The Greatest Love of All is To Get Into On Negosyo

FOR CPAs, NON-CPAs and NON-LAWYERS

From the time that I entered the Pamantasan ng Lungsod ng Maynila (PLM) until I graduated in 1986, my Mother seldom missed a chance to lovingly remind me about the beauty and benefits of having a college degree.

I know right there and then that she doesn’t want me to replicate her ‘labandera cum plantsadora’ lifestyle. Although, she did not complete her formal studies, she led me to understand the (1) principles of matching costs against revenue, (2) strategy of a meeting, (3) marketing and selling techniques, (4) structural pricing, (5) cost and quality controls, (6) customer relation, (7) business ethics, and (8) time management. Little did she know that she profoundly helped and assisted me to become what I am today.

I know right there and then that she doesn’t want me to replicate her ‘labandera cum plantsadora’ lifestyle. Although, she did not complete her formal studies, she led me to understand the (1) principles of matching costs against revenue, (2) strategy of a meeting, (3) marketing and selling techniques, (4) structural pricing, (5) cost and quality controls, (6) customer relation, (7) business ethics, and (8) time management. Little did she know that she profoundly helped and assisted me to become what I am today.

I am thanking the Almighty God for making my Mother a business person, - labandera cum plantsadora, because if she was an employee then, she would always be racing to punch in her card before 8 am and too tired to share her wisdoms after 5 pm. Notwithstanding the fact that at that time her revenue is more than what a minimum wage earner is receiving, it is still insufficient to our family needs due to the fact that businesses have erratic and unpredictable earnings.

Now let’s talk about your Dream.

Dreaming to be an employee is a NO NEGOSYO nightmare.

I was also brain-washed, brain-conditioned that after all the schoolings are done, the next best thing to do is to write a biota (resume), submit it to as many employers there are, compete with my friends and schoolmates for a preferred job-opening, wear proper attire during interview, impress potential employer, work from 8 - 12 hours a day, do an extraordinary and exceptional work, wait for the boss to notice it, wait either for a promotion so that an increased compensation may become a reality, or legislated wage-increase, etc., etc., etc.

Aspiring to be an entrepreneur is an ON NEGOSYO ambition.

