Emelino T Maestro

TIN 129 596 230

LEGAL PETITION NOTICE

FOR THE URGENT ACTION OF HONOURABLE OMBUDSMAN

Greetings.

May the intellect and wisdom of the Almighty God be added unto the minds of all the employees and officials of the Office of the Ombudsman whenever they are reading a similar Legal Petition Notice. I pray this always.

Preamble.

The Office of the Ombudsman shall investigate on its own, or on complaint by any person, any act or omission of any public official, employee, office or agency, when such act or omission appears to be illegal, unjust, improper, or inefficient.

Legal Issues to be Resolved.

This Office has a legal issue to be resolved (extinguish) whether (a) a Legal Petition Notice when filed and submitted to this Office is an inadmissible form of communication or not, and (b) the acts knowingly performed by the BIR Chief although no explicit orders from the Secretary of Finance are known or have been secured are valid and enforceable against the taxpaying public.

What I understood.

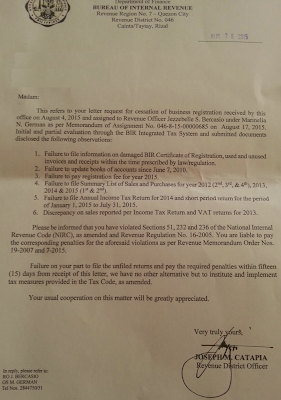

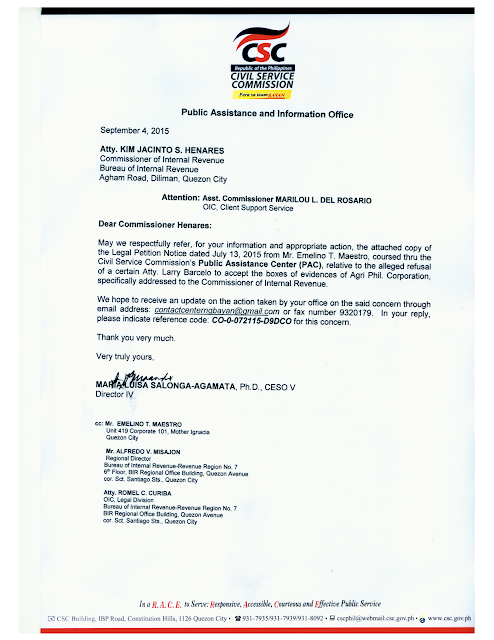

Last week I received two letters allegedly penned by Atty. Julita M Calderon. For this purpose, I scan-pasted them herein.

Her first letter implicitly explained that any LPN shall no longer be accepted and entertained while her second letter has acknowledged the receipt of an LPN. Although these letters hurt my feelings, they miserably failed to clearly tackle the issue of usurpation, abuse and lack of power and authority to carry out the orders of the laws of this State, specifically, Sections 6, 244 and 245, National Internal Revenue Code, as amended.

What must be done.

Doubtlessly, the Ombudsman and I would agree that BIR-corruption must be stopped. And, to do it, the communication avenues between me and the Ombudsman, including you - the readers of this, must be kept open and accessible, - 24/7. A trust agreement that is spelled out in the Philippine Constitution guarantees it.

In communicating, the form and substance, through the years, have evolved dramatically and drastically. Thus, the history of the world would provide ample evidences that there is no fix and fast rules as far as the form and substance of communication are concerned. However, it can surely be agreed upon that they must also be given significance and I want to share my point of view in that view.

For the ‘form’ view, the Courts had adopted for uniformity and consistency purposes the so-called Motion, Pleading, Comment, Affidavit, etc. while for businesspeople, they prefer to call their communicating evidences as business letters. I, as a unique and distinct therefrom, design, develop and innovate my own idiosyncratic and genuine form which I called LEGAL PETITION NOTICE. Acts that are contrary to law, public order, public policy and public safety and good moral are considered illegal and irregular and must not be pursued. Applying that oldest legal doctrine, my LPN being NOT CONTRARY TO LAW, PUBLIC ORDER, PUBLIC POLICY AND PUBLIC SAFETY AND GOOD MORAL should not be banned for its appearance and format (form) or to be used as an escape route to avoid the extinguishment of a legal obligation because the default of the Philippine Constitution for it is a ‘go-signal’.

I seek and stimulate the Honourable Ombudsman to rule and issue a relevant resolution on the first issue taking into account my explanation above.

