#EMELINOTMAESTRO is so concerned that he has to conduct an hour WEBINAR on January 6, 2016 from 5-6pm.

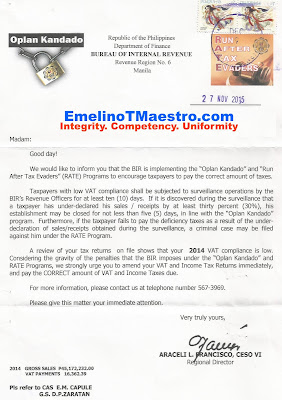

1,000,000 letters as shown across had been sent to alarm and warn everyone including those who did not receive such letter..THAT THIS COMING NEW YEAR MANY WILL BE PLACED UNDER THE OPLAN KANDADO AND RUN AFTER TAX EVADER PROGRAM OF THE BUREAU OF INTERNAL REVENUE.

To appease your burdened heart and stressed out minds, you are cordially invited to attend the above seminar. ETM will fully expose to you the BIR-plan of attacks and your possible defensive tactics or counter attack. You must understand that your failure to find appropriate reliefs to a clear and present danger may lead you to an unmanageable and irreversible situations. FOR THE DURATION OF ONE FULL HOUR, #ETM will explain to you the content and context of the letter as shown hereinabove.

This WEBINAR EVENT is about to

(1) avoid the erroneous application, by newly hired and corrupt revenue officers, of laws to the transactions of a taxpayer, (2) decrease the issuance of miscalculated deficiency tax assessment notices, (3) reduce the administrative expenses in pursuing a losing tax cases, (4) not to expose the revenue officers from a criminal prosecution for being incompetent and ignorant of the laws and (5) push a taxpayer to expose himself from danger, harm and disaster by way of directly admitting his guilt and ill-intentioned schemes to defraud the Philippine Government, the BIR had designed and develop the attached notice.

Please click this REGISTRATION FORM so that an accountable form will appear.

The good things that can be derived from going to a WEBINAR are (1) not experiencing the daily terrible traffic (saving time, gas, money and the environment),(2) learning and enjoying the event with your friends, relatives and co-workers (saving money by paying a single seminar fee), and (3) listening and watching ETM in the comfort and safety of your own place.

For a relevant Taxation Professional's services, you may call 0922 801 0922, visit Unit 419 Corporate 101 Mother Ignacia Quezon City or etmtaxagentoffice.com, or share-like Kataxpayer Facebook.

Ignorance is the basic foundation of graft and corruption. The BIR-corrupt brigade is maximizing its full potential and profitability. Fishes find strength, courage and competence in numbers. They had conquered their predators/enemies by grouping together in order to make them bigger than their enemies. You too can become bigger than the fear that lingered in your minds and hearts. Join 'JuanTALKS' now and share your knowledge and experiences to other Filipinos.

Sunday 20 December 2015

Saturday 19 December 2015

BIR Chief Declares an Assessment Holiday

From December 16, 2016 up to January 5, 2015, all revenue officers are forbidden to prepare, sign and release a tax deficiency assessment notice to any taxpayer. More so, all tax mapping, oplan kandado and inventory taking activities are suspended.

Many taxpayers had welcomed this development because they will be relieved uninvited guests and unwanted visitors. In turn, a lot of cash may be spared off or saved.

However, all tax investigations and audits for cases prescribing on April 16, 2016 and tax fraud cases will remain in effect and not be affected by the assessment holiday. The full details of the BIR Chief's instructions can be viewed via Revenue Memorandum Order 75-2015.

Taxpayers concerned are advised and strongly encouraged to take photos and prepare relevant proofs against erring and enterprising revenue officers who knowingly disregard the rules on assessment holidays. Comment, please, your spotted violations or upload your photos thereof via Crimes Against Taxpayers Facebook.

ETM Tax Agent Office is much willing to help and assist you in removing from service those who are oppressing you. For the services of a Taxation Professional, please call 0922 801 0922.

Understanding a BIR-Legal Threat:

The Oplan Kandado and Tax Evasion Threat

January 6, 2016, 5-6pm

Webinar Type

CPA on Demand Orientation (Chip-in)

January 12, 2016, 1-5pm

University Hotel, UP Campus, QC

Payroll Accounting, Documentation and Taxation

January 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Many taxpayers had welcomed this development because they will be relieved uninvited guests and unwanted visitors. In turn, a lot of cash may be spared off or saved.

However, all tax investigations and audits for cases prescribing on April 16, 2016 and tax fraud cases will remain in effect and not be affected by the assessment holiday. The full details of the BIR Chief's instructions can be viewed via Revenue Memorandum Order 75-2015.

Taxpayers concerned are advised and strongly encouraged to take photos and prepare relevant proofs against erring and enterprising revenue officers who knowingly disregard the rules on assessment holidays. Comment, please, your spotted violations or upload your photos thereof via Crimes Against Taxpayers Facebook.

ETM Tax Agent Office is much willing to help and assist you in removing from service those who are oppressing you. For the services of a Taxation Professional, please call 0922 801 0922.

Attend and Announce:

The Oplan Kandado and Tax Evasion Threat

January 6, 2016, 5-6pm

Webinar Type

CPA on Demand Orientation (Chip-in)

January 12, 2016, 1-5pm

University Hotel, UP Campus, QC

Conference-forum Type

Payroll Accounting, Documentation and Taxation

January 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

No Worry Tax Deficiency Payments

Many taxpayers became an unwilling victims of graft and corrupt practices. One of which is the instructions of several revenue officers to many authorised agent banks (AABs). The AABs are prohibited to accept a tax deficiency payments from taxpayers if the BIR Form covering such payment doesn't have the signature of an approving revenue officer. This practice is devoid of any legal justification and opens up graft and corruption opportunities to many revenue officers, creates unwelcome inconvenience to many taxpayers and totally deprives and denies the Philippine Government to timely hold and have the cash to be remitted by the taxpayers concerned.

Thanks to the gallant act of the BIR Chief, she totally dismantled this malicious practice by way of issuing Revenue Memorandum Circular 75-2015 authorising all the taxpayers to disregard the above-cited practice as well as directed them to pay their known tax deficiency at an AAB having jurisdiction over their principal place of business.

To help and assist you, please post at Crimes Against Taxpayers Facebook, photos of people and places such revenue officers, bank officials, BIR offices, bank-branches, etc. who knowingly failed and refused to honour and abide by the rules set forth so that Emelino T Maestro may help you draft and file a relevant complaint.

For tax updates, webinars and training programs in enhancing your capabilities and skills in taxation and other fields of concerns, please visit EmelinoTMaestro.com. For your tax reliefs and remedies, please call 0922 801 0922 or visit Unit 419 Corporate 101 Mother Ignacia, Quezon City and look for Juliet or Dhen so that they can immediately advise you of your next careful acts.

Attend and Announce:

The Oplan Kandado and Tax Evasion Threat

January 6, 2016, 5-6pm

Webinar Type

CPA on Demand Orientation (Chip-in)

January 12, 2016, 1-5pm

University Hotel, UP Campus, QC

Conference-forum Type

Payroll Accounting, Documentation and Taxation

January 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Sunday 13 December 2015

CPA on Demand and Professional on Demand with Emelino T Maestro

BAGO AT KUMIKITANG NEGOSYO sa taong 2016.

para sa OFWs, bookkeepers, logistics, CPAs, lawyers, o kahit sinong gusto ng pera

...

CPA Unite. Create Synergy. Join CPA on Demand

#CPAonDemand #EmelinoTMaestro

3 year Residency Program:

I don't understand why a newly passed CPA needs to undergo a 3-year Residency Program from any company in order to be allowed to CPA-practice. Isn't it enough that this CPA passed the exams that the Professional Regulation Commission gave. Unfair... puede namang maging freelancer, o consultant o auditor kaagad ang bagong pasang CPA ... Bakit kailangang pahirapan pa sa pamamagitan ng pagiging empleyado sa ibang tao o dayuhan.... Akala ko ba ang policy ng Gobyerno ay development of Entrepreneurs.... ... Curtailment of business ata ang pinupuntahan nito.... Unconstitutional...

Poor CPAs became Poorer CPAs:

More than 100,000 CPAs na... Ang nagyayari ay marami na ang nagiging Certified Public Atsoy sa ibang bansa.. Pumamasok sila bilang caregiverd kasi alang opportunity daw dito sa Pinas... Namputsa naman kayo... Binababoy ninyo ang professionals...

CPA on Demand....