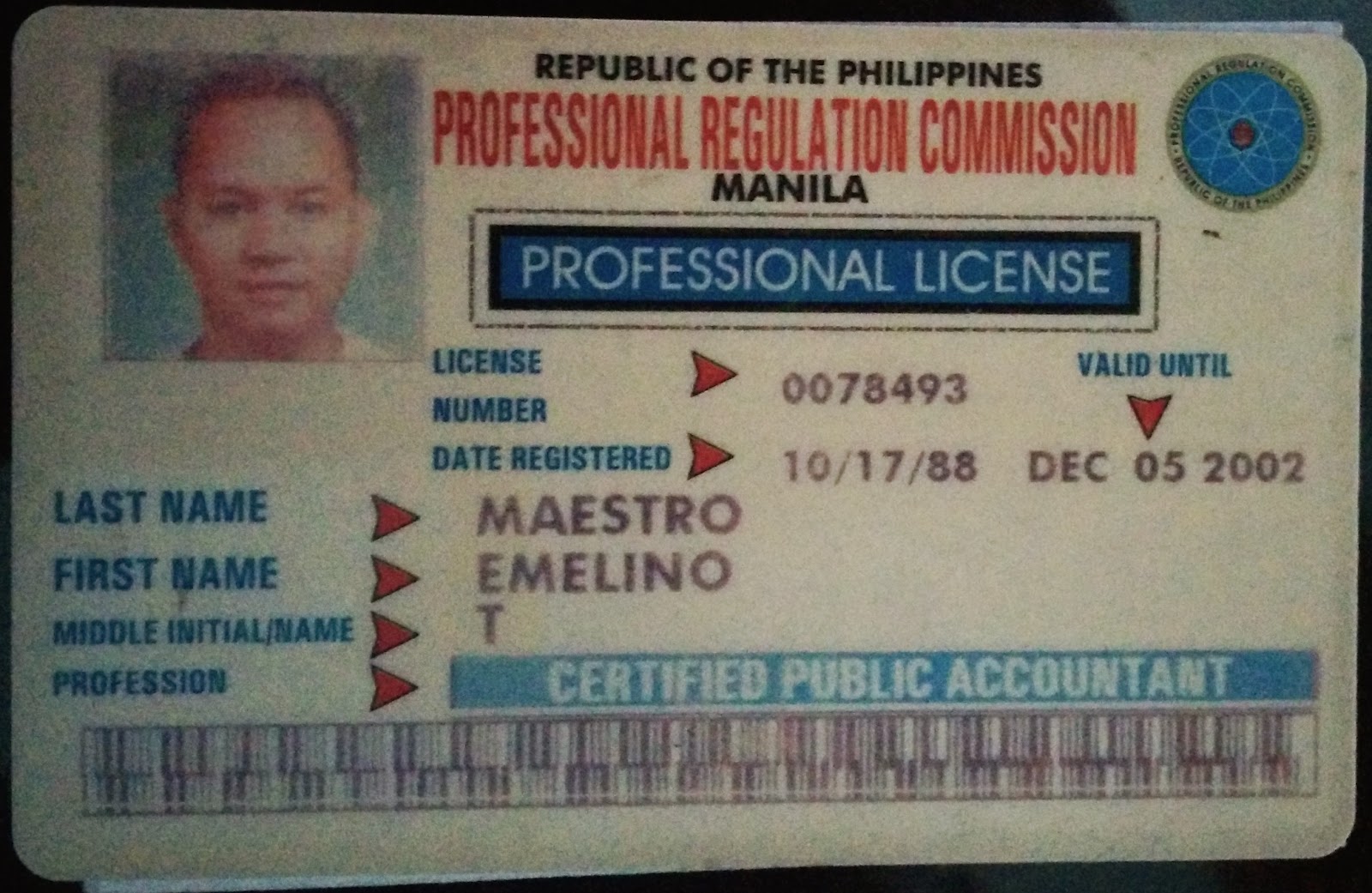

I am so lucky to realise early enough that to be a successful Certified Public Accountant (CPA) is too difficult, dirty, and dangerous. In the Philippines, only those who either have tie-ups with big, famous and foreign-owned CPA Firms (difficult), political connections (dirty), or a dishonourable character to perjure, lie, misrepresent and bribe (dangerous) are the factors constituting ‘success’. I, Katax ETM, have neither hitch-up with any giant CPA firm, political attachment, nor am engaged in immorality. However, without these baggages, I still manage to be a successful business consultant.

Surely, in the beginning of being a Tax Consultant (For more substance, let it be called ‘Taxnocrat’.), I made so many mistakes and failures. That is the only reason for writing this, I DON’T WANT YOU TO REPLICATE MY ‘MISTAKES AND FAILURES’ LIFESTYLE. Truly, what I learned from PLM didn’t make any great impact but from what I experienced in dealing with so many business persons (presidents, accountants, lawyers, bookkeepers, beggars, security guards, etc.), revenue officials and other government employees made and is still making me a relevant and competent educator as far as the Philippine local and national taxation is concerned. Would you like to continue learning from inexperienced persons? If you’re answer is ‘NO’, then, you’re ‘ON’ Negosyo mode.

Here’s the deal.

I am looking for a business partner, venturer, franchisee, licensee, etc. who will handle the influx of clients when I launch my newest business model and campaign. It's called TAXNOCRAT.

No franchise or licensee fee is to be paid or collected in the meantime. However, the books, training materials, seminar-room rentals, applicable taxes and other expenses related to your training are for your account. Per pax, the regular rate is 5,000 pesos while the early bird rate is just 1,500 pesos. However, if you'll bring a least two (2) of your many friends, you're entitled to a VIP rate of 500 pesos. Furthermore, if you will bring more friends, you will earn, in excess of two (2) your friends, 10% of the gross receipt (net of applicable taxes) collected therefrom. Finally, you friends can also avail of the VIP rate.

To be discussed in the ORIENTATION

a. Who are qualified?

b. What are to be learned from a specific course?

c. How long it will take to finish a course?

d. Opportunities and challenges of being a specialist?

e. Feasibility and practicability of being a specialist?

f. Who will be your potential competitions?

g. Marketing a specialist services?

h. Profit sharing and revenue allocation?

i. Other costs and expenses to be incurred?

j. Many more . …… ……..

Specialists that taxpayers are looking for......

1. Payroll master-specialist

2. Tax bookkeeper-specialist

3. VAT return preparer-specialist

4. Income tax return preparer-specialist

5. Withholding tax return preparer-specialist

6. Financial statements consolidator-specialist

7. Business registration, renewal and retirement specialist

Important: Subject to (1) change without notice and obligation and (2) all the applicable terms and conditions. By sending your email to go@taxaccountingguru.com, you knowingly and unconditionally agreed and adopted ETM's instructions, decisions and resolutions.

