Ignorance is the basic foundation of graft and corruption. The BIR-corrupt brigade is maximizing its full potential and profitability. Fishes find strength, courage and competence in numbers. They had conquered their predators/enemies by grouping together in order to make them bigger than their enemies. You too can become bigger than the fear that lingered in your minds and hearts. Join 'JuanTALKS' now and share your knowledge and experiences to other Filipinos.

Tuesday 24 March 2015

Friday 20 March 2015

Lawyer, Lawyer, Liar, Liar?????

Although by deed, the illegal counsel from the Bureau of Internal Revenue verbally confirmed that the case he filed at the Department of Justice would ultimately be dismissed because it was based on a so hollow ground, the pretending to be competent lawyer who is representing a client insisted that the case should be prolonged for a period of ten (10) years. His reasons are standing

on two (2) foundations. The first foundation is that there is a valid threat from the illegal counsel from the BIR that in the case of dismissal, he would still seek and search scenarios to harass again the client. The last foundation is that the existing case is a good card that can be used as a trade off.

As a TAXNOCRAT for 30 years, it is also a crime and an advertisement of insensitiveness to prolong the agony and stress of a client. To plan that a simple and dismissible case shall be prolonged for a period of ten (10) consecutive years is the most amazing and embarrassing to hear. Not only it would mean that the winning would knowingly be foregone but the escalation of stress and mental anguish would create havoc and destruction within the family and friends of the said client. Notwithstanding the professional fees to be paid to this pretending to be competent lawyer..

If a lawyer, CPA or consultant is bragging about his connections and contacts, then, it can safely be concluded that such lawyer, CPA or consultant has no knowledge and competency in the field of concern....

Beware these people will only not increase your cash outlays but also their plans are destined to fail... 09228010922 and 09989793922..

A PRIVILEGED COMMUNICATION... DON'T SHARE.

on two (2) foundations. The first foundation is that there is a valid threat from the illegal counsel from the BIR that in the case of dismissal, he would still seek and search scenarios to harass again the client. The last foundation is that the existing case is a good card that can be used as a trade off.

As a TAXNOCRAT for 30 years, it is also a crime and an advertisement of insensitiveness to prolong the agony and stress of a client. To plan that a simple and dismissible case shall be prolonged for a period of ten (10) consecutive years is the most amazing and embarrassing to hear. Not only it would mean that the winning would knowingly be foregone but the escalation of stress and mental anguish would create havoc and destruction within the family and friends of the said client. Notwithstanding the professional fees to be paid to this pretending to be competent lawyer..

If a lawyer, CPA or consultant is bragging about his connections and contacts, then, it can safely be concluded that such lawyer, CPA or consultant has no knowledge and competency in the field of concern....

Beware these people will only not increase your cash outlays but also their plans are destined to fail... 09228010922 and 09989793922..

A PRIVILEGED COMMUNICATION... DON'T SHARE.

Wednesday 18 March 2015

IRS BLUFFS, BIR BLUFFS MORE

If the Internal Revenue Service (IRS) of the United States of America operates on 90% BLUFF, THERE IS NO DOUBT THAT THE BUREAU OF INTERNAL REVENUE also operates on a much higher percentage.

Yes, it is believed to be truly, truly proper because the TAX CODE OF THE REPUBLIC OF THE PHILIPPINES IS COPIED FROM

THE UNITED STATES OF AMERICA.