Mga CPA, di bale, ang pang aapi sa inyo ... gamitin natin para umulad tayo... Magtulungan na lang tayo... Gumagawa si #EmelinoTMaestro ng CPA on Demand para maibenta ang inyong CPA services sa loob at labas ng Pinas... Sama ka sa first orientation program.... P700/pax chip in tayo (light -am-snacks/lunch/pm-snacks)... Para malaman ng iba na may "INTEGRIDAD" ang CPAs... puede din sumama ang hindi nakapasang CPAs, mga OFWs o sinumang gustong makaroon ng NEGOSYO o iyong naghahanap ng NEGOSYONG ALANG MALAKING PUHUNAN. May meeting tayo sa University of the Philippines, January 8, 2015, 9am -5pm... To register, click this http://goo.gl/forms/AUpEm2JdfT (paki lagay after your name the word 'COD') para alam ni ETM sa CPA on Demand ka aattend... Finally, you must Share this onto your Facebook account so others may have a new NEGOSYO this year 2016.....You must email the screen-shot of your Sharing Act to ETM via go@taxaccountingguru.com. Thanks.

Mga CPA, di bale, ang pang aapi sa inyo ... gamitin natin para umulad tayo... Magtulungan na lang tayo... Gumagawa si #EmelinoTMaestro ng CPA on Demand para maibenta ang inyong CPA services sa loob at labas ng Pinas... Sama ka sa first orientation program.... P700/pax chip in tayo (light -am-snacks/lunch/pm-snacks)... Para malaman ng iba na may "INTEGRIDAD" ang CPAs... puede din sumama ang hindi nakapasang CPAs, mga OFWs o sinumang gustong makaroon ng NEGOSYO o iyong naghahanap ng NEGOSYONG ALANG MALAKING PUHUNAN. May meeting tayo sa University of the Philippines, January 8, 2015, 9am -5pm... To register, click this http://goo.gl/forms/AUpEm2JdfT (paki lagay after your name the word 'COD') para alam ni ETM sa CPA on Demand ka aattend... Finally, you must Share this onto your Facebook account so others may have a new NEGOSYO this year 2016.....You must email the screen-shot of your Sharing Act to ETM via go@taxaccountingguru.com. Thanks.

Please pay on or before January 6, 2016... Those who not pay on the said date shall pay P1,200/pax... Deposit your payment under Emelino T Maestro BPI-savings account number 9629 0045 96. Print your complete name on the BPI validated deposit slip. Finally, scan-email the said slip to 'go@taxaccountingguru.com' ASAP... You understand that your payment is not a payment for ETM professional services.... It shall be considered in a fiduciary account that will be used to propagate the cause herein stated.

para sa OFWs, bookkeepers, logistics, CPAs, lawyers, o kahit sinong gusto ng pera

...

CPA Unite. Create Synergy. Join CPA on Demand

#CPAonDemand #EmelinoTMaestro

3 year Residency Program:

I don't understand why a newly passed CPA needs to undergo a 3-year Residency Program from any company in order to be allowed to CPA-practice. Isn't it enough that this CPA passed the exams that the Professional Regulation Commission gave. Unfair... puede namang maging freelancer, o consultant o auditor kaagad ang bagong pasang CPA ... Bakit kailangang pahirapan pa sa pamamagitan ng pagiging empleyado sa ibang tao o dayuhan.... Akala ko ba ang policy ng Gobyerno ay development of Entrepreneurs.... ... Curtailment of business ata ang pinupuntahan nito.... Unconstitutional...

Poor CPAs became Poorer CPAs:

More than 100,000 CPAs na... Ang nagyayari ay marami na ang nagiging Certified Public Atsoy sa ibang bansa.. Pumamasok sila bilang caregiverd kasi alang opportunity daw dito sa Pinas... Namputsa naman kayo... Binababoy ninyo ang professionals...

CPA on Demand....

Mga CPA, di bale, ang pang aapi sa inyo ... gamitin natin para umulad tayo... Magtulungan na lang tayo... Gumagawa si #EmelinoTMaestro ng CPA on Demand para maibenta ang inyong CPA services sa loob at labas ng Pinas... Sama ka sa first orientation program.... P700/pax chip in tayo (light -am-snacks/lunch/pm-snacks)... Para malaman ng iba na may "INTEGRIDAD" ang CPAs... puede din sumama ang hindi nakapasang CPAs, mga OFWs o sinumang gustong makaroon ng NEGOSYO o iyong naghahanap ng NEGOSYONG ALANG MALAKING PUHUNAN. May meeting tayo sa University of the Philippines, January 8, 2015, 9am -5pm... To register, click this http://goo.gl/forms/AUpEm2JdfT (paki lagay after your name the word 'COD') para alam ni ETM sa CPA on Demand ka aattend... Finally, you must Share this onto your Facebook account so others may have a new NEGOSYO this year 2016.....You must email the screen-shot of your Sharing Act to ETM via go@taxaccountingguru.com. Thanks.

Mga CPA, di bale, ang pang aapi sa inyo ... gamitin natin para umulad tayo... Magtulungan na lang tayo... Gumagawa si #EmelinoTMaestro ng CPA on Demand para maibenta ang inyong CPA services sa loob at labas ng Pinas... Sama ka sa first orientation program.... P700/pax chip in tayo (light -am-snacks/lunch/pm-snacks)... Para malaman ng iba na may "INTEGRIDAD" ang CPAs... puede din sumama ang hindi nakapasang CPAs, mga OFWs o sinumang gustong makaroon ng NEGOSYO o iyong naghahanap ng NEGOSYONG ALANG MALAKING PUHUNAN. May meeting tayo sa University of the Philippines, January 8, 2015, 9am -5pm... To register, click this http://goo.gl/forms/AUpEm2JdfT (paki lagay after your name the word 'COD') para alam ni ETM sa CPA on Demand ka aattend... Finally, you must Share this onto your Facebook account so others may have a new NEGOSYO this year 2016.....You must email the screen-shot of your Sharing Act to ETM via go@taxaccountingguru.com. Thanks.Please pay on or before January 6, 2016... Those who not pay on the said date shall pay P1,200/pax... Deposit your payment under Emelino T Maestro BPI-savings account number 9629 0045 96. Print your complete name on the BPI validated deposit slip. Finally, scan-email the said slip to 'go@taxaccountingguru.com' ASAP... You understand that your payment is not a payment for ETM professional services.... It shall be considered in a fiduciary account that will be used to propagate the cause herein stated.

Payroll Accounting, Documentation & Taxation by Emelino T Maestro

Bureau of Internal Revenue's rules and regulations that govern the proper way of documenting an employee-employer relationship are sometimes hard to understand and most of the times, are to implement. Erroneous interpretation and misunderstanding of the BIR rules and regulations lead to improper use of accounting titles and miscalculated entries in the books of accounts. The result of these unwelcome actions is sometimes devastating to the owners and officials of a company.

To remedy this tax trouble, HR Managers and their counterparts in the Finance Department who may be the Accounting Manager and Finance Director must understand the intricacies and complexities of complying with the procedural due processes that the law on taxation imposed.

You, your friends and business associates, investors, employees, suppliers and creditors are welcome to discuss your existing set up with Emelino T Maestro and his appointed person so that at this early stage, the appropriate correction or improvement of your situation may be made.

Please email 'go@taxaccountingguru.com', text 0998 979 3922, or call 02-439 3918.... PLEASE CLICK THIS REGISTRATION FORM AND AN ACCOUNTABLE FORM WILL APPEAR

Thanks for sharing this. Click this video about Payroll Accounting....

January 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Ways to Overcome an electronic Letter of Authority

Subpoena Duces Tecum and Letter Notice

February 10, 11 and 12, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

To remedy this tax trouble, HR Managers and their counterparts in the Finance Department who may be the Accounting Manager and Finance Director must understand the intricacies and complexities of complying with the procedural due processes that the law on taxation imposed.

You, your friends and business associates, investors, employees, suppliers and creditors are welcome to discuss your existing set up with Emelino T Maestro and his appointed person so that at this early stage, the appropriate correction or improvement of your situation may be made.

Please email 'go@taxaccountingguru.com', text 0998 979 3922, or call 02-439 3918.... PLEASE CLICK THIS REGISTRATION FORM AND AN ACCOUNTABLE FORM WILL APPEAR

Thanks for sharing this. Click this video about Payroll Accounting....

Attend and announce

Payroll Accounting, Documentation and TaxationJanuary 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Ways to Overcome an electronic Letter of Authority

Subpoena Duces Tecum and Letter Notice

February 10, 11 and 12, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Tuesday 1 December 2015

Bookkeeping Regulations (BIR RR V-1): Pay it Forward Principle

This is a PAY IT FORWARD Principles.

