Email go@taxaccountingguru.com for more details

Here is a sample..

Preamble.

Ignorance is the most expensive lifestyle. A Filipino can’t be called ignorant if he only failed to know and apply the science/math principles and standards. But, not knowing the law of this Republic is crime punishable civilly or criminally because the ignorance of the law excuses no one from compliance therewith.

Ignorance is the most expensive lifestyle. A Filipino can’t be called ignorant if he only failed to know and apply the science/math principles and standards. But, not knowing the law of this Republic is crime punishable civilly or criminally because the ignorance of the law excuses no one from compliance therewith.

What I understood.

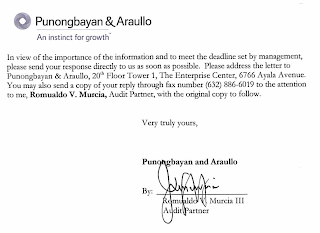

What I understood.On October 2, 2015, EmelinoTMaestro (I, me, my or mine) received a September 30, 2015 letter (letter) from Punongbayan and Araullo (PA).

The letter requested me to briefly discuss, as at December 31, 2014, the tax assessments and tax cases wherein the alleged plaintiff or defendant is the Ambulatory Health Care Institute, Inc (Clinica Manila).

It also requested me to disclose matters that are existing as of December 31, 2014 including the subsequent events appurtenant thereto.

Finally, I am enjoined to voluntarily expose my billed and unbilled professional fee as at December 31, 2014.

What must be done.

What must be done.First, I am not a lawyer so I must not be referred to as ‘Atty.’, I don’t appreciate putting an untruthful branding on me.

On May 28, 2015, Clinica Manila (it, its or as the context requires) received a May 27, 2015 Final Decision on Disputed Assessment (Decision).

The Decision stated that due to its failure to support its July 10, 2013 Protest with the necessary documentations, its protest is without merit.

Thus, its previously issued deficiency tax assessment for the taxable year 2008 is reiterated. For this purpose, its summary is presented hereunder, viz

Furthermore, it requested it to immediately settle the above amount. Otherwise, it shall become final and executory.

Clinica Manila requested me to help and assist it to answer the above concerns.

Although, it's believed that the top management of PA is populated with people from the Department of Finance (DOF) and the Bureau of Internal Revenue (BIR), I find it hard to believe that my opinion is still needed in order that its opinionated financial statements as of December 31, 2014 will be fabricated and released.

As of today, Clinica Manila is not a plaintiff or a defendant. These two (2) words are improper and irregular for they mean that in the administrative level, its deficiency tax assessment becomes final and executory, which I definitely denied.

As of December 31, 2014, it has no legal obligation to the BIR because the stated assessment is yet to become final and executory. The recommendation that it has to immediately compensate the BIR or acknowledge the amount shown in the said assessment, although a protest against it was filed and submitted before the due date set forth therein, should be treated as an irrelevant and irresponsible pigment of imagination and must not be given due course.

According to our New Civil Code, although it was developed more than fifty (50) years ago, an assessment shall only become due and demandable if it is not protested or the Court’s decision favouring the BIR becomes final and executory. As of today, the referred assessment is not yet final and executory and there is reason to believe it will not affect in anyway any opinionated financial statement to be issued before the receipt thereof.

Moreover, the assessment itself recognised that its contents will not become a valid claim if a protest is logged before the date set forth for the payment that is shown therein.

Finally, I opine that to ask my billed and unbilled professional fees as of December 31, 2014 is irrational, irrelevant, irresponsible and irritating. I was also a FINANCIAL AUDITOR before I shifted my skills and efforts to tax accounting and tax consulting activities. During the era of the ’80, I find ways on how to check my fellow auditors’ professional fees without them knowing it/participating thereto. However, although I am so offended with the intrusion of my privacy, I will tell any member of PA that as of December 31, 2014, Neither I was an employee nor an engaged tax consultant of Clinica Manila. In short words, I did not receive anything from it as of December 31, 2014.

Signature.

I affix my signature below to attest my personal belief and conviction.

I affix my signature below to attest my personal belief and conviction.

No comments:

Post a Comment