Secretary of Justice Leila De Lima said, "WE ARE PRESUMING THAT MS. ALAMUDDIN IS KNOWLEDGEABLE OF THE WORKING OF THE PHILIPPINE CRIMINAL JUSTICE SYSTEM BECAUSE IT IS PATTERNED AFTER THE AMERICAN SYSTEM." A2, March 12, 2015, Philippine Daily Inquirer.... 0922 8010922, 0998 9793922

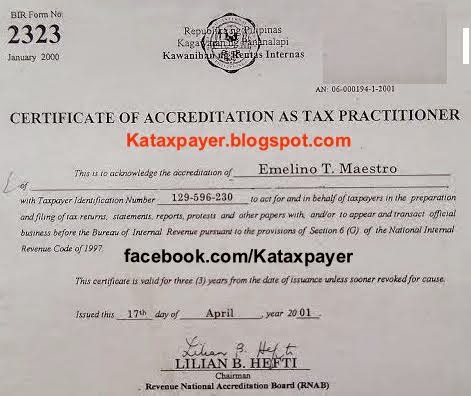

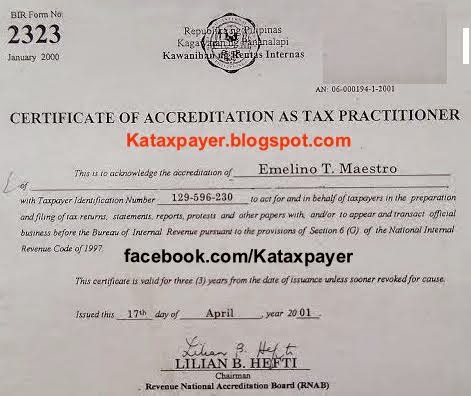

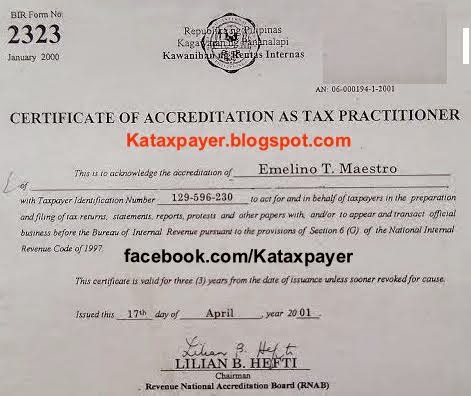

To help you with your tax problems, please call ETM by way of downloading the image herein shown.

Yes, it is believed to be truly, truly proper because the TAX CODE OF THE REPUBLIC OF THE PHILIPPINES IS COPIED FROM

THE UNITED STATES OF AMERICA.

Secretary of Justice Leila De Lima said, "WE ARE PRESUMING THAT MS. ALAMUDDIN IS KNOWLEDGEABLE OF THE WORKING OF THE PHILIPPINE CRIMINAL JUSTICE SYSTEM BECAUSE IT IS PATTERNED AFTER THE AMERICAN SYSTEM." A2, March 12, 2015, Philippine Daily Inquirer.... 0922 8010922, 0998 9793922

To help you with your tax problems, please call ETM by way of downloading the image herein shown.

Binondo: Oplan Kandado... How to handle ...

Revenuers of RD 30-Binondo, led by RDO Virgilio Cembrano, together with RR 6 Regional Director Araceli Francisco and Regional Evaluation

Board officers, padlocked two (2) establishments at 999 Mall Building 2 in Binondo, Manila, namely: Mega One Marketing and First Asia

General Merchandise..

Revenuers of RD 30-Binondo, led by RDO Virgilio Cembrano, together with RR 6 Regional Director Araceli Francisco and Regional Evaluation

Board officers, padlocked two (2) establishments at 999 Mall Building 2 in Binondo, Manila, namely: Mega One Marketing and First Asia

General Merchandise..If www.emelinotmaestro.com would handle these Oplan Kandados, he would check the laws used in closing down the said businesses. Endmost, he would check if the due process was strictly observed.

Willful Failure To Pay Taxes... Tax Evasion?

The BIR website swaggering reported that TERESITA R. ALCANTARA,

DAINAN INTERNATIONAL, INC. and its President NELSON TIA, and VIVETECH CORPORATION and its President/Chairman EDWIN B.

