Tax Evasion Cases Under RATE and RATS Programs

Deemed to Suffer Irreparable Damages -

According to our Constitution, the speedy resolution for case filed at the Ombudsman and the DOJ should be resolved within a reasonable time. Thus, if the Ombudsman and the DOJ failed to follow this simple instruction, the case, according to the our Supreme Court should outright be dismissed by the concerned lower court. The numbers of dismissed cases due to this so-called 'negligence' of the assigned prosecutors are now beyond the acceptable level. Therefore, the loser is again the Filipino people (See the Sandiganbayan's cases agaist Victor Endriga, Deogracias Savellano and Chavit Singson).

As far as RATE and RATS cases are concerned, they are now pending at the DOJ and ageing like the most expensive wines. If they will be elevated to the Court of Tax Appeals, definitely, they would also be dismissed for the same reason. The question is, 'Can the CTA refuse the dismissal of these 'prolonged cases'? The answer is already provided by our Supreme Court where in it says that all decisions of inferior courts should emanated its decision.

Good to Remember

Please remember/tell your friends about this, ‘IGNORANCE OF THE LAW IS THE MOST EXPENSIVE LIFESTYLE. Let us make your compliance with the Tax Code as easy as you breathe so that you will live no more in the shadows of fear/corruption that not knowing them brings.

