Ignorance is the basic foundation of graft and corruption. The BIR-corrupt brigade is maximizing its full potential and profitability. Fishes find strength, courage and competence in numbers. They had conquered their predators/enemies by grouping together in order to make them bigger than their enemies. You too can become bigger than the fear that lingered in your minds and hearts. Join 'JuanTALKS' now and share your knowledge and experiences to other Filipinos.

Saturday 26 August 2017

When you recon a law with a standard, you raped the law.

When you recon a law with a standard, you compromised the law and definitely, you confirmed that you violated such law. The 'S' from the PFRS and PSA refers to SUGGESTIONS. My standards may differ from your standards but we will not go to jail for that differences. However, when your act differs from the language of the law, you will end up in jail. Your compliance with the law is not subject to compromise, just like, your breathing. Furthermore, when you sign any tax return, you, under the pains of PERJURY, declared that its contents are in accordance with the law (TAX CODE) and not in accordance with PFRS or PSA. You are becoming inconsistent if after you signed a tax return, you will later tell the BIR that the facts and figures shown therein are based on PFRS or PSA. Thus, a crime of perjury will set in. THE LAW MAKES US CIVILISED PEOPLE. No types of STANDARDS MAY REPLACE A RELEVANT LAW. ETM is still looking for a Supreme Court's decision that is based on PFRS and PSA. Please help him locate one. Thanks.

Negosyante Acts Now, Thinks Later. Be a Tax Bookkeeper Today. Ask ETM how.

Be a Tax Bookkeeper Today.

Avail the Study Now Pay ETM Later Plan.

ETM will lend you his BRAND 'ETM'

ETM will allow you to use his ADDRESS.

ETM will SUPPORT you technically

ETM will share with you his INTEGRITY

ETM will make you COMPETENT

Act Now, Think Later.

Call Sonia or Len 02-9216107

Thanks a lot. TaxationProfessionalUniversity.com

Be an ETM Business Partners. Be a Wealth Protection & Estate Planning Specialist Today

Start Your Own Practice (SYOP) as a Wealth Protection & Estate Planning Specialist. Training will be provided to those who will qualify. Your Orientation will be on Sep 9, 2017 (9-11.30am) and Sep 16, 2017 (2-5pm) at the University Hotel, UP Diliman Campus, QC. Investment fee is P2,500/pax. 5-session training will be from Sep 25 up to Sep 29, 2017. ETM will expose you to the vast, blue-ocean-like opportunities using, of course, taxation. No walk in shall be allowed to enter the training room. 50% discount if you will copy-paste the image and texts herein shown and email them to 20 friends or relatives before the event date (copy furnished go@taxaccountingguru.com). Else, you're disqualified to get the 50% discount. FREE 504-page Wealth Protection & Estate Planning Manual if you will deposit your payment to ETM's account and email the validated deposit slip to go@taxaccountingguru.com. Insurance agents and brokers and real property brokers, consultants and agents are most WELCOME.

New event dates may be scheduled, call the number shown on the image for the details. Thanks.

Sunday 13 August 2017

Study Now Pay ETM Later Plan (Avail Today. Start Bookkeeping Now.)

PREAMBLE.

I, whose legal name and true signature appear herein, knowingly prepared, verified, executed this legal document and accept and understand its terms and conditions.

When used herein, the pronouns ‘I, me, mine and my’ and ‘you, yours, and your’ shall refer to the Framer-applicant and Emelino T Maestro, respectively. When both are referenced, the pronoun ‘we, our and us’ is used. The provisions hereof shall also be enforceable and relevant to our staff, authorised representatives and relatives by consanguinity and affinity within the fourth degree.

OBJECTIVE.

To start up, build and maintain my profitable and independent tax practice, I, without mental reservation and purpose of evasion, commit myself and resources to use, promote, protect, sell and market your Brand, lease, occupy and use your Addresses, office spaces and facilities located everywhere in the Philippines, seek, avail and use your intellectual Support, promote, protect and preserve our Integrity, and access, avail and use your Competence. For this purpose, the terms ‘Brand’, ‘Address’, ‘Support’, ‘Integrity’ and ‘Competence’ shall collectively refer to ‘BASIC’. Importantly, I seek for the approval of this Application for Assistance for Individual’s Development (A1D) and Study Now Pay ETM Later (PayETM).

MY OBLIGATION.