LUMAGUE and Treasurer ROEDEL R. LUMAGUE were charged with willful failure to pay long overdue deficiency taxes due to the government

amounting to P 19.69 Million (2007), P 54.27 Million (2008) and P 32.96 Million (2009), respectively. Therefore, they were charged with “Willful Failure to Pay Taxes.”

The BIR website swaggering reported that TERESITA R. ALCANTARA,

DAINAN INTERNATIONAL, INC. and its President NELSON TIA, and VIVETECH CORPORATION and its President/Chairman EDWIN B.

LUMAGUE and Treasurer ROEDEL R. LUMAGUE were charged with willful failure to pay long overdue deficiency taxes due to the government

amounting to P 19.69 Million (2007), P 54.27 Million (2008) and P 32.96 Million (2009), respectively. Therefore, they were charged with “Willful Failure to Pay Taxes.”If www.emelinotmaestro.com would handle these case, he would definitely check whether or not (1) the right of the BIR is already prescribed, (2) the due process was properly observed, (3) the BIR has jurisdiction over these taxpayers, and (4) these taxpayers have capacity to pay the said deficiency tax assessments.

Royale Business Club, How Will You Defend? Case Scenario

The BIR website boastfully reported that popular Quezon City multi-level

marketing club, ROYALE BUSINESS CLUB INTERNATIONAL, INC.

(ROYALE), together with its responsible corporate officers – President

JULIUS ALLAN G. NOLASCO and Vice President for Finance/Treasurer

ISA ANGELA C. BAUTISTA – and its responsible employees – Asst.

Treasurer JEANETTE R. MAGHIRANG, Asst. Treasurer IMELDA P.

PEDRON and Asst. Accounting Manager MARJORIE G. MOLINA, was charged with tax evasion with a civil liability of P 359.75 Million after the

BIR discovered that it has received a combined income payment from the Bank of the Philippine Islands, Metrobank, and Banco de Oro amounting

to P 190.79 Million in 2011, P 236.38 Million in 2012 and P 354.06 Million in 2013, but only declared in its ITR gross sales amounting to P 39.14

Million in 2011, P 106.69 Million in 2012 and P 196.68 Million in 2013, thus substantially under-declaring its correct taxable sales by 387% or

P 151.64 Million in 2011, by 122% or P 129.69 Million in 2012 and by 80% or P 157.38 Million in 2013.

The BIR website boastfully reported that popular Quezon City multi-level

marketing club, ROYALE BUSINESS CLUB INTERNATIONAL, INC.

(ROYALE), together with its responsible corporate officers – President

JULIUS ALLAN G. NOLASCO and Vice President for Finance/Treasurer

ISA ANGELA C. BAUTISTA – and its responsible employees – Asst.

Treasurer JEANETTE R. MAGHIRANG, Asst. Treasurer IMELDA P.

PEDRON and Asst. Accounting Manager MARJORIE G. MOLINA, was charged with tax evasion with a civil liability of P 359.75 Million after the

BIR discovered that it has received a combined income payment from the Bank of the Philippine Islands, Metrobank, and Banco de Oro amounting

to P 190.79 Million in 2011, P 236.38 Million in 2012 and P 354.06 Million in 2013, but only declared in its ITR gross sales amounting to P 39.14

Million in 2011, P 106.69 Million in 2012 and P 196.68 Million in 2013, thus substantially under-declaring its correct taxable sales by 387% or

P 151.64 Million in 2011, by 122% or P 129.69 Million in 2012 and by 80% or P 157.38 Million in 2013.If www.emelinotmaestro.com would handle this case, he would check if the due process requirements were strictly observed by the revenue officers assigned to investigate the case. Secondly, he would double check if the accounting method used by Royale and the said banks are congruent to one another. Finally, he would make sure that the amount received by Royale was not attributable to the so-called 'fiduciary account'.