Learn the Most Relevant Topics Today - EmelinoTMaestro.com

09228010922@MaestroTaxation.org

02-4393918 & 02-9216107

Courses for TAX ACCOUNTING

101 - NonVAT-Optional Standard Deduction Individuals

October 9-10, 2014

March 31-April 1, 2015

102 - NonVAT-Allowable Itemised Deduction Individuals

November 6-7, 2014

June 9-10, 2015

November 5-6, 2015

103 - VAT-Optional Standard Deduction Individuals

January 8-9, 2015

April 7-8, 2015

December 2-3, 2015

104 - VAT-Allowable Itemised Deduction Individuals

October 30-31, 2014

June 18-19, 2015

November 25-26, 2015

201 - NonVAT-Optional Standard Deduction Corporations

January 14-15, 015

March 5-6, 2015

November 11-12, 2015

202 - VAT-Allowable Itemised Deduction Corporations

August 21-22, 2014

December 8-9, 2014

March 18-19-2015

May 7-8, 2015

203 - VAT-Allowable Itemised Deduction PEZA-entities

February 12-13, 2015

July 7-8, 2015

Courses for TAX CONSULTING

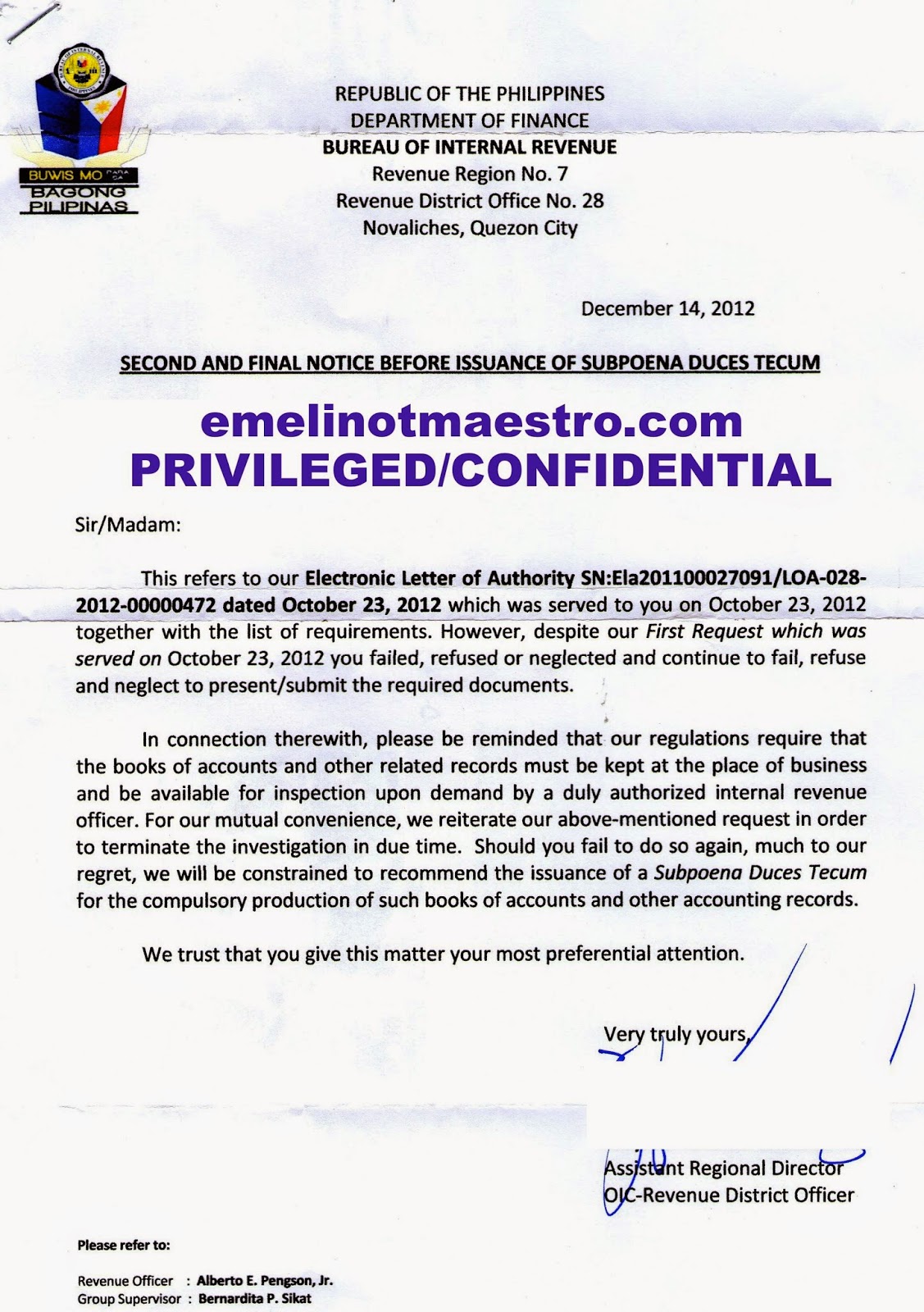

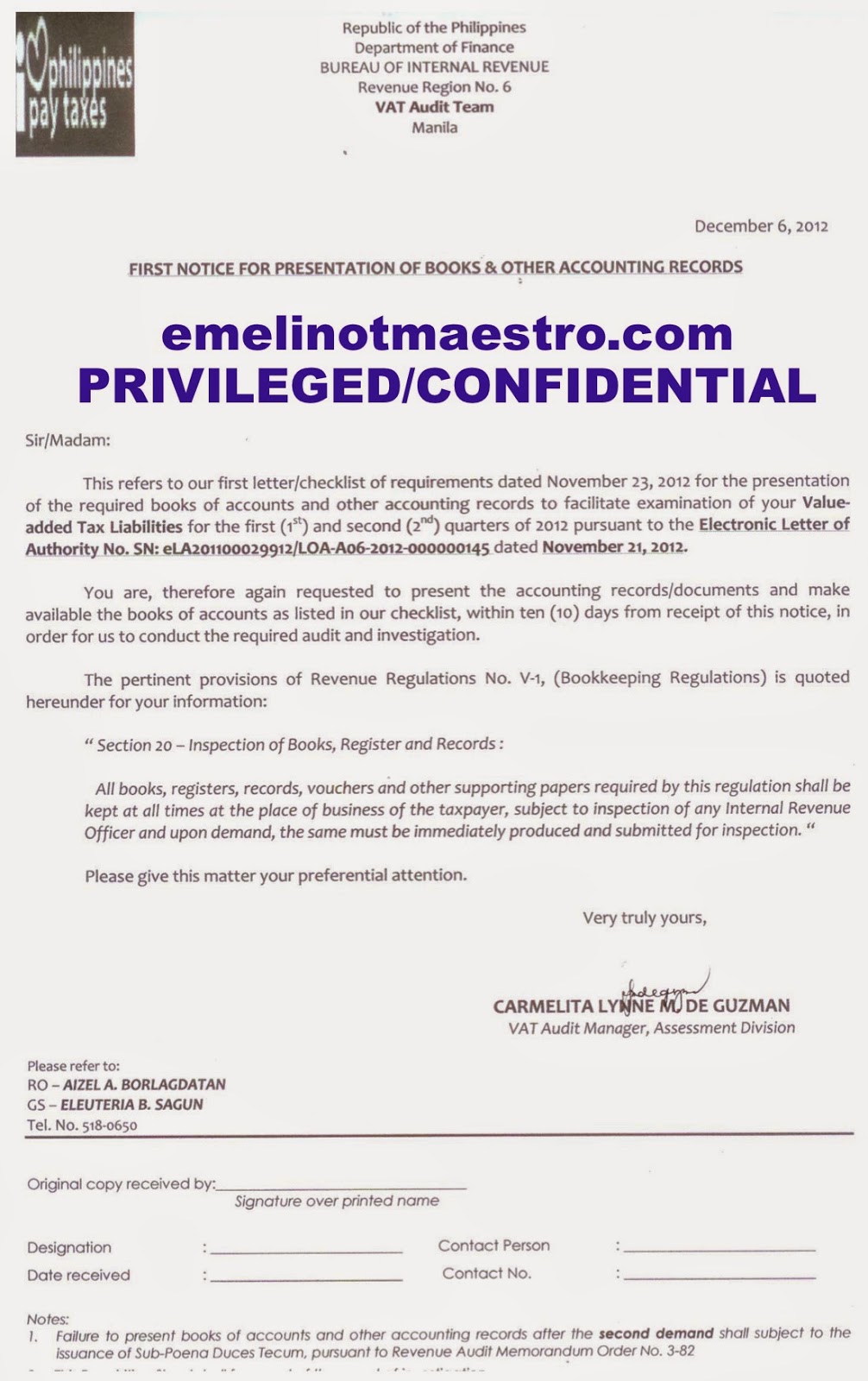

501 - eLetter of Authority, Letter Notice, Subpoena Duces Tecum

August 14-15, 2014

September 25-26, 2014 (Davao)

October 2-3, 2014 (Cebu)

November 13-14, 2014 (Iloilo)