To seek, read, study, understand and execute diligently and on time your policy-directions, orders, instructions, decisions, memorandums, rules and regulations which are ordinary and necessary in carrying out your plans and programs and achieve our goals and objectives;

To use, promote, protect, sell, advertise and market your Brand and never to associate myself with or use other Brands that directly compete or are antagonistic to your Brand;

To lease, occupy and use your Address and other facilities and never lease, occupy and use an Address other than your Address and other facilities;

To seek, avail, and use your intellectual Support and furthermore, to prioritise and access the support from your accredited Taxation Professionals;

To promote, protect and preserve our Integrity and never to do an act that will tarnish or blemish your character, image and reputation;

To access, avail and use of your Competence and never to use what I learned for any illegal purposes;

To create, maintain and operate a productive and prolific social media accounts having current and your approved contents;

To conduct my business lawfully and in good faith and best business practices;

To perform my contractual obligations promptly pursuant to agreements by which I am bound;

To avail and secure a loan from you;

To pay habitually and punctually the principal amount of the loan that you had granted unto me; the leased Address and other facilities, and shares from the businesses that we jointly entered into;

To maintain and keep properly and adequately my books of accounts and accounting bookkeeping records in accordance with the Tax Code and permit you to examine such records at your convenient moment;

To discuss with you my business and financial conditions;

To comply, at all times, with the laws, rules, regulations, orders and directives of any governmental authority;

To file a true, correct, complete and timely tax returns, schedules, lists, statements and other reportorial requirements mandated by any government agency and pay the taxes, fees, permits, licenses and other charges due and demandable thereon;

To furnish you with records, statements, returns, reports and other relevant data that you may use to check my compliance with the laws and this Application;

To give you a written notice if an event that will adversely affect this Application or materially damage your BASIC happened or might happen in the nearest future;

To transfer not, neither assign my rights and privileges set forth herein to any person

To inform you of the changes in my contact info; and

To relentlessly pursue with passion all legal acts that will make my business profitable and on-going.

YOUR OBLIGATION.

To allow me to use, promote, protect, sell, advertise and market your Brand;

To permit me to lease, occupy and use your Address;

To help me seek, avail, and use your intellectual Support;

To guide me in accessing, availing and using your Competence;

To treat my data and information strictly private and confidential;

To pay my fees, for the services that I rendered to your clients; and

To inform me of the changes in your contact info.

CONSIDERATION.

For the value of the skills, trainings, workshops, lectures and the likes and access to the lectures provided by the website shown herein, I, by this promissory note, unconditionally promise to pay you the amount (in peso-equivalent) of Eight Thousand USDollars. I understand that I will be developed and honed only as a Tax Bookkeeper and to be given access to the Tax Bookkeeping for (1) Consumer Relations, (2) Supplier Relations, (3) Creditor Relations, (4) Investor Relations, (5) Employee Relations, (6) Government Regulations, and (7) Management Operations, and have to hand over to ETM my initial payment on and the remaining balance of my payment shall be paid within 365 days from the approval-date hereof.

SET-OFF.

In the event that I failed to pay you your due and demandable fees and other charges and the principal amount of the loan that you have granted unto me, I irrevocably appoint and assign you to be my attorney-in-fact, with full power and authority and without prior notice, to set-off or apply my deposits and receivables from any person in payment thereof.

RELATIONSHIP.

I am your independent Contractor. Nothing contained herein shall create an employee-employer, principal-agent or any other fiduciary relationship, partnership or joint venture. You are not entitled to worker's compensation, retirement, insurance or other benefits afforded to a regular employee of mine.

COMMUNICATIONS.

Our notices shall be sent via provided email addresses. In some instances, the use of SMS, snail mail and call may be permitted.

GOVERNING LAW.

This Application shall be subject to and governed by the laws of the Republic of the Philippines and their implementing rules and regulations. Furthermore, any court in the National Judicial Region shall have the exclusive jurisdiction over any conflict that may arise hereof. This supersedes and renders void any and all our arrangements and understandings, whether verbal or written, that we have or have not previously entered into and bear the same subject matters and considerations as they are shown herein.

MISCELLANEOUS.

Whether they are written or unwritten, your prescribed policies and procedures, which I acknowledged to be superior to any order, resolution and the likes, shall apply. You are not liable for any misunderstanding, expectation, error, or omission occurring outside hereof except for a written Addendum containing your notarised signature. In any case, your civil liability shall not exceed five thousand Philippine pesos. No alteration, novation, addition and any collateral agreement or contract shall be valid and binding between us without our written consent.