Tuesday 17 March 2015

Additional (P82,000) NonTaxable Income for Employees

Labourers and workers from agricultural and non agricultural sectors are now assured that their 13th month pay and other incentives will no longer be subject to income taxation, thus, withholding of a tax, unless the same exceeded the P82,000 threshold. However, the basic pay and other allowances exceeding the minimum wage rate are still subject to regular income tax, thus, withholding of a tax.

Labourers and workers from agricultural and non agricultural sectors are now assured that their 13th month pay and other incentives will no longer be subject to income taxation, thus, withholding of a tax, unless the same exceeded the P82,000 threshold. However, the basic pay and other allowances exceeding the minimum wage rate are still subject to regular income tax, thus, withholding of a tax.According to BIR Revenue Regulations 3-2015 (RR 3-2015), this benefit is not available either to a self-employed individual or any juridical entity.

A FORUM SHALL BE HELD TO TACKLE THE DOs and DONTs as well as the opportunities hidden therefrom.

For reservation, registration, time and venue, please see www.facebook.com/kataxpayer.

Or, click and download the images shown herein.

www.emelinotmaestro.com

Wednesday 11 March 2015

Ask for Receipt Identification Card (BIR ID Card)

A POCKET OR A CREDIT CARD SIZED 'ASK FOR RECEIPT' ID

Now, taxpayer’s employees or suppliers who shall reimburse the expenses to be incurred in the furtherance of their employers' businesses shall only place the name, address and TIN of the said taxpayer on the space provided in the BIR Ask for Receipt ID and whenever an invoice or official receipt shall be asked for, the said employees or suppliers shall only present the said ID to the attending seller’s staff so that the latter may not commit mistake or error in placing the correct and complete info in an invoice or a official receipt.

How shall it be used? Whenever www.emelinotmaestro.com is with a company of clients having dinner or lunch in a regular restaurant or hotel, he observed that his clients always ask for a receipt or an invoice under the name of their respective companies. By doing so, the attending hotel/restaurant personnel would ask back his clients as to whom the official receipt or sales invoice shall be issued.

Whenever the said receipt or invoice was handed over his clients, facebook.com/Kataxpayer noticed that the information contained therein is incomplete. Thus, such receipt or invoice cannot be used to be an evidence in claiming a creditable input tax. Worst, the issuing taxpayer is liable for penalty for failure to issue correct official receipt or sales invoice.

To resolve this shortcoming not only on the part of Kataxpayer.blogspot.com's clients but also on the part of the attending sellers of services or goods, KATAX ETM, once again, innovate and improve the way the BIR ask for receipt shall be used and utilised.

The other side of the Card having the identical statement of an original BIR Ask for Receipt shall be a reminder to all the attending seller’s staff that their obligation is to issue an invoice or an official receipts.

TO GET A FREE COPY, please email go@taxaccountingguru.com... If you want ETM Tax Agent Office to send it to you by snail mail (PhilPost), please donate ten (10) pesos to be used for the expenses attributable to mailing it to you... For detail, please call Eric or Mario at 439 3918 ...

Limited copies... first ask, first serve....

Monday 9 March 2015

Free Tax Accounting Seminar Workshop

Free Tax Accounting

Free Tax AccountingSeminar Workshop

Rules and Regulations

Free Tax Accounting Seminar Workshop for all the Graduating Students (regardless of what is the degree or course being pursued) from any College or University and other concerned taxpayers...... Because seats are limited, please email your name, age, address, school/company and mobile number and an explanation why you should be chosen to go@taxaccountingguru.com ... Wait to an email-reply-confirmation ...

All those who will undergo this training will be referred, for possible employment, to companies where kataxpayer.blogspot.com has tie-ups . Others will be offered as partners or business venturers (www.emelinotmaestro.com)

Because every Filipino will become a real taxpayer soon, he must know the rules of taxation in order not to be a victim of graft and corrupt from the few lawyers, CPAs, consultants, bookkeepers, auditing firms, revenue officers and persons misbehaving.