February 5-6, 2015

June 25-26, 2015

September 3-4, 2015

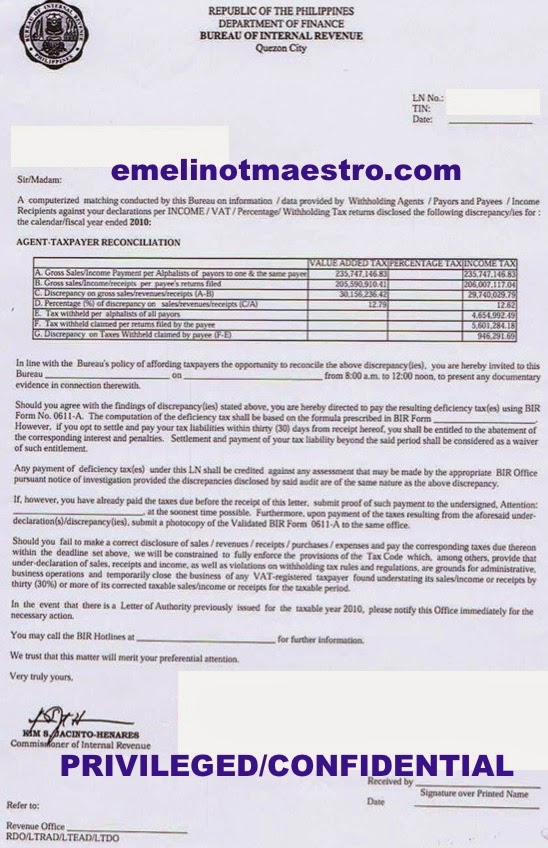

502 - Tax Mapping, Benchmarking, Oplan Kandado

December 2-3, 2015

February 26-27, 2015

May 21-22, 2015

September 10-11, 2015

December 8-9, 2015

THOSE WHO PLACED THEIR EMAIL ADDRESSES HEREIN SHALL RECEIVE THE ANSWER AGAINST THE BIR'S ASSAULT THAT IS FAILURE TO COMPLETE THE INFORMATION ON THE FACE OF AN OFFICIAL RECEIPT/SALES INVOICE WHICH HAS A PENALTY OF 5,000/10,000 PER VIOLATION (Tax Mapping)