READ ALSO OTHER BLOGS OF KATAX ETM @ KATAXPAYER.BLOGGER.COM

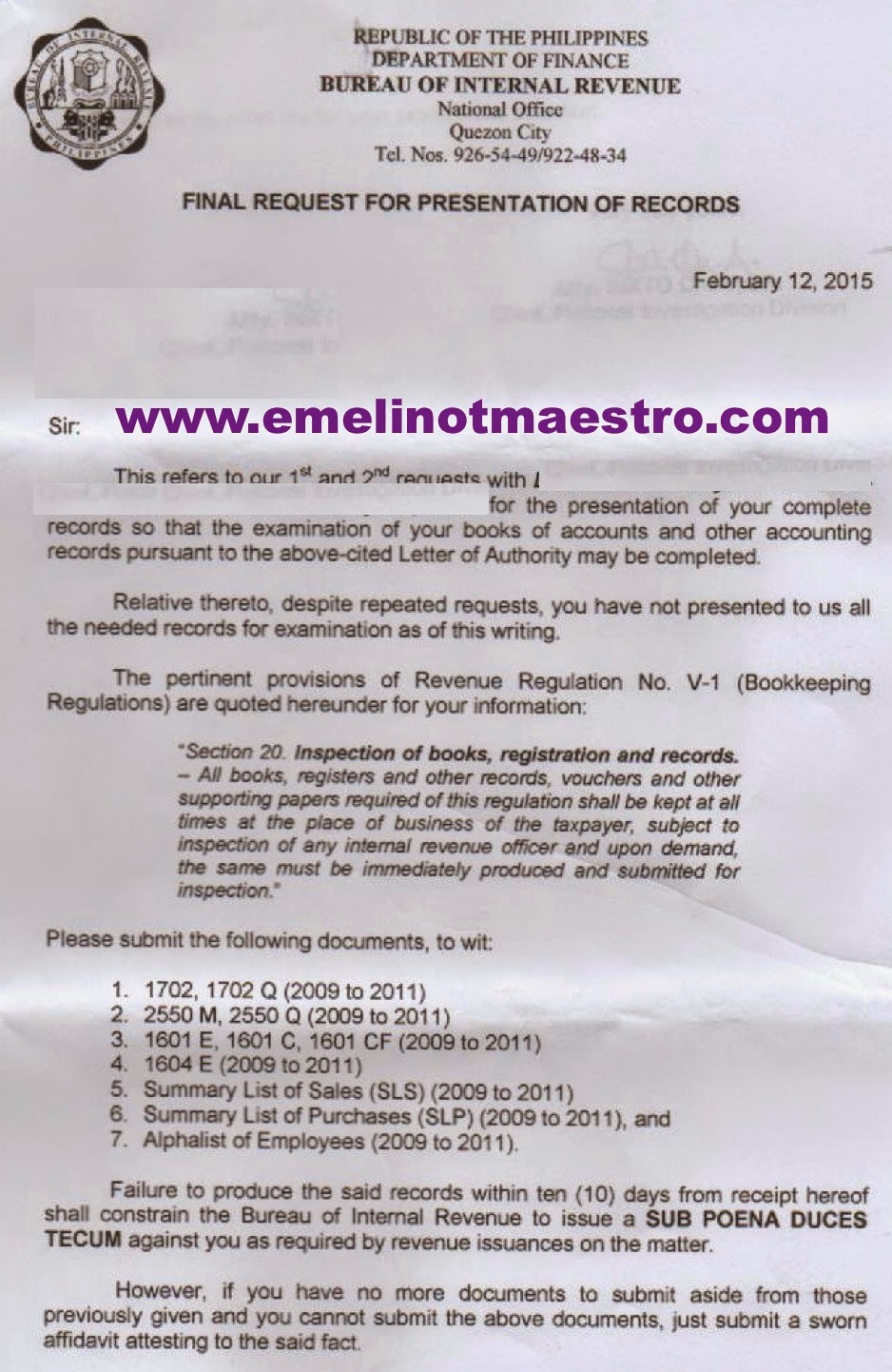

Procedures in Availing the Free Consultation on Deficiency Value Added Tax to be held at Sofitel Hotel

Procedures in Availing the Free Consultation on Deficiency Value Added Tax to be held at Sofitel Hotel 3. Download the GATE PASS as shown in kataxpayer.blogpot.com. Then, email it to at least 10 persons whom you know have tax troubles cc: go@taxaccountingguru

3. Download the GATE PASS as shown in kataxpayer.blogpot.com. Then, email it to at least 10 persons whom you know have tax troubles cc: go@taxaccountingguru

.jpg)