Because every Filipino will become a real taxpayer soon, he must know the rules of taxation in order not to be a victim of graft and corrupt from the few lawyers, CPAs, consultants, bookkeepers, auditing firms, revenue officers and persons misbehaving.

Visit www.facebook.com/kataxpayer for the time, day and venue details and the LAST DAY TO REGISTER...YOUR COMMENCEMENT EXERCISE STARTS NOW.

Our purpose is to help the Philippine Government and its Bureau of Internal Revenue from being victimised by its own trusted officials and employees by way of delivering unnecessary delay & knowingly exercising all the misfeasance & malfeasance acts.

Our purpose is to help the Philippine Government and its Bureau of Internal Revenue from being victimised by its own trusted officials and employees by way of delivering unnecessary delay & knowingly exercising all the misfeasance & malfeasance acts.Sharing this to friends & family is obeying the Almighty God.

Thursday 5 March 2015

34 Ways to Harass a Taxpayer...

For the past 30 years, www.EmelinoTMaestro.com has uncovered the mysteries and complexities of a Bureau of Internal Revenue's Deficiency Income Tax Assessments which are also the basis of assessing and collecting Deficiency Value Added Tax. He chronicled them, presented herein and made an event that may shatter the illegal recommendations of so many corrupt-inclined persons such as lawyers, CPAs, consultants and revenue officers.

This is a relevant event that you must not miss.

There are more than 34 deficiency income tax cases to be learned... and most importantly, the legal solutions to reduce such assessments, if they can't be totally eradicated.

The investment fee is much, much lower than the usual bribe of 350,000 pesos per audit notice.

Click the Today's Important News for contact details... Only few will be entertained and accepted to the class..

Dates, time and venue to be announced at www.facebook.com/kataxpayer

This is a relevant event that you must not miss.

There are more than 34 deficiency income tax cases to be learned... and most importantly, the legal solutions to reduce such assessments, if they can't be totally eradicated.

The investment fee is much, much lower than the usual bribe of 350,000 pesos per audit notice.

Click the Today's Important News for contact details... Only few will be entertained and accepted to the class..

Dates, time and venue to be announced at www.facebook.com/kataxpayer

Monday 2 March 2015

BIR says ' Oplan Kandado'. EmelinoTMaestro says, 'Oplan Prevention'.

Procedures in Availing the Free Consultation on Oplan Kandado to be held at Sofitel Hotel

Procedures in Availing the Free Consultation on Oplan Kandado to be held at Sofitel Hotel1. Due to a very limited space and time, only those who will strictly follow the prescribed instructions shall be given a chance to get a free consultation on matters pertaining to Oplan Kandado only.

2. For reservation, please email your name, company, mobile and Oplan Kandado-notices to go@taxaccountingguru. Time will definitely be saved if the consultants may have a chance to read your problems in advance.

3. Download the GATE PASS as hereunder shown. Then, email it to at least 10 persons whom you know have tax troubles cc: go@taxaccountingguru

3. Download the GATE PASS as hereunder shown. Then, email it to at least 10 persons whom you know have tax troubles cc: go@taxaccountingguru4. You'll receive an email-confirmation as to the moment that you will be entertained.

5. Print the GATE PASS and paste at the back thereof your calling card and staple your Oplan Kandado-notices and email-confirmation. Then, bring them all at the right moment.

6. Don't encourage any revenue officer but invite as many friends, suppliers and customers to like and share the post at www.facebook.com/kataxpayer.

7. Failure to confirm back your attendance shall mean that you forgo your entitlement.

8. Subject to (a) change without notice and obligation, and (b) Katax's terms and conditions.

ALL INFORMATION THAT YOU WILL BE SHARING AND SENDING SHALL BE HANDLED CONFIDENTIALLY AND WILL NOT BE SHARED OR SOLD TO ANYBODY.

For knowing more, please download and print the 'TODAY'S IMPORTANT NEWS'

0922 8010922

Subscribe to:

Posts (Atom)