RELEVANCE.

This Application, after signed by both of us, (a) shall be superior to all the contracts having the same subject matter, whether verbal or in writing, that we have or have not entered into; and (b) is not modified by mere acts of tolerance. This Application is confidential between the two of us and shall not be disclosed to any third party without your consent.

VALIDITY.

Without notice or demand, this arrangement is deemed ‘terminated’ if I failed and continue to fail to comply with your requirements, plans and instructions or on the 30th day of the 12th month from signing hereof, whichever comes first. A duly approved and signed copy hereof shall be provided to me.

PAGES/COUNTERPARTS.

This privileged communication has 2 pages and 3 original counterparts.

SIGNATURE.

To attest my faithful compliance with your existing and succeeding policies and procedures and the terms and conditions herein prescribed, I affirm that I knowingly prepared, read, understood this Application and voluntarily enter into its arrangements, by way of printing my legal name and placing herein my true signature.

————————

ACCEPTED/APPROVED.

Tax Accounting for Government Regulations (Do It Yourself Tax Bookkeeping)

If you see a Provision for Income Tax in your Income Statement or annual income tax return and a Income Tax Payable in your Balance Sheet, you are a candidate to RECEIVE A BIR's LETTER OF AUTHORITY because you are advertising that you are ignorant of the Tax Code and boosting that you have ample money for bribery. Tsk. Tsk. Tsk. ETM suggests that it is time to change your CPAs or re-visit his contract with you.

Learn and continue to use the legal bookkeeping. Meaning, you use the dialect of the BIR in recording and reporting your business transactions. Principles and Standards as being promoted by business guru and CPAs are not laws of the Republic of the Philippines and sometimes, the source of graft and corruption because they are contrary to the laws, Tax Code.

ETM already finished the Tax Bookkeeping for Government Regulations wherein he presented the true and correct application of the Tax Code into your bookkeeping needs (not wants). Tax Code is called a Special Law. Thus, your Bookkeeping is also called a Special Bookkeeping. For this purpose, Financial bookkeeping should not replace the Special Bookkeeping. Neither, the managerial bookkeeping replaces the Special Bookkeeping.

At TaxationProfessionalUniversity.com, ETM presented the pre-formatted bookkeeping entries that you need to use to comply with the language or dialect of the Tax Code (Remember the saying, 'When in Rome, do what the Romans do.) The proper entries for filing of no payment return, with payment return and late payment return, deficiency tax, tax refund and other transaction affecting the tax returns and reportorial requirements had been provided generously.

Furthermore, you may avail yourself, your friends and relatives of the Study Now Pay ETM Later Program. Request for a copy of its contract today.

For those CPAs, Non-CPAs and Consultants who feel that they need the help and mentorship of Emelino T Maestro, feel free to contact him at your most convenient time and date.

ETM contact details are go@taxaccountingguru.com, 0998 9793922, 0922 8010922, 0917 8610550, TaxationProfessionalUniversity.com and Unit 419 Corporate 101, Mother Ignacia, Quezon City.

Thank you for sharing this info to other taxpayers.

Tax Bookkeepers' Guide To Tax Compliance (Consumer Relations)

ETM already completed the pre-formatted or pre-determined accounting entries for sales transactions affecting VAT, WT and IT (value added tax, withholding tax and income tax). If you want to impress the BIR auditors that your registered books of accounts have true and correct accounting entries and can withstand their scrutiny and examination, ETM is inviting you to look at its comprehensive contents.

For once, please try to enrich you knowhow so that you will not be imprisoned by your own ignorance and dependency to other people.

For this purpose, you may avail of the Study Now Pay Later Plan so that you can save a lot of money from paying the CPAs, Non-CPAs, Lawyers and Consultants who pretend to be competent by way of telling you that they have relatives, connections and friends inside the BIR.

Health is wealth. Go ahead and do some exercises. But, you must also exercise your brains by giving it ample information that you and your family will benefit in the nearest future. Study Now, Pay ETM Later... Request for the copy of its contract today.

The tax bookkeeping manual's contents are shown in the picture.

Furthermore, you may avail yourself, your friends and relatives of the Study Now Pay Later Program.

ETM contact details are go@taxaccountingguru.com, 0998 9793922, 0922 8010922, 0917 8610550, TaxationProfessionalUniversity.com and Unit 419 Corporate 101, Mother Ignacia, Quezon City.