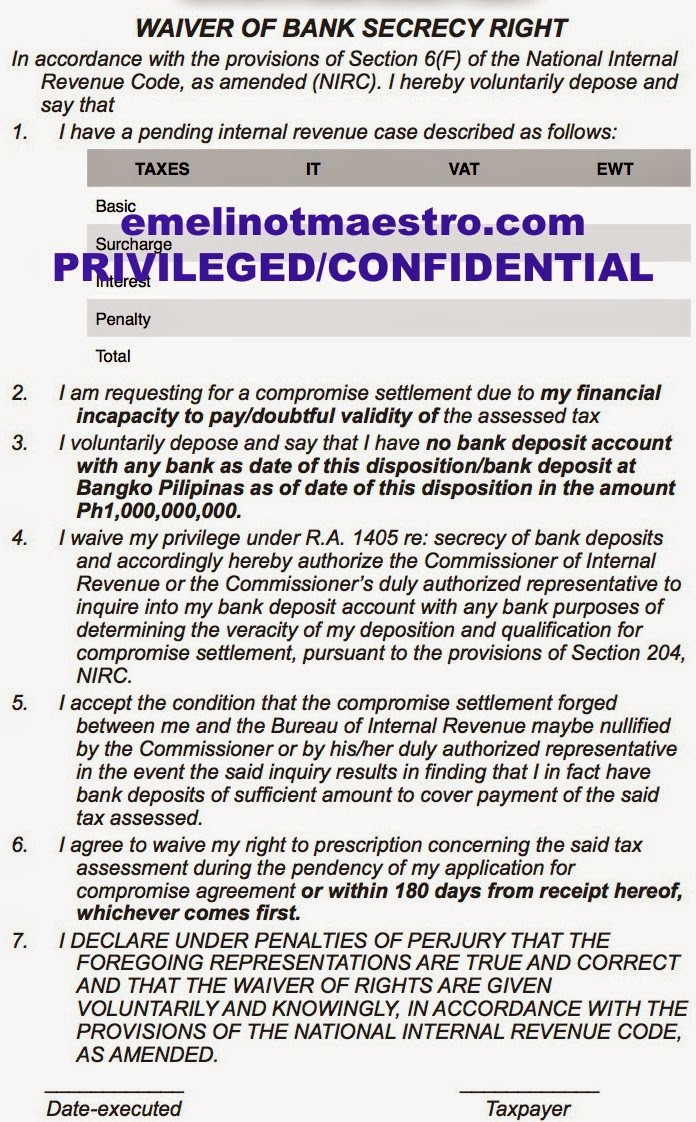

503 - How to Compromise Your Tax, Surcharge, Interest, Penalty

January 29-30, 2015

August 5-6, 2015

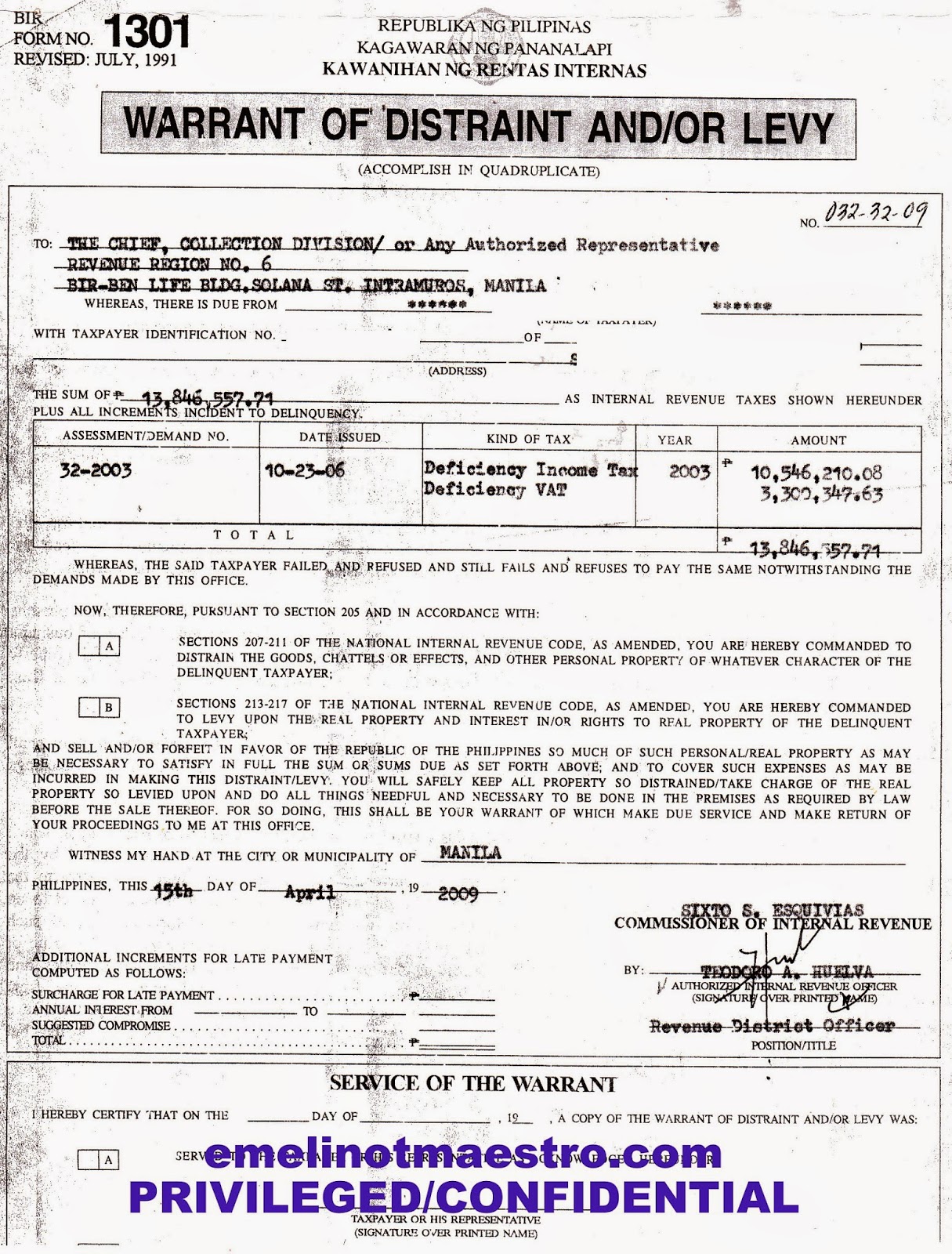

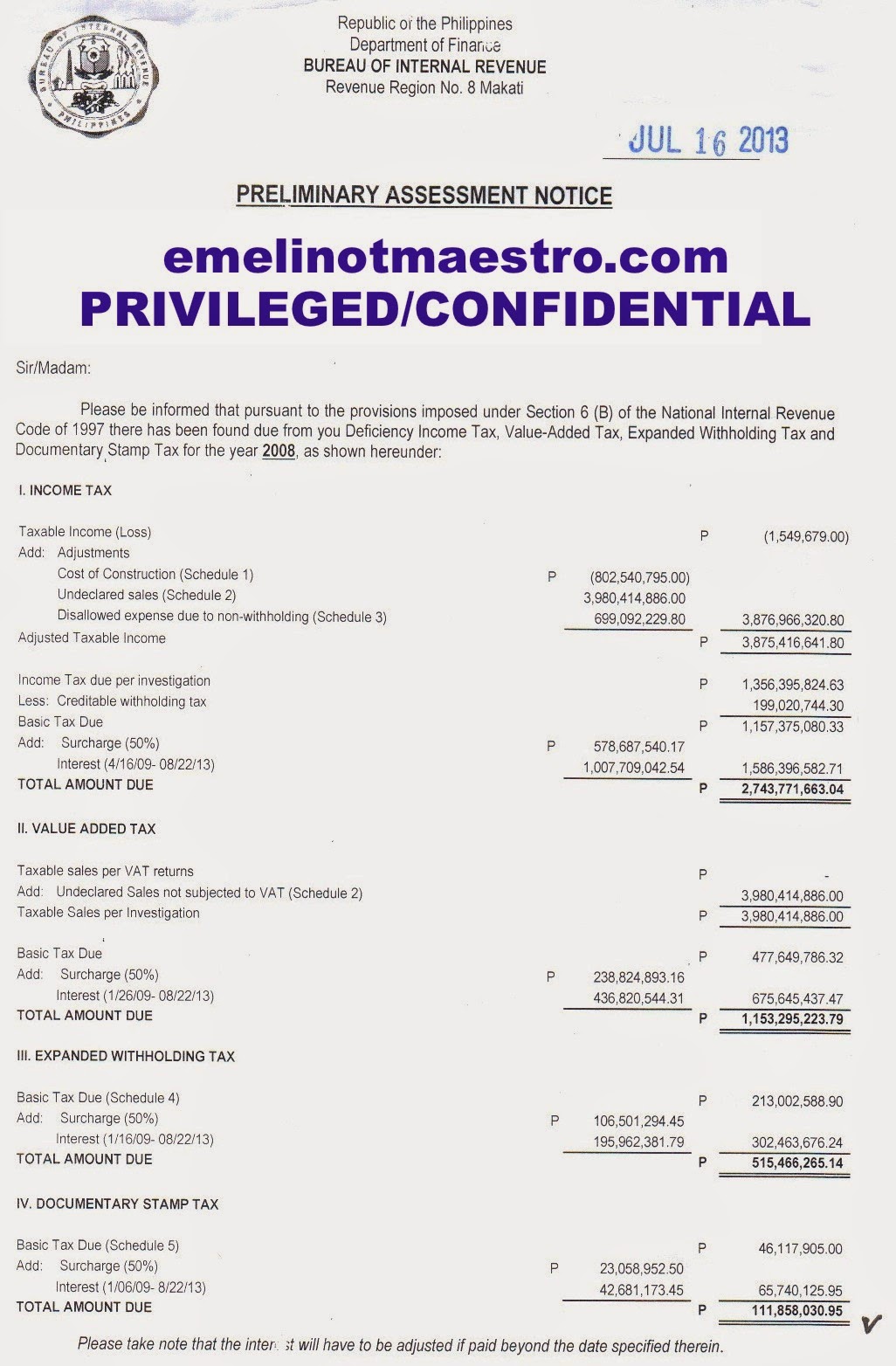

504 - Top 10 BIR Deficiency Assessments for Income Tax

April 29-30, 2015

August 13-14, 2015

October 7-8, 2015