#EmelinoTMaestro #Bookkeepingregulations

No matter how loyal, trusted and effective your people are, their resignation, retirement and redundancy would eventually set in. When these people go, your secrets, policies and procedures leave also with them. Acquiring and hiring new personnel may bring chill and excitement but any experimentation in taxation is not strongly advised. Without mental reservation and purpose of evasion, all the tax compliance policies and procedures should always be ready/available; never to be compromised; and profoundly, must correctly/consistently be applied. This Republic is not under legal duty to equip you with what you need to know, comprehend and use. It had already laid down all the fundamentals in making you, including your suppliers and customers, to be law-abiding. In this view, a customised/updated “TAX ACCOUNTING SYSTEM” that would never resign, retire and be redundant is all you need.

#EmelinoTMaestro #Bookkeepingregulations

No matter how loyal, trusted and effective your people are, their resignation, retirement and redundancy would eventually set in. When these people go, your secrets, policies and procedures leave also with them. Acquiring and hiring new personnel may bring chill and excitement but any experimentation in taxation is not strongly advised. Without mental reservation and purpose of evasion, all the tax compliance policies and procedures should always be ready/available; never to be compromised; and profoundly, must correctly/consistently be applied. This Republic is not under legal duty to equip you with what you need to know, comprehend and use. It had already laid down all the fundamentals in making you, including your suppliers and customers, to be law-abiding. In this view, a customised/updated “TAX ACCOUNTING SYSTEM” that would never resign, retire and be redundant is all you need.

EMELINOTMAESTRO (ETM) will waive his right to earn in selling the Bookkeeping Regulations (RR V-1) book. This ebook will be emailed to you free of charge. Morally speaking, you are encouraged to forward-email it to as many friends that you have. The purpose is so simple that is HELP THEM UNDERSTAND THE LAW SO THAT THEY WILL NOT BECOME VICTIMS OF A VERY CONTAGIOUS DISEASE CALLED 'IGNORANCE'. No need to call or text his mobile number 0922 801 0922 or email him at go@taxaccountingguru.com or PM him at Kataxpayer Facebook or visit his Unit 419 Corporate 101 Mother Ignacia Quezon City office. IF YOU HAVE TIME AND MORE CARE TO OTHER PREYED TAXPAYERS, you are also encouraged to download any picture hereof and post it on your SocMed accounts such as Facebook, Instagram, Tweeter, etc. Thanks....

EMELINOTMAESTRO (ETM) will waive his right to earn in selling the Bookkeeping Regulations (RR V-1) book. This ebook will be emailed to you free of charge. Morally speaking, you are encouraged to forward-email it to as many friends that you have. The purpose is so simple that is HELP THEM UNDERSTAND THE LAW SO THAT THEY WILL NOT BECOME VICTIMS OF A VERY CONTAGIOUS DISEASE CALLED 'IGNORANCE'. No need to call or text his mobile number 0922 801 0922 or email him at go@taxaccountingguru.com or PM him at Kataxpayer Facebook or visit his Unit 419 Corporate 101 Mother Ignacia Quezon City office. IF YOU HAVE TIME AND MORE CARE TO OTHER PREYED TAXPAYERS, you are also encouraged to download any picture hereof and post it on your SocMed accounts such as Facebook, Instagram, Tweeter, etc. Thanks.... Monday 9 November 2015

Derek Arthur Ramsay won his fight against BIR Deficiency Tax Assessment

The Derek-Approach in Reducing Tax ASSessment

The Derek-Approach in Reducing Tax ASSessment19.5 million deficiency tax assessment was cancelled.

Learn the CORRECT SECRET AND RIGHT LEGAL WAY

Emelino T Maestro's IC3 Tax Consulting Program

for Non-lawyers and Non-accountants

January 7, 2016, 2-4pm

University of the Philippines, Diliman, Quezon City

Investment fee-rate per attendee

Investment fee-rate per attendeeSuper-saver: 500 plus VAT, December 10, 2015-payment due

Group-5: 1,995, January 5, 2016-payment due

Early-bird: 1,795, December 20, 2015-payment due

Regular: 2,225, on or before January 7, 2016

YourRegistration is via go@taxaccountingguru.com

To avail the Super-saver rate, please follow the instructions shown in this link http://kataxpayer.blogspot.com/2015/10/sino-ang-gustong-ng-libro-ng-bir.html.. Else, you are disqualified to avail it...

Share this on you Facebook account in order to help other harassed taxpayers.

Tuesday 27 October 2015

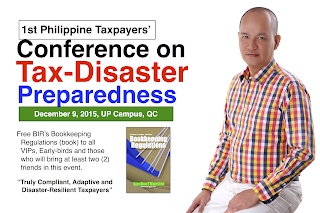

1st Philippine Taxpayers' Conference on Tax-Disaster Preparedness, University of the Philippines, Quezon City

Super Conference:

1st Philippine Taxpayers' Conference on Tax-Disaster Preparedness

1st Philippine Taxpayers' Conference on Tax-Disaster Preparedness

Areas of Concerns:

1. Disaster Prevention

1.a. Minimise vulnerability and exposure of taxpayers to all tax hazards such as electronic Letter of Authority, Letter Notice, Subpoena Duces Tecum, Tax Mapping, Benchmarking, Oplan Kandado, etc

1.a. Minimise vulnerability and exposure of taxpayers to all tax hazards such as electronic Letter of Authority, Letter Notice, Subpoena Duces Tecum, Tax Mapping, Benchmarking, Oplan Kandado, etc

1.b. Improve knowledge and know-hows of taxpayers to minimise their own tax risks and cope with the impacts of all hazards

2. Disaster Preparedness

2.a. Increase the level of consciousness of the taxpayers to the threats and impacts of all hazards, risks and vulnerabilities

2.b. Equip the taxpayers with the necessary knowledge and know-hows to cope with the negative impacts of a tax disaster

2.b. Equip the taxpayers with the necessary knowledge and know-hows to cope with the negative impacts of a tax disaster

2.c. Develop and implement comprehensive and uniform preparedness guidelines, plans and systems

2.d. Strengthen partnership and support systems among all taxpayers

3. Disaster Response

3.a. Reduce the number of preventable errors and mistakes

3.b. Concentrate on the basic and legal needs

3.c. Restore regular operations

3.c. Restore regular operations

4. Disaster Rehabilitation

4.a. Retool and retrain the affected employees

4.b. Restructure the affected accountable forms

4.c. Reassure the affected suppliers, customers and banks

4.d. Improve the business processes and systems

Perceived-Regulatory Hazards:

1. Compliance with too many restrictions/rules

2. Registration of activities, facilities, forms, systems, equipment, etc.

3. Assessment procedures for tax deficiencies

4. Collection procedures for tax delinquencies

Investment fee:

Investment fee:

1. Very Important Person. Front seat, Free Bookkeeping Regulations Book, Free One (1) Email-Consultation, Can Ask a Question during the Event, Free ETM-signing of the Book... Php3,495. per VIP

2. Super-saver Person. Middle seat, Free Bookkeeping Regulations Book, Pays on or before November 20, 2015, 5pm... Php1,495. per SSP

3. Group 10. Middle/Back seats, Pay on or before November 28, 2015, 5pm.. Php1,295. per GT-member

4. Regular Person. Middle/Back seat... Php 1,995. per RP

Venue*:

Bahay ng Alumni

Bahay ng Alumni

University of the Philippines

Quezon City

Parking space:

Free and plenty

Date and Time:

December 9, 2015, from 12 noon to 5 pm

*Subject to change without notice or obligation

Tutorial video for clicking

1st Philippine Taxpayers' Conference on Tax-Disaster Preparedness

1st Philippine Taxpayers' Conference on Tax-Disaster PreparednessAreas of Concerns:

1. Disaster Prevention

1.a. Minimise vulnerability and exposure of taxpayers to all tax hazards such as electronic Letter of Authority, Letter Notice, Subpoena Duces Tecum, Tax Mapping, Benchmarking, Oplan Kandado, etc

1.a. Minimise vulnerability and exposure of taxpayers to all tax hazards such as electronic Letter of Authority, Letter Notice, Subpoena Duces Tecum, Tax Mapping, Benchmarking, Oplan Kandado, etc1.b. Improve knowledge and know-hows of taxpayers to minimise their own tax risks and cope with the impacts of all hazards

2. Disaster Preparedness

2.a. Increase the level of consciousness of the taxpayers to the threats and impacts of all hazards, risks and vulnerabilities

2.b. Equip the taxpayers with the necessary knowledge and know-hows to cope with the negative impacts of a tax disaster

2.b. Equip the taxpayers with the necessary knowledge and know-hows to cope with the negative impacts of a tax disaster2.c. Develop and implement comprehensive and uniform preparedness guidelines, plans and systems

2.d. Strengthen partnership and support systems among all taxpayers

3. Disaster Response

3.a. Reduce the number of preventable errors and mistakes

3.b. Concentrate on the basic and legal needs

3.c. Restore regular operations

3.c. Restore regular operations4. Disaster Rehabilitation

4.a. Retool and retrain the affected employees

4.b. Restructure the affected accountable forms

4.c. Reassure the affected suppliers, customers and banks

4.d. Improve the business processes and systems

Perceived-Regulatory Hazards:

1. Compliance with too many restrictions/rules

2. Registration of activities, facilities, forms, systems, equipment, etc.

3. Assessment procedures for tax deficiencies

4. Collection procedures for tax delinquencies

Investment fee:

Investment fee: 1. Very Important Person. Front seat, Free Bookkeeping Regulations Book, Free One (1) Email-Consultation, Can Ask a Question during the Event, Free ETM-signing of the Book... Php3,495. per VIP

2. Super-saver Person. Middle seat, Free Bookkeeping Regulations Book, Pays on or before November 20, 2015, 5pm... Php1,495. per SSP

3. Group 10. Middle/Back seats, Pay on or before November 28, 2015, 5pm.. Php1,295. per GT-member

4. Regular Person. Middle/Back seat... Php 1,995. per RP

Venue*:

Bahay ng Alumni

Bahay ng AlumniUniversity of the Philippines

Quezon City

Parking space:

Free and plenty

Date and Time:

December 9, 2015, from 12 noon to 5 pm

*Subject to change without notice or obligation

Tutorial video for clicking

Sinong may gustong ng librong gamit ng BIR? Bookkeeping Regulations (BIR RR V-1)

Hindi lang dapat ang Certified Public Accountant mo ang makaalam at makaintindi ng ACCOUNTING BOOKKEEPING.

Hindi ang ACCOUNTING PRINCIPLES na kinopya sa ibang bansa ang ginagamit ng Bureau of Internal Revenue (BIR). Higit sa lahat ay wala itong value o kwenta sa mata ng husgado at gobyerno ng Pilipinas... Kaya nga mayroon Commission on Audit...may batas para sa totoo at tamang ACCOUNTING.

GAMIT NG BIR. DAPAT GAMIT MO RIN.

Huwag ng pahuli... Humingi ng nga librong ito. To register, please click this.

Mga dapat gawin..... i-share ito sa lahat ng iyong email contacts at facebook, instagram at tweeter friends...CC: go@taxaccountingguru.com

Your chance of getting is just around the corner.... 09228010922

Click this for a detailed discussion Bookkeeping Regulations (BIR RR V-1)

For those who will avail the Super-Saver rate for the January 7, 2016 seminar workshop, you will get this book FREE OF CHARGE. Please follow these procedures...

1. Copy all the message shown herein.

2. Paste it all in the Compose Mail of your personal email account.

3. Email this to at least 50 persons from your contact list

4. CC: go@taxaccountingguru.com

5. Click the January 7, 2016 link as it is shown above

6. Share the link in your personal Facebook account

7. Tag EmelinoTMaestro or Kataxpayer to inform ETM

8. Only those who will obey the above procedures will be entitled to the Super-Saver rate and will get the above cited book (on the seminar date)

9. Failure to attend will forfeit this privilege of yours.

Thanks for sharing

Hindi ang ACCOUNTING PRINCIPLES na kinopya sa ibang bansa ang ginagamit ng Bureau of Internal Revenue (BIR). Higit sa lahat ay wala itong value o kwenta sa mata ng husgado at gobyerno ng Pilipinas... Kaya nga mayroon Commission on Audit...may batas para sa totoo at tamang ACCOUNTING.

GAMIT NG BIR. DAPAT GAMIT MO RIN.

Huwag ng pahuli... Humingi ng nga librong ito. To register, please click this.

Mga dapat gawin..... i-share ito sa lahat ng iyong email contacts at facebook, instagram at tweeter friends...CC: go@taxaccountingguru.com

Your chance of getting is just around the corner.... 09228010922

Click this for a detailed discussion Bookkeeping Regulations (BIR RR V-1)

For those who will avail the Super-Saver rate for the January 7, 2016 seminar workshop, you will get this book FREE OF CHARGE. Please follow these procedures...

1. Copy all the message shown herein.

2. Paste it all in the Compose Mail of your personal email account.

3. Email this to at least 50 persons from your contact list

4. CC: go@taxaccountingguru.com

5. Click the January 7, 2016 link as it is shown above

6. Share the link in your personal Facebook account

7. Tag EmelinoTMaestro or Kataxpayer to inform ETM

8. Only those who will obey the above procedures will be entitled to the Super-Saver rate and will get the above cited book (on the seminar date)

9. Failure to attend will forfeit this privilege of yours.

Thanks for sharing

Friday 23 October 2015

THE DENIAL AND MOUSE-TRAP TACTICS OF BIR OFFICERS

Last week, a client approached facebook.com/EmelinoTMaestro. She asked if the vouchers that she issued to her borrowers can be used as evidences of loan agreements.

Yes, a voucher, according to RMC 48-2011, can be considered as a loan document. Thus, it is subject to documentary stamp tax (DST). ETM reminded that either she or her borrowers should pay the corresponding DST attached thereto.

True to her duty, she requested ETM to compute her DST. Although her request entailed a payment of ETM's professional fee, ETM declined to do the computation for he doesn't want her client to incur an additional cost even if it will mean that he is depriving himself and his family of an easy money making and a decent living. Instead, ETM encouraged her to go to the BIR-Plaridel where the revenue officer of the day (OD) is mandated by law to compute for her the DST that she failed to pay on time.

True to her duty, she requested ETM to compute her DST. Although her request entailed a payment of ETM's professional fee, ETM declined to do the computation for he doesn't want her client to incur an additional cost even if it will mean that he is depriving himself and his family of an easy money making and a decent living. Instead, ETM encouraged her to go to the BIR-Plaridel where the revenue officer of the day (OD) is mandated by law to compute for her the DST that she failed to pay on time.

When she presented the vouchers to the OD, the OD refused to help her for a voucher, as the OD reasoned out, can't be used as an evidence in computing a deficiency DST. THIS IS A DENIAL TACTIC. It is designed to shoo you away after you have already exposed yourself and company to a tax violation penalised by imprisonment (tax evasion). If you fell into this trap, you will be surprised that a notice of investigation for being a TAX EVADER will be served to you in the nearest future. Don't fall into this trap that is called legally as a MALFEASANCE.

Having a presence of mind, she called ETM and explained to him what happened. ETM requested her to give the phone to the OD. After a small chat, the OD agreed to prepare the computation. After the OD drafted her computation, she gave it to her (ETM-client) and asked her to copy-paste the information that she wrote in a yellow paper to the actual tax return. THIS IS A MOUSE-TRAP TACTIC. It is designed to use your handwriting to cover up a potential miscomputation and miscalculation of the deficiency DST. There is reason to believe that the tax due per yellow paper is totally wrong. So in case that you copy the info per yellow paper and paid the amount that you copies, then, it is you who made the mistake and not the OD. In this case the DST due, as computed by the OD is 3,000,000 pesos.

Doubtful, ETM-client called up ETM again and story-told what happened. Now, ETM was so pissed off. Because, the rule is that the OD shall prepare the tax return using her own handwriting and placing her name and signature therein in order to show that the tax return was made by the OD and not by the client of ETM. ETM, via phone, talked to the immediate boss of the OD, a group supervisor (GS) and asked him to cite the BIR issuance that allowed the OD to do what she is doing. As their incompetence set in, the GS just cited a provision of the Tax Code that is irrelevant to the situation. So, to make the discussion easy, ETM requested his client to print and show RMC 48-2011 to these two ODs . Without a notice, ETM called up the RDO but he was not present at that time so ETM call was taken by her secretary. ETM told the secretary of what transpired and issued a warning that if the OD would continue to fail and refuse to prepare a tax return via her own handwriting with her name and signature therein, then, ETM will file a criminal case against her at the Office of the Ombudsman.

After thoroughly reading the RMC 48-2011, the OD agreed to prepare and sign the required tax return and by this time, the amount of deficiency DST went down to 800,000 pesos from 3,000,000 pesos (yellow paper).

IF YOU WANT TO BE A TAX ACCOUNTANT EVEN IF YOU ARE NOT A CERTIFIED PUBLIC ACCOUNTANT OR GRADUATE OF ACCOUNTANCY, ETM is giving a FREE FRANCHISE to help you start your own business..

IF YOU WANT TO BE A TAX CONSULTANT EVEN IF YOU ARE NOT A LAWYER, A PREVIOUS EMPLOYEE OF THE BUREAU OF INTERNAL REVENUE OR A GRADUATE OF ACCOUNTANCY, ETM is giving a FREE FRANCHISE to help you start your own business...

Email ETM now .. go@taxaccountingguru.com

October 23, 2015

Yes, a voucher, according to RMC 48-2011, can be considered as a loan document. Thus, it is subject to documentary stamp tax (DST). ETM reminded that either she or her borrowers should pay the corresponding DST attached thereto.