This is the VATable entry made by a trained financial accountant cum managerial accountant for the sale of paper and pencil to a Non VAT registered consumer.

Debit to Receivables 1,120.00

Credit to Sales 1,000.00

Credit to Output tax 120.00

This entry is short of being true and correct. Please be reminded that Section 232, Tax Code required you to make an entry in your registered books of accounts so that the BIR can easily ascertain your tax dues and correct application of the Tax Code and other laws related thereto. The Tax Bookkeeping for Consumer Relations helps and assist you in complying with the mandate of the Tax Code by way of giving the exact, true and correct book entry for each type of sales transactions. For this purpose, the pre-determined entries to be recorded in your registered books of accounts are now accessible and available at TaxationProfessionalUnivesity.com (Avail the Study Now Pay Later Plan Today).

A. Sale of a VAT registered Taxpayer

What to expect? Tax Bookkeeping for Consumer Relations

Sale to a Non-VAT consumer by a VAT registered Taxpayer (3 entries)

Sale to a VAT-registered consumer by a VAT registered Taxpayer (3 entries)

Sale to Government by a VAT registered Taxpayer (2 entries)

Export sale by a VAT registered Taxpayer (7 entries)

Sale of a VAT-exempt Product by a VAT registered Taxpayer (15 entries)

B. Special Types of Sales by a VAT registered Taxpayer

Sale of Real Property by a VAT registered Taxpayer (4 entries)

Royalties, Licenses and Franchises by a VAT registered Taxpayer (2 entries)

Practice of Profession by a VAT registered Taxpayer (2 entries)

Leasing of Rights, Airtime, Personal and Real Properties, Space, Vehicles, Billboards, Clothing and Other Types of Properties by a VAT registered Taxpayer (2 entries)

Contracting and Sub-contracting Business by a VAT registered Taxpayer (2 entries)

Contracting and Sub-contracting Business by a VAT registered Taxpayer (2 entries)

Logistics and Freight Forwarding Business by a VAT registered Taxpayer (2 entries)

Being a Talent, Model, Actor, Director, etc. by a VAT registered Taxpayer (2 entries)

Sale of Shares of Stock by a VAT registered Taxpayer

Dividends Received by a VAT registered Taxpayer (5 entries)

Deposits from Banks and Financial Institutions by a VAT registered Taxpayer

Share in Partnership’s Profits by a VAT registered Taxpayer

Prizes and Winnings by a VAT registered Taxpayer

Commission Earned by a VAT registered Taxpayer

Restaurant, Service Charge and Customer’s Tip by a VAT registered Taxpayer

Compensation Earned by a VAT registered Taxpayer

Gifts and Donations to a VAT registered Taxpayer (2 entries)

C. Sale of a Non-VAT registered Taxpayer

Sale to a Non-VAT registered consumer by a Non VAT registered Taxpayer (3 entries)

Sale to a VAT-registered consumer by a Non VAT registered Taxpayer (3 entries)

Sale to Government by a Non VAT registered Taxpayer (2 entries)

Export sale by a Non VAT registered Taxpayer (7 entries)

D. Special Types of Sales by a Non VAT registered Taxpayer

Sale of Real Property by a Non VAT registered Taxpayer (4 entries)

Royalties, Licenses and Franchises by a Non VAT registered Taxpayer (2 entries)

Practice of Profession by a Non VAT registered Taxpayer (2 entries)

Leasing of Rights, Airtime, Personal and Real Properties, Space, Vehicles, Billboards, Clothing and Other Types of Properties by a Non VAT registered Taxpayer (2 entries)

Contracting and Sub-contracting Business by a Non VAT registered Taxpayer (2 entries)

Bookkeeping Services by a Non VAT registered Taxpayer (2 entries)

Logistics and Freight Forwarding Business by a Non VAT registered Taxpayer (2 entries)

Being a Talent, Model, Actor, Director, etc. by a Non VAT registered Taxpayer (2 entries)

Sale of Shares of Stock by a Non VAT registered Taxpayer

Dividends Received by a Non VAT registered Taxpayer (5 entries)

Deposits from Banks and Financial Institutions by a Non VAT registered Taxpayer

Share in Partnership’s Profits by a Non VAT registered Taxpayer

Prizes and Winnings by a Non VAT registered Taxpayer

Commission Earned by a Non VAT registered Taxpayer

Restaurant, Service Charge and Customer’s Tip by a Non VAT registered Taxpayer

Compensation Earned by a Non VAT registered Taxpayer

Gifts and Donations by a Non VAT registered Taxpayer (2 entries)