505 - Top 10 BIR Deficiency Assessments for Withholding Tax

December 11-12, 2014

September 16-17, 2015

October 14-15, 2015

506 - Top 10 BIR Deficiency Assessments for Value Added Tax

March 11-12, 2015

August 19-20, 2015

October 22-23, 2015

April 23-24, 2015

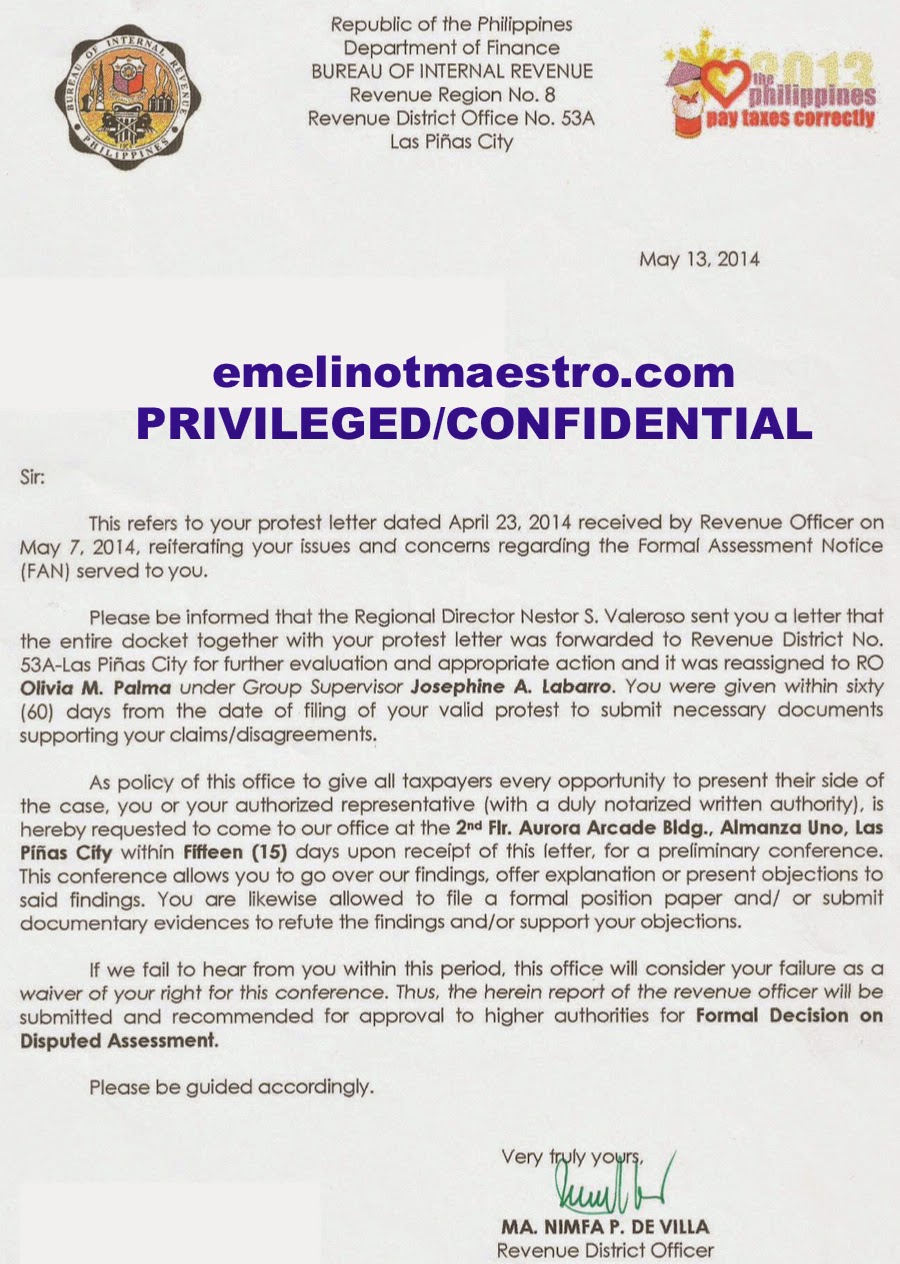

507 - Surviving a Publicly Humiliating Tax Evasion Assault

October 23-24, 2014

May 13-14, 2015

September 24-25, 2015

December 10-11, 2015

508 - Saving & Shielding Your Assets from Taxes & Expenses

August 25/27/29, 2014

November 18/21/25, 2014

July 22-24, 2015

November 18/19/20, 2015

Subject to

(1) change without notice/obligation

(2) applicable terms and conditions

www.Facebook.com/KATAXPAYER (8 photos)