True to her duty, she requested ETM to compute her DST. Although her request entailed a payment of ETM's professional fee, ETM declined to do the computation for he doesn't want her client to incur an additional cost even if it will mean that he is depriving himself and his family of an easy money making and a decent living. Instead, ETM encouraged her to go to the BIR-Plaridel where the revenue officer of the day (OD) is mandated by law to compute for her the DST that she failed to pay on time.

True to her duty, she requested ETM to compute her DST. Although her request entailed a payment of ETM's professional fee, ETM declined to do the computation for he doesn't want her client to incur an additional cost even if it will mean that he is depriving himself and his family of an easy money making and a decent living. Instead, ETM encouraged her to go to the BIR-Plaridel where the revenue officer of the day (OD) is mandated by law to compute for her the DST that she failed to pay on time.When she presented the vouchers to the OD, the OD refused to help her for a voucher, as the OD reasoned out, can't be used as an evidence in computing a deficiency DST. THIS IS A DENIAL TACTIC. It is designed to shoo you away after you have already exposed yourself and company to a tax violation penalised by imprisonment (tax evasion). If you fell into this trap, you will be surprised that a notice of investigation for being a TAX EVADER will be served to you in the nearest future. Don't fall into this trap that is called legally as a MALFEASANCE.

Having a presence of mind, she called ETM and explained to him what happened. ETM requested her to give the phone to the OD. After a small chat, the OD agreed to prepare the computation. After the OD drafted her computation, she gave it to her (ETM-client) and asked her to copy-paste the information that she wrote in a yellow paper to the actual tax return. THIS IS A MOUSE-TRAP TACTIC. It is designed to use your handwriting to cover up a potential miscomputation and miscalculation of the deficiency DST. There is reason to believe that the tax due per yellow paper is totally wrong. So in case that you copy the info per yellow paper and paid the amount that you copies, then, it is you who made the mistake and not the OD. In this case the DST due, as computed by the OD is 3,000,000 pesos.

Doubtful, ETM-client called up ETM again and story-told what happened. Now, ETM was so pissed off. Because, the rule is that the OD shall prepare the tax return using her own handwriting and placing her name and signature therein in order to show that the tax return was made by the OD and not by the client of ETM. ETM, via phone, talked to the immediate boss of the OD, a group supervisor (GS) and asked him to cite the BIR issuance that allowed the OD to do what she is doing. As their incompetence set in, the GS just cited a provision of the Tax Code that is irrelevant to the situation. So, to make the discussion easy, ETM requested his client to print and show RMC 48-2011 to these two ODs . Without a notice, ETM called up the RDO but he was not present at that time so ETM call was taken by her secretary. ETM told the secretary of what transpired and issued a warning that if the OD would continue to fail and refuse to prepare a tax return via her own handwriting with her name and signature therein, then, ETM will file a criminal case against her at the Office of the Ombudsman.

After thoroughly reading the RMC 48-2011, the OD agreed to prepare and sign the required tax return and by this time, the amount of deficiency DST went down to 800,000 pesos from 3,000,000 pesos (yellow paper).

IF YOU WANT TO BE A TAX ACCOUNTANT EVEN IF YOU ARE NOT A CERTIFIED PUBLIC ACCOUNTANT OR GRADUATE OF ACCOUNTANCY, ETM is giving a FREE FRANCHISE to help you start your own business..

IF YOU WANT TO BE A TAX CONSULTANT EVEN IF YOU ARE NOT A LAWYER, A PREVIOUS EMPLOYEE OF THE BUREAU OF INTERNAL REVENUE OR A GRADUATE OF ACCOUNTANCY, ETM is giving a FREE FRANCHISE to help you start your own business...

Email ETM now .. go@taxaccountingguru.com

October 23, 2015

Thursday 8 October 2015

Documentary Accounting (go@taxaccountingguru.com for Free Tax Updates)

Lawyers are using documentary evidences to support an allegation or defend a preposition.

Accountants, specially people who underwent training under the watch of EmelinoTMaestro, learned that a new and one of a kind term that is DOCUMENTARY ACCOUNTING....

What is documentary accounting? (to be continued...)

Accountants, specially people who underwent training under the watch of EmelinoTMaestro, learned that a new and one of a kind term that is DOCUMENTARY ACCOUNTING....

What is documentary accounting? (to be continued...)

Sunday 4 October 2015

RMO 57-2015 as amended by RMO 61-2015

Pain in the Ass, Have you?

How to reduce your deficiency tax without bribing a revenue officer?

Inventory List, Deadline October 31, 2015

Recently, the BIR issued RMO 57-2015 that requires almost all of the taxpayers to prepare, sign and submit an inventory list of its merchandises, supplies and other inventory used, consumed or formed part of the services or finished goods being offered to other taxpayers. The original due date was moved from September 30, 2015 to October 31, 2015 (RMO 61-2015) due to the fact that a mistake, which became so habitual as far as the revenue officers who fathered the several regulations of the BIR, must be covered up.

Let Emelino T Maestro explain it to you, Rules and regulations that impose a disability, burden or obligation or create a right, privilege or opportunity will become effective and operational 15 days from its general publication. In this case. The original due date is a mistake and to cover it up, the BIR, which became a knight with a dilapidated armour and the mastermind in imposing again a burden to you, appeared to be giving you a fresh start to submit an INVENTORY LIST that is true, correct and in accordance with the NIRC. Whether you submit it or not, on or before October 31, 2015, you are putting yourself and your business in jeopardy.

"The BIR's Amazing Plan for your submitted INVENTORY LIST"

Expect that a visitation from unwanted guests will happen between November this year up to February 2016. It is called 'OPLAN KANDADO'...Oplan Kandado will start by way of using your inventory list as a guide to conduct an OVERT SURVEILLANCE..Afterwards, you will receive a presumptive assessment (interpolation) in which you will be coerced by legal means or threat that you must pay the amount indicated therein. Otherwise, you business will be closed. It is estimated and there is reason to believe that the bargain bribing has already reached an alarming amount of not less than 5 million pesos(?). If you don't have a 5 mil today, Emelino T Maestro is encouraging you to join his group so that you may be appraised of your privileges and possible defences against the malicious approaches of certain BIR officials... Please take note that an ELECTION is fast approaching.

Thanks for sharing ETM-personal conviction and belief's post.

How to reduce your deficiency tax assessment?

Sofitel Hotel, PICC, Metro Manila

50% discount if you will register and pay on or before October 15, 2015

Call Eric 0998 979 3922

Salamat..

How to Answer a Financial Auditor's Intrusion? go@taxaccountingguru.com

How to Answer a Financial Auditor's Intrusion?

What I understood.

What I understood.

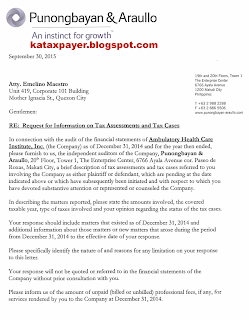

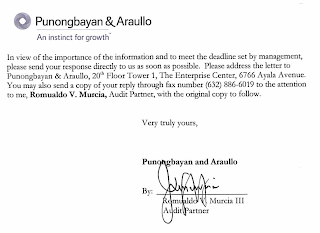

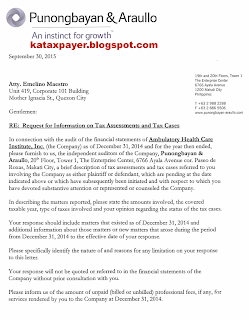

On October 2, 2015, EmelinoTMaestro (I, me, my or mine) received a September 30, 2015 letter (letter) from Punongbayan and Araullo (PA).

The letter requested me to briefly discuss, as at December 31, 2014, the tax assessments and tax cases wherein the alleged plaintiff or defendant is the Ambulatory Health Care Institute, Inc (Clinica Manila).

It also requested me to disclose matters that are existing as of December 31, 2014 including the subsequent events appurtenant thereto.

Finally, I am enjoined to voluntarily expose my billed and unbilled professional fee as at December 31, 2014.

What must be done.

What must be done.

First, I am not a lawyer so I must not be referred to as ‘Atty.’, I don’t appreciate putting an untruthful branding on me.

On May 28, 2015, Clinica Manila (it, its or as the context requires) received a May 27, 2015 Final Decision on Disputed Assessment (Decision).

The Decision stated that due to its failure to support its July 10, 2013 Protest with the necessary documentations, its protest is without merit.

Thus, its previously issued deficiency tax assessment for the taxable year 2008 is reiterated. For this purpose, its summary is presented hereunder, viz

Furthermore, it requested it to immediately settle the above amount. Otherwise, it shall become final and executory.

Clinica Manila requested me to help and assist it to answer the above concerns.