For the ‘substance’ view, I’ve been hurt a lot when I read the two letters that allegedly penned by Atty. Julita M Calderon because it just copied the BIR regulations that distorted the spirit, essence and dialect of the National Internal Revenue Code.

However, before I will go deeply into my exposure, the Ombudsman and I would agree that any communication is not confined to having a single subject matter. In the above two letters, the subject of the first one is about the Warrant of Levy and Distraint irregularly prepared and issued while the issue of the second one tackled the irregular preparation and release of an electronic Letter of Authority. It can be deduced therefrom that the resolution of the Ombudsman for two different and distinct issues are one and the same. I am so curious, ‘How does the Ombudsman come up with such likeliness?’

Of course, I would not be penalised for dealing with more than one issues or subject matters herein, am I? Just asking……

I recognised the power and authority of the BIR Chief to have a sole and an exclusive jurisdiction to interpret the NIRC. However, this power and authority is subject to certain and precedent conditions. The Secretary of Finance is mandated also by NIRC to make all the necessary rules and regulations that will implement all the provisions of the said law. And, he, the Secretary, is prohibited or not allowed to delegate the said administrative supervision and control to the BIR Chief. So all the delegation orders and instructions from the Secretary that renounce his power and authority to the BIR Chief are void ab initio. More importantly, laws must be harmonised with one another and not to be taken as an isolation from other laws.

The Ombudsman and I would agree that CORRUPTION is in the MIND. The MIND means malfeasance, incompetence, negligence, delinquency. Sadly, most of the revenue officials have MIND of their own.

In the second letter, the topic is the abuse of authority being perpetuated and emphasised (m), the implementing rules and regulations that the BIR Chief had recommended to the Secretary and later on approved by him clearly required her to prepare a PROGRAM FOR ANNUAL AUDIT SELECTION CRITERIA. Then, part of the right to due process and access to records of a taxpayer under investigation, the said AUDIT PROGRAM must be written on the face of every electronic Letter of Authority to be prepared and served to the said taxpayer who may double check if he is really covered by the said ANNUAL AUDIT PROGRAM.

Parts of me is telling me that to circumvent this simple and easy to follow order of the Secretary, the BIR Chief, although several LPNs reminding her about this have already been sent to her, knowingly ignored and skipped off the preparation and issuance of a PROGRAM FOR ANNUAL AUDIT SELECTION CRITERIA.

In that view, the Ombudsman has already acquired jurisdiction over the said case. Thus, I seek and hearten the Ombudsman to look at these cases carefully and set aside the resolutions that allegedly penned by Atty. Julita M Calderon.

For any legal advise, please coordinate with Raymond Hernandez and Ronalyn Yu

Prayer.

I encourage the BIR and its authorised and appointed revenue officers to pray with me and ask the Almighty God that (a) this shall be accepted and acknowledged upon presentment; (b) all the correct, admissible and relevant actions to be accomplished in reply to the legal issues and simple requests herein presented should consciously be made in writing and delivered to me, within five (5) days from receipt hereof, all the available and legal reliefs and remedies shall knowingly and willingly be dispensed to me without mental reservation and purpose of evasion.

Signature.

My personal belief and conviction,

I don’t know much about the ‘tax’ and ‘accounting’ things. For such, I engaged the services of a CPA to do them for me. I want to comply with the law of the Philippines because by doing so, I understand that I am pampering myself with respect and peace of mind. However, in my past and present situations, my CPA is not an ASSET anymore but more of a LIABILITY. I am becoming aware that CPAs should no longer be TRUSTED in doing what the BIR requires. I need someone who would NOT RECOMMEND to ‘bribe’ a revenue officer and can explain in a clear and accurate language the tax assessments, and rules and regulations which I can’t get or experience from the list of CPAs.

I don’t know much about the ‘tax’ and ‘accounting’ things. For such, I engaged the services of a CPA to do them for me. I want to comply with the law of the Philippines because by doing so, I understand that I am pampering myself with respect and peace of mind. However, in my past and present situations, my CPA is not an ASSET anymore but more of a LIABILITY. I am becoming aware that CPAs should no longer be TRUSTED in doing what the BIR requires. I need someone who would NOT RECOMMEND to ‘bribe’ a revenue officer and can explain in a clear and accurate language the tax assessments, and rules and regulations which I can’t get or experience from the list of CPAs.