about the electronic Letter of Authority, Subpoena Duces Tecum and Letter Notice, please feel free to email go@taxaccountingguru.com to learn the procedures on how to get a free seat on the upcoming 3-continual sessions about the eLA, SDT and LN at the University of the Philippines, Diliman, Quezon City. Again, you may get a FREE SEATS if you will email EmelinoTMaestro, right now.

As a payment to this generous act, please copy-paste all the information and image herein shown and post everything in your FACEBOOK ACCOUNT. You must screen-shot the said posting and them email the jpg file to go@taxaccountingguru.com.

For contact details, please visit the site 'TaxAccountingGuru.com'.

Affidavit of Discrepancy: Department of Foreign Affairs

EMELINO T MAESTRO, Taxnocrat

Unit 419 Corporate 101 Mother Ignacia Quezon City

TIN 129 596 230

AFFIDAVIT OF DISCREPANCY

I, EMELINO TOLENTINO MAESTRO, of legal age, married to Marites Lapira Soliven-Maestro, citizen of the Republic of the Philippines and presently residing at the above address, after having been duly sworn to in accordance with law, do hereby attest and assert:

That my name is EMILINO TOLENTINO MAESTRO, as stated and registered in my birth certificate issued by the local civil registrar in country of my birth, Republic of the Philippines;

That during my childhood and adult years, I have been accustomed to the use of the name EMELINO TOLENTINO MAESTRO;

That I assumed the name EMELINO TOLENTINO MAESTRO, when I signed official documents and exercised my professional work in the Philippines;

That the names EMELINO TOLENTINO MAESTRO and EMILINO TOLENTINO MAESTRO refer to one and the same person; and

That I am executing this Affidavit to clear any discrepancy which may arise from official documents bearing either name “EMELINO TOLENTINO MAESTRO” or “EMILINO TOLENTINO MAESTRO “;

IN WITNESS WHEREOF, I have hereunto set my hand and affix my signature on the date and place as they are shown hereunder.

EMELINO TOLENTINO MAESTRO

(Affiant)(0998 9793922)

Signed in the presence of:

___________________ ____________________

Jose Filomar Bas Divine Grace Fresco

TIN TIN

Subscribed and sworn me to before me on ______ this ________ .

NOTARY PUBLIC

Subscribe to:

Posts (Atom)