Although, it's believed that the top management of PA is populated with people from the Department of Finance (DOF) and the Bureau of Internal Revenue (BIR), I find it hard to believe that my opinion is still needed in order that its opinionated financial statements as of December 31, 2014 will be fabricated and released.

As of today, Clinica Manila is not a plaintiff or a defendant. These two (2) words are improper and irregular for they mean that in the administrative level, its deficiency tax assessment becomes final and executory, which I definitely denied.

As of December 31, 2014, it has no legal obligation to the BIR because the stated assessment is yet to become final and executory. The recommendation that it has to immediately compensate the BIR or acknowledge the amount shown in the said assessment, although a protest against it was filed and submitted before the due date set forth therein, should be treated as an irrelevant and irresponsible pigment of imagination and must not be given due course.

According to our New Civil Code, although it was developed more than fifty (50) years ago, an assessment shall only become due and demandable if it is not protested or the Court’s decision favouring the BIR becomes final and executory. As of today, the referred assessment is not yet final and executory and there is reason to believe it will not affect in anyway any opinionated financial statement to be issued before the receipt thereof.

Moreover, the assessment itself recognised that its contents will not become a valid claim if a protest is logged before the date set forth for the payment that is shown therein.

Finally, I opine that to ask my billed and unbilled professional fees as of December 31, 2014 is irrational, irrelevant, irresponsible and irritating. I was also a FINANCIAL AUDITOR before I shifted my skills and efforts to tax accounting and tax consulting activities. During the era of the ’80, I find ways on how to check my fellow auditors’ professional fees without them knowing it/participating thereto. However, although I am so offended with the intrusion of my privacy, I will tell any member of PA that as of December 31, 2014, Neither I was an employee nor an engaged tax consultant of Clinica Manila. In short words, I did not receive anything from it as of December 31, 2014.

Email go@taxaccountingguru.com for more details

Here is a sample..

Preamble.

Ignorance is the most expensive lifestyle. A Filipino can’t be called ignorant if he only failed to know and apply the science/math principles and standards. But, not knowing the law of this Republic is crime punishable civilly or criminally because the ignorance of the law excuses no one from compliance therewith.

Ignorance is the most expensive lifestyle. A Filipino can’t be called ignorant if he only failed to know and apply the science/math principles and standards. But, not knowing the law of this Republic is crime punishable civilly or criminally because the ignorance of the law excuses no one from compliance therewith.

What I understood.

What I understood.On October 2, 2015, EmelinoTMaestro (I, me, my or mine) received a September 30, 2015 letter (letter) from Punongbayan and Araullo (PA).

The letter requested me to briefly discuss, as at December 31, 2014, the tax assessments and tax cases wherein the alleged plaintiff or defendant is the Ambulatory Health Care Institute, Inc (Clinica Manila).

It also requested me to disclose matters that are existing as of December 31, 2014 including the subsequent events appurtenant thereto.

Finally, I am enjoined to voluntarily expose my billed and unbilled professional fee as at December 31, 2014.

What must be done.

What must be done.First, I am not a lawyer so I must not be referred to as ‘Atty.’, I don’t appreciate putting an untruthful branding on me.

On May 28, 2015, Clinica Manila (it, its or as the context requires) received a May 27, 2015 Final Decision on Disputed Assessment (Decision).

The Decision stated that due to its failure to support its July 10, 2013 Protest with the necessary documentations, its protest is without merit.

Thus, its previously issued deficiency tax assessment for the taxable year 2008 is reiterated. For this purpose, its summary is presented hereunder, viz

Furthermore, it requested it to immediately settle the above amount. Otherwise, it shall become final and executory.

Clinica Manila requested me to help and assist it to answer the above concerns.

Although, it's believed that the top management of PA is populated with people from the Department of Finance (DOF) and the Bureau of Internal Revenue (BIR), I find it hard to believe that my opinion is still needed in order that its opinionated financial statements as of December 31, 2014 will be fabricated and released.

As of today, Clinica Manila is not a plaintiff or a defendant. These two (2) words are improper and irregular for they mean that in the administrative level, its deficiency tax assessment becomes final and executory, which I definitely denied.

As of December 31, 2014, it has no legal obligation to the BIR because the stated assessment is yet to become final and executory. The recommendation that it has to immediately compensate the BIR or acknowledge the amount shown in the said assessment, although a protest against it was filed and submitted before the due date set forth therein, should be treated as an irrelevant and irresponsible pigment of imagination and must not be given due course.

According to our New Civil Code, although it was developed more than fifty (50) years ago, an assessment shall only become due and demandable if it is not protested or the Court’s decision favouring the BIR becomes final and executory. As of today, the referred assessment is not yet final and executory and there is reason to believe it will not affect in anyway any opinionated financial statement to be issued before the receipt thereof.

Moreover, the assessment itself recognised that its contents will not become a valid claim if a protest is logged before the date set forth for the payment that is shown therein.

Finally, I opine that to ask my billed and unbilled professional fees as of December 31, 2014 is irrational, irrelevant, irresponsible and irritating. I was also a FINANCIAL AUDITOR before I shifted my skills and efforts to tax accounting and tax consulting activities. During the era of the ’80, I find ways on how to check my fellow auditors’ professional fees without them knowing it/participating thereto. However, although I am so offended with the intrusion of my privacy, I will tell any member of PA that as of December 31, 2014, Neither I was an employee nor an engaged tax consultant of Clinica Manila. In short words, I did not receive anything from it as of December 31, 2014.

Signature.

I affix my signature below to attest my personal belief and conviction.

I affix my signature below to attest my personal belief and conviction.

Thursday 1 October 2015

THE TRUE CONFESSION OF A BIR REVENUE EXAMINER

THE TRUE CONFESSION OF A BIR REVENUE EXAMINER

Now, you really need to change your habit. Re-tool self/employees

FREE TAX CONSULTING TRAINING WORKSHOP FOR ELECTRONIC LETTER OF AUTHORITY AND LETTER NOTICE.

Attend the FREE TAX ACCOUNTING SEMINAR WORKSHOP.

YourRegistration is via go@taxaccountingguru.com

Now, you really need to change your habit. Re-tool self/employees

FREE TAX CONSULTING TRAINING WORKSHOP FOR ELECTRONIC LETTER OF AUTHORITY AND LETTER NOTICE.

Attend the FREE TAX ACCOUNTING SEMINAR WORKSHOP.

YourRegistration is via go@taxaccountingguru.com

Today, Information travels fast. It’s really amazing. Technology helps the people to express their knowledge, feelings and thoughts on the Internet where everyone can immediately read and response.

People have called for rallies through the Internet. People have enjoyed voicing out their concerns on the Internet. They made themselves to participate even by writing simple comments on Yahoo, Facebook, Twitter, and other websites.

The outcome is good. In fact, the rallies calling for the removal of PDAF were made through the Internet. Although there are those who don’t do it right—hackers defacing the government websites—it affects the government.

People make comments. Some are true arguments while some are fallacies. People are participating to fight against the wrong actions of the government, especially against corruption. This is very healthy. I would like to give an input that may help to save the country from the slavery of poverty.

I am a Revenue Officer at the BIR and designated as Tax Examiner.

When the President said, “Kung walang korap walang mahirap and tuwid na daan”, my impression was that he will look into the lifestyle of the government employees especially of those branded as corrupt government agencies. That he will look into their banks accounts. That his administration will file the corresponding cases against them if found to have unexplained wealth. That he will remove them. That he will implement strict and concrete procedures to reduce, if not eradicate entirely, the corruption. That after cleaning up, he will increase the salaries of the employees of these agencies.

I was so excited at the beginning. I saw his administration making the former president, the former ombudsman, the former chief justice, and other members of the former administration accountable. But suddenly, I have felt dismayed. He stopped. I have wondered. The actions were not against corruption but against the opposition. It’s not what the people wanted. The people want to eradicate corruption from all government agencies at different level.

The president’s term is about to end. Where are we now? We are like a car that was cleaned up and fully furnished on the outside but the engine is totally wrecked. What’s the use of that but for display?

I saw hope when the Supreme Court decided that PDAF is unconstitutional. Until now, it’s like I am dreaming. Right now everything could happen. As an examiner, it’s normal to audit government contractors’ records. It’s not surprising that you will find how the money for the projects is divided among COA auditor, budget officer, the accountant, and of course, corrupt politicians.

The issue I am raising is bigger than PDAF. It’s about the corruption in the BIR. Indeed, corruption through PDAF is just the tip of the iceberg.

I saw hope when the Supreme Court decided that PDAF is unconstitutional. Until now, it’s like I am dreaming. Right now everything could happen. As an examiner, it’s normal to audit government contractors’ records. It’s not surprising that you will find how the money for the projects is divided among COA auditor, budget officer, the accountant, and of course, corrupt politicians.