E. Sales Discount, Refund, Barter and Exchange

Sales Discount (4 entries)

Sales Refund (5 entries)

Sales Barter by Non VAT registered and VAT registered Taxpayers (42 entries)

Sales exchange (6 entries)

Saturday 12 August 2017

Tax Bookkeeping for Government Regulations (Course, Seminar, Training and Workshop)

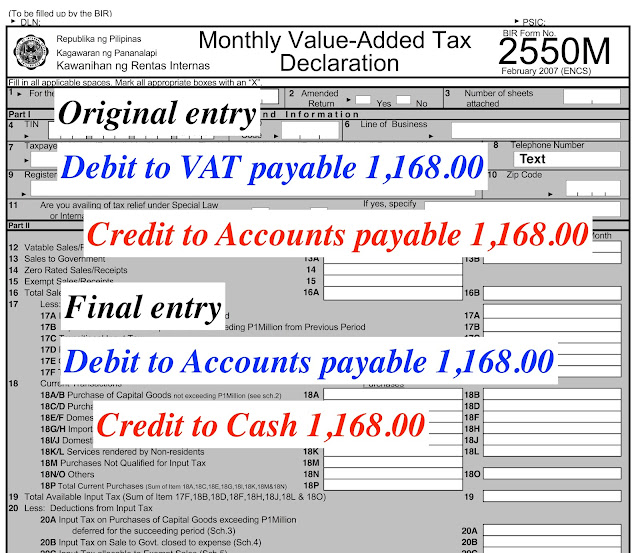

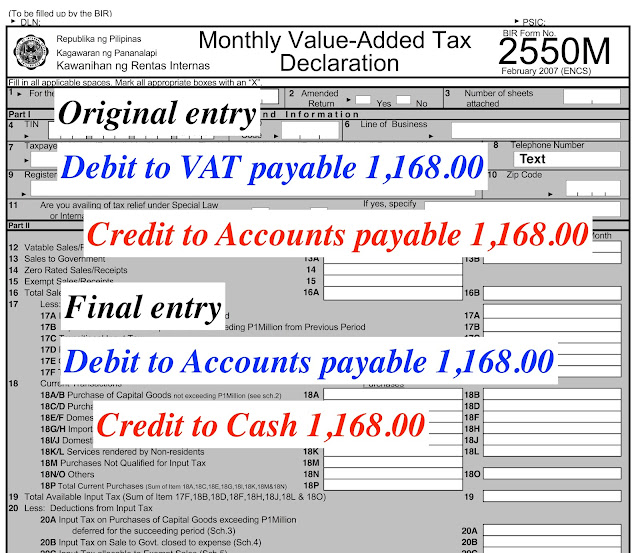

This really happened. For the past 30 years of being a defender of your tax rights, remedies, reliefs and privileges, ETM or TaxationProfessionalUniversity.com usually is surprised that until today, many graduates of accounting, whether CPAs or Non-CPAs, and other business courses related to accounting still prepare the entries shown in the picture at the time they prepared the monthly VAT return that is BIR Form No. 2550M;

These entries are just a waste of time, totally incorrect and contrary to the Tax Code and the rules issued under its authority.

You are invited to update, upscale and level up not only your knowledge in taxation but most importantly, your knowhow. You cannot rely on the hallow promises of many CPAs, Non-CPAs, consultants who are pretending to be competent and reliable because they have friends, relatives and connections inside and out of the Bureau of Internal Revenue (BIR).

Don't lose your trust on them but as the Former U.S. President Ronald Reagan once said, 'Trust but Verify.', you alone should verify if these CPAs, Non-CPAs, consultants are truly competent, reliable and law-abiding.

To help and assist you, the training, seminar, workshop and lecture about the proper entries to be made in your BIR-registered books of accounts are now available and accessible at the above website. You shall only look for the scenario where you belong, use the pre-determined debit and credit entries, and replace the amount commensurate to you actual value added tax, withholding tax and income tax transactions.

Furthermore, you may avail yourself, your friends and relatives of the Study Now Pay Later Program.

ETM contact details are go@taxaccountingguru.com, 0998 9793922, 0922 8010922, 0917 8610550, TaxationProfessionalUniversity.com and Unit 419 Corporate 101, Mother Ignacia, Quezon City.

Thank you.

Subscribe to:

Posts (Atom)