The issue I am raising is bigger than PDAF. It’s about the corruption in the BIR. Indeed, corruption through PDAF is just the tip of the iceberg.

I would like to share how corruption works at the BIR. I want everybody to understand and feel its gravity to our life. This is bigger than PDAF because the accumulated amount is enormous. Continuous pain is worst than short time severe pain.

Voluntary payments, withholding taxes, and investigation of taxpayers—these are the ways of collecting taxes by the BIR. An example of voluntary payment is the filing of an annual income tax return. This is the one we rush to pay every April 15. Withholding tax on compensation—deducted by the employers from the employees together with the pag-ibig, sss, and other deductions monthly—is an example of a withholding tax. The case of Manny Pacquiao is an example of audit of taxpayer.

Voluntary payments, withholding taxes, and investigation of taxpayers—these are the ways of collecting taxes by the BIR. An example of voluntary payment is the filing of an annual income tax return. This is the one we rush to pay every April 15. Withholding tax on compensation—deducted by the employers from the employees together with the pag-ibig, sss, and other deductions monthly—is an example of a withholding tax. The case of Manny Pacquiao is an example of audit of taxpayer.

Corruption transpires during the investigation of businesses by the revenue officers.

Examiners, supervisors (assessment section), assistant RDO, Revenue District Officers (RDO), Directors, and some commissioners—these are the specific revenue officers involved to the scheme. No examiners, supervisors, RDOs, & Directors can claim that he was never been involved in this scheme. Is there any policeman who has never touched a gun? Is there any fisherman who has never tasted the fresh or sea water?

Every year the BIR conducts tax examinations to most business establishments. Initially, the BIR issues letter of investigation.

Letter of Authority (L.A.), Tax Verification Notice (T.V.N.), and Letter Notice (L.N.)—these are the letter of investigations issued by the BIR, although the L.N. is not actually used for thorough investigation.

Letter of Authority (L.A.), Tax Verification Notice (T.V.N.), and Letter Notice (L.N.)—these are the letter of investigations issued by the BIR, although the L.N. is not actually used for thorough investigation.

The LA is used for regular audit. The TVN is used when LA is inappropriate. This includes closure of small businesses. Another used of TVN is when transferring the ownership of real property by inheritance.

The LN is used for some circumstances. When the BIR found a discrepancy between the information submitted by a taxpayer and the information gathered by the BIR from another taxpayer outside the formal audit, an LN is issued.

This happens usually between a distributor and a whole seller. Both of them submit information to the BIR. Considering their relationship, the former being the buyer and the latter being the seller, the information are compared based on the records submitted to the BIR. Any discrepancy will lead to the issuance of LN. As a consequence, the taxpayer can pay the tax if he agrees; otherwise, he can explain why such discrepancy occurred.

The main source of corruption is the LA because this is the normal way of authorizing the audit.

The main source of corruption is the LA because this is the normal way of authorizing the audit.

In the eyes of the revenue officers, LA means money. With LA, revenue officers are like stockholders of every corporation. In some case, when a revenue officer received a LA, he is already borrowing money for casino because he is sure that on or before 120 days he has money, specifically from that LA.

LA is like a certificate of deposit. It’s like a check. It smells money. It’s money. Revenue Officers call it “the bread and butter”.

Examiners and group supervisors quarrel for LA. Each lobbies, some even make advance payment to their RDO just to get the taxpayer they desire to audit.

LA is like a certificate of deposit. It’s like a check. It smells money. It’s money. Revenue Officers call it “the bread and butter”.

Examiners and group supervisors quarrel for LA. Each lobbies, some even make advance payment to their RDO just to get the taxpayer they desire to audit.

The LA is assigned to the examiners with a group supervisor. An examiner can have several LA at the same time, more or less ten (10) LAs per examiner depending on the number of examiners in a district. A group supervisor can have more than one group of examiners.

The transaction is straightforward and simple. The audit is conducted by the examiners. The findings are presented to the taxpayers, often with the supervisor. The taxpayer arrange schedule with the supervisors to discuss the settlement which includes the amount to be shown on the receipt and the amount that goes for the boys—the bribe money.

The supervisor discusses the settlement with the RDO. If approved, the payment form is prepared signed by the RDO and the taxpayer pays with the bank. The taxpayer returns to the supervisor and with him are the payment form and the money for the boys. In some cases the taxpayer just gives the whole amount to the examiner or supervisor and let them pay with the bank. The revenue officer will just send the original copy of the payment form to the taxpayer after payment with the bank.

The supervisor divides the money among himself, the examiners, and the RDO. The RDO divides the money given to him by the supervisor. He gives to the assistant RDO and to the Director. And finally, the Director distributes the money to the commissioners of his choice.

These are the common scenarios that you would see almost every day at the BIR. There are some districts where the supervisor reports the money to the assistant RDO. The reason why the usual distribution of money is from the supervisor to the RDO and not to the assistant is because of “Bukol”. This is a common word inside the BIR. It refers to the amount of money not reported by one to another.

At first, I cannot believe what I see. I know it’s illegal but I wonder if it’s illegal why it’s happening plainly and nobody seems to care. Regardless of age—from the youngest revenue officers to the retirees—everyone is engaged in the scheme. I see even those appearing to be religious individuals involved in the scheme. They conduct masses at the office as they involved themselves to this detestable scheme of corruption. It’s very mind twisting. I don’t know how the president could say “tuwid na daan” as this is happening. If he only knows, maybe, he will not say these words. It’s confusing. An ordinary Filipino hears different thing from his president compared to what he sees.

But the main issue here is that no one can prove it except through entrapment. Currently, unless you entrap a revenue officer you won’t prove it. There are no audit trails. How can anyone prove it? Money transfers from one hand to another in seconds. Transactions occur anytime and anywhere. It happens inside the BIR office. It happens at the lobby. Transactions take place at the revenue officers’ car. It happens at the restaurant near the BIR offices. Anywhere the transactions transpire.

That’s why I think the only way to address this issue is to pass a law requiring all personnel in that position to be subjected to regular audit of their bank accounts and regularly conduct lifestyle check. It must be on regular basis and not just on random or especial occasions.

The government’s loss from this scheme is tremendous. There are about more or less 2,000 examiners including supervisors across the country. If each gets P1,000,000 each month, in a year the total loss of the government must be P24,000,000,000.00. This is every year. It happens every year.

But, be noted that, that’s not the actual loss by the government. That’s just the portion of the total amount of tax that must be collected for the government.

The amount is just those got by the examiners and supervisors. Remember the taxpayers settle with the revenue officers. Why? It’s because in exchange for something.

It’s not surprising that majority of the taxpayers intentionally don’t pay the correct taxes simply because of our environment.

Let’s take for instance the case of the contractors, particularly, the government contractors.

Let’s take for instance the case of the contractors, particularly, the government contractors.

There are expenses that cannot be deducted from the gross income. That’s bad for the business because it leads to overpayment of taxes. An example of this expense is the kickbacks. It’s a common knowledge that most government projects have kickbacks. The contractor cannot deduct this resulting to higher taxes.

Another problem of the contractors is that they cannot transact with the government unless they have tax clearance. One of the requirements for the clearance is that a taxpayer must not have a pending case with the BIR.

Arbitrary assessment or not is still an assessment. The taxpayer must prove it wrong first before it can be taken aside. If a taxpayer refused an offer of the revenue officers for settlement, they will issue an assessment. Regardless whether it’s valid or not the taxpayer is obliged to deal with it first before he can secure a clearance. Consequently, the taxpayer needs to secure the services of a lawyer. That means additional expenses. The damage is not only money but time also.

It is; therefore, wise for a contractor to under declare transactions either by decreasing his gross income or increasing his expenses or both.

A 50% or more under declaration is not surprising. This makes businessmen feel safe. When the BIR comes, they settle for the 50% to 75% of the under declaration. If you are the businessmen, why file your taxes correctly? You will just put yourself in trouble. This has became the attitude of the taxpayers towards taxation.

Let’s set an example. If the total amount of tax to be paid is P100.00, the taxpayer will declare P60.00 resulting under payment of tax amounting to P40.00. The examiners will settle for P20.00 and out of this P10.00 goes to the government and the other P10.00 goes to the revenue officers.

Let’s set an example. If the total amount of tax to be paid is P100.00, the taxpayer will declare P60.00 resulting under payment of tax amounting to P40.00. The examiners will settle for P20.00 and out of this P10.00 goes to the government and the other P10.00 goes to the revenue officers.

The amount shown at the beginning amounting to 24B, in the example above represents the P10.00 stolen by the revenue officers. Can you imagine how much is the actual loss of the government? That P10.00 represents 25% of the total loss by the government. The 100% must be P96B.

But not yet, it was just based on the amount stolen by the examiners and supervisors. How about the amount that goes to the assistant RDO, RDO, assistant Director, Director, and some commissioners? The amount taken by these officers were not yet included to the above computation. At least you have the idea of how serious this problem is.

If the government could just collect properly these amounts, is there a need to impose a VAT on gasoline and in electricity?

The salary of Revenue Officer I, including the examiners, is just about P13,000.00 gross of deductions but look around the BIR offices and notice the brand new cars parking on the parking space. Who owns it? How an examiner with such salary is capable of buying this kind of cars?

The salary of Revenue Officer I, including the examiners, is just about P13,000.00 gross of deductions but look around the BIR offices and notice the brand new cars parking on the parking space. Who owns it? How an examiner with such salary is capable of buying this kind of cars?

The BIR says, “Run after the tax evaders” but the real tax evaders are inside the BIR. All revenues whatever the source—legal or illegal—is subject to tax. How much the revenue officers have declared to their income tax return compared to their bank accounts and properties? They are the root of tax evasion. They teach the taxpayers to evade taxes. More often than not, the issuance of LA is just for formality only. Beforehand, the agreement is already arranged. A taxpayer is informed in advance that a LA will be issued and the amount of settlement is already arranged.

Recently, the BIR goes with the big issues. When the case on the chief justice broke out, there’s the BIR. When the PDAF scandal broke out there’s the BIR. There’s also the case of Manny Pacquiao. That’s the magic trick—leading the eyes of the audiences to one direction using one hand as the other hand performs the trick. It’s okay to ride with these issues, after all there’s a legal and factual basis, but it must be assured that the real issue are being addressed and that’s the corruption at the BIR.

The BIR has filed tax evasion cases to countless taxpayers. They are those who refused to settle with the revenue officers. Some of them are just sacrificial lambs. Others are the enemies of the administration. That’s sad.

Recently, the BIR goes with the big issues. When the case on the chief justice broke out, there’s the BIR. When the PDAF scandal broke out there’s the BIR. There’s also the case of Manny Pacquiao. That’s the magic trick—leading the eyes of the audiences to one direction using one hand as the other hand performs the trick. It’s okay to ride with these issues, after all there’s a legal and factual basis, but it must be assured that the real issue are being addressed and that’s the corruption at the BIR.

The BIR has filed tax evasion cases to countless taxpayers. They are those who refused to settle with the revenue officers. Some of them are just sacrificial lambs. Others are the enemies of the administration. That’s sad.

I cannot undo the past. I want the country to prosper—the real prosperity and not by figures, not by non-sense surveys, not by standards used by the government which is far from the truth. Is this the kind of environment the next generations shall receive? Until this issue is properly addressed, the country will never kick off.

Taxes, the main source of revenues of the government is like the engine of a car. How can a car run fast with a wrecked engine? You can beautify the body by painting it, change its side mirrors, change the seat covers, and so on and so forth but they are all useless if the car won’t run properly because of wrecked engine.

The corruption at the BIR cannot be eradicated alone by the commissioner, the secretary of finance, not even by the president. It requires law. It requires the coordination of the congress, senate, and the executive. There must be a law that would strictly monitor the revenue officers and the president must exert the effort because he is the highest authority.

The connivance is within and outside the bureau. This is a call for the Professional Regulation Commission (PRC). Most accountants don’t value the “Auditor’s Independent Report” anymore. There are those who express an “unqualified opinion” even the financial statements are incomplete. They don’t care whether the financial statements are totally distorted. They connive with the revenue officers because they get 5% to 10% commission for every settlement; consequently, it does not matter to them whether the financial statements are fairly presented or not.

This is also a call for the Board of Accountancy. The time will come that our “Auditor’s Independent Report” will lost its credibility. Who will rely on the works of the accountants in the future?

You will know the tree by its fruits. “Kung walang korap walang mahirap, tuwid na daan” are more than words. It requires actions. The fruits of those words should be beneficial to the people; not to the leaders and their political party.

You will know the tree by its fruits. “Kung walang korap walang mahirap, tuwid na daan” are more than words. It requires actions. The fruits of those words should be beneficial to the people; not to the leaders and their political party.

The main reasons why the BIR goes with the highly profile issues is for everyone to see it visible, as if it doing everything to collect the taxes needed, and create fear to the taxpayers. This is the style of the new management which is good. However, to run after the tax evaders, it must start from within; otherwise, the outcome is different. The revenue officers can easily intimidate the taxpayers to settle with them rather than guiding the taxpayers to pay taxes appropriately. In the end, it’s always the people who suffer.

If the taxes collected are insufficient, the normal course of the government is to either increase the tax rates or the coverage. Electricity and gasoline used to be vat exempt. The most basic commodities that the poorest among us can’t almost afford were included among the vatable commodities. The real issue is not the tax but the proper collections. If the taxes are properly collected, is there a need to increase the tax rate or increase the coverage? This will always be the case until this concern is properly addressed.

If the taxes collected are insufficient, the normal course of the government is to either increase the tax rates or the coverage. Electricity and gasoline used to be vat exempt. The most basic commodities that the poorest among us can’t almost afford were included among the vatable commodities. The real issue is not the tax but the proper collections. If the taxes are properly collected, is there a need to increase the tax rate or increase the coverage? This will always be the case until this concern is properly addressed.

Should we wait that sale or importation of agricultural and marine food products in their original state, etc as stated on Sec. 109 (A) of the NIRC be included to VAT just to cover the deficiency of the government considering the real concern is that the taxes are not properly collected and just being pocketed by the revenue officers?

Today the BIR has difficulty in reaching its goals. That’s not surprising. What’s surprising is, it’s always the people that suffer. The equation is very simple. You cannot completely fill a glass full of holes with water. What goes in goes out. No matter what increases in tax rates & coverage is useless if the actions of the revenue officers are still the same.

Today the BIR has difficulty in reaching its goals. That’s not surprising. What’s surprising is, it’s always the people that suffer. The equation is very simple. You cannot completely fill a glass full of holes with water. What goes in goes out. No matter what increases in tax rates & coverage is useless if the actions of the revenue officers are still the same.

I love the BIR. This is not to destroy it but rather to clean it. The current culture at the BIR is like termite in a house.

Look around and analyze what you see. With the current salary grade where did the examiners, supervisors, RDO, & Directors get their wealth? Each drives brand new cars. Some has condominium units. Some goes to casino regularly. The houses are big and expensive. Some has many houses. Some has farm lots in their provinces. Some has many businesses. Many wear expensive jewelries. They have up-to-date gadgets. Some often goes to other countries like Hong Kong and Singapore. And you know what…? This is the funniest… Some has their own drivers, yes, that’s plural, drivers… more than one driver.

Look around and analyze what you see. With the current salary grade where did the examiners, supervisors, RDO, & Directors get their wealth? Each drives brand new cars. Some has condominium units. Some goes to casino regularly. The houses are big and expensive. Some has many houses. Some has farm lots in their provinces. Some has many businesses. Many wear expensive jewelries. They have up-to-date gadgets. Some often goes to other countries like Hong Kong and Singapore. And you know what…? This is the funniest… Some has their own drivers, yes, that’s plural, drivers… more than one driver.

It’s very rare to see an examiner who has no car. Indeed, a new examiner, in three months time already owns a brand new car.

LA is not just the source of corruption. Corruption takes place even in TVN and LN. LA and TVN, in process are just the same. They are both authority to investigate. The process is just the same. Even in LN corruption takes place. The revenue officers tango with the taxpayers. They even fake the supporting documents to cover up the discrepancy. Often, the money involved with LN is bigger than LA especially if it is the first time a taxpayer received a notice from the BIR.

LA is not just the source of corruption. Corruption takes place even in TVN and LN. LA and TVN, in process are just the same. They are both authority to investigate. The process is just the same. Even in LN corruption takes place. The revenue officers tango with the taxpayers. They even fake the supporting documents to cover up the discrepancy. Often, the money involved with LN is bigger than LA especially if it is the first time a taxpayer received a notice from the BIR.

Other source of corruption at the BIR is the transfer of property mostly by way of deed of sale. The taxpayers under declare the amount of sale and connive with the revenue officers. This is almost impossible to resolve. One must really audit the buyer or the seller if they have businesses to see how much really came in and out from their bank accounts. There’s also a need to look into the lawyer’s records. But the point here is, it’s almost impossible to know it. The only remedy is to really look into the bank accounts of the revenue officers.

Most of the time the revenue officers will arbitrarily assessed the taxpayer by overstating the zonal value of a property. This is done by using a different classification of the property. This is not corruption but robbery. Whatever it is, it’s inappropriate.

During the time of I think Pres. Erap, some revenue officers made a rally against this scheme. They shouted against the connivance of these revenue officers with the taxpayers and accountants. It was in the News. Nobody had cared. Until now I see no action from the government.