#EMELINOTMAESTRO is so concerned that he has to conduct an hour WEBINAR on January 6, 2016 from 5-6pm.

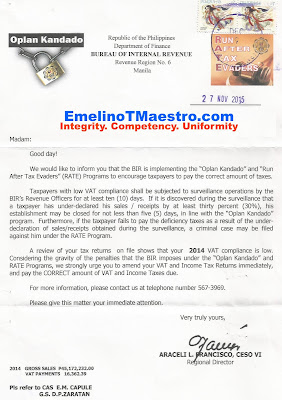

1,000,000 letters as shown across had been sent to alarm and warn everyone including those who did not receive such letter..THAT THIS COMING NEW YEAR MANY WILL BE PLACED UNDER THE OPLAN KANDADO AND RUN AFTER TAX EVADER PROGRAM OF THE BUREAU OF INTERNAL REVENUE.

To appease your burdened heart and stressed out minds, you are cordially invited to attend the above seminar. ETM will fully expose to you the BIR-plan of attacks and your possible defensive tactics or counter attack. You must understand that your failure to find appropriate reliefs to a clear and present danger may lead you to an unmanageable and irreversible situations. FOR THE DURATION OF ONE FULL HOUR, #ETM will explain to you the content and context of the letter as shown hereinabove.

This WEBINAR EVENT is about to

(1) avoid the erroneous application, by newly hired and corrupt revenue officers, of laws to the transactions of a taxpayer, (2) decrease the issuance of miscalculated deficiency tax assessment notices, (3) reduce the administrative expenses in pursuing a losing tax cases, (4) not to expose the revenue officers from a criminal prosecution for being incompetent and ignorant of the laws and (5) push a taxpayer to expose himself from danger, harm and disaster by way of directly admitting his guilt and ill-intentioned schemes to defraud the Philippine Government, the BIR had designed and develop the attached notice.

Please click this REGISTRATION FORM so that an accountable form will appear.

The good things that can be derived from going to a WEBINAR are (1) not experiencing the daily terrible traffic (saving time, gas, money and the environment),(2) learning and enjoying the event with your friends, relatives and co-workers (saving money by paying a single seminar fee), and (3) listening and watching ETM in the comfort and safety of your own place.

For a relevant Taxation Professional's services, you may call 0922 801 0922, visit Unit 419 Corporate 101 Mother Ignacia Quezon City or etmtaxagentoffice.com, or share-like Kataxpayer Facebook.

Ignorance is the basic foundation of graft and corruption. The BIR-corrupt brigade is maximizing its full potential and profitability. Fishes find strength, courage and competence in numbers. They had conquered their predators/enemies by grouping together in order to make them bigger than their enemies. You too can become bigger than the fear that lingered in your minds and hearts. Join 'JuanTALKS' now and share your knowledge and experiences to other Filipinos.

Sunday 20 December 2015

Saturday 19 December 2015

BIR Chief Declares an Assessment Holiday

From December 16, 2016 up to January 5, 2015, all revenue officers are forbidden to prepare, sign and release a tax deficiency assessment notice to any taxpayer. More so, all tax mapping, oplan kandado and inventory taking activities are suspended.

Many taxpayers had welcomed this development because they will be relieved uninvited guests and unwanted visitors. In turn, a lot of cash may be spared off or saved.

However, all tax investigations and audits for cases prescribing on April 16, 2016 and tax fraud cases will remain in effect and not be affected by the assessment holiday. The full details of the BIR Chief's instructions can be viewed via Revenue Memorandum Order 75-2015.

Taxpayers concerned are advised and strongly encouraged to take photos and prepare relevant proofs against erring and enterprising revenue officers who knowingly disregard the rules on assessment holidays. Comment, please, your spotted violations or upload your photos thereof via Crimes Against Taxpayers Facebook.

ETM Tax Agent Office is much willing to help and assist you in removing from service those who are oppressing you. For the services of a Taxation Professional, please call 0922 801 0922.

Understanding a BIR-Legal Threat:

The Oplan Kandado and Tax Evasion Threat

January 6, 2016, 5-6pm

Webinar Type

CPA on Demand Orientation (Chip-in)

January 12, 2016, 1-5pm

University Hotel, UP Campus, QC

Payroll Accounting, Documentation and Taxation

January 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Many taxpayers had welcomed this development because they will be relieved uninvited guests and unwanted visitors. In turn, a lot of cash may be spared off or saved.

However, all tax investigations and audits for cases prescribing on April 16, 2016 and tax fraud cases will remain in effect and not be affected by the assessment holiday. The full details of the BIR Chief's instructions can be viewed via Revenue Memorandum Order 75-2015.

Taxpayers concerned are advised and strongly encouraged to take photos and prepare relevant proofs against erring and enterprising revenue officers who knowingly disregard the rules on assessment holidays. Comment, please, your spotted violations or upload your photos thereof via Crimes Against Taxpayers Facebook.

ETM Tax Agent Office is much willing to help and assist you in removing from service those who are oppressing you. For the services of a Taxation Professional, please call 0922 801 0922.

Attend and Announce:

The Oplan Kandado and Tax Evasion Threat

January 6, 2016, 5-6pm

Webinar Type

CPA on Demand Orientation (Chip-in)

January 12, 2016, 1-5pm

University Hotel, UP Campus, QC

Conference-forum Type

Payroll Accounting, Documentation and Taxation

January 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

No Worry Tax Deficiency Payments

Many taxpayers became an unwilling victims of graft and corrupt practices. One of which is the instructions of several revenue officers to many authorised agent banks (AABs). The AABs are prohibited to accept a tax deficiency payments from taxpayers if the BIR Form covering such payment doesn't have the signature of an approving revenue officer. This practice is devoid of any legal justification and opens up graft and corruption opportunities to many revenue officers, creates unwelcome inconvenience to many taxpayers and totally deprives and denies the Philippine Government to timely hold and have the cash to be remitted by the taxpayers concerned.

Thanks to the gallant act of the BIR Chief, she totally dismantled this malicious practice by way of issuing Revenue Memorandum Circular 75-2015 authorising all the taxpayers to disregard the above-cited practice as well as directed them to pay their known tax deficiency at an AAB having jurisdiction over their principal place of business.

To help and assist you, please post at Crimes Against Taxpayers Facebook, photos of people and places such revenue officers, bank officials, BIR offices, bank-branches, etc. who knowingly failed and refused to honour and abide by the rules set forth so that Emelino T Maestro may help you draft and file a relevant complaint.

For tax updates, webinars and training programs in enhancing your capabilities and skills in taxation and other fields of concerns, please visit EmelinoTMaestro.com. For your tax reliefs and remedies, please call 0922 801 0922 or visit Unit 419 Corporate 101 Mother Ignacia, Quezon City and look for Juliet or Dhen so that they can immediately advise you of your next careful acts.

Attend and Announce:

The Oplan Kandado and Tax Evasion Threat

January 6, 2016, 5-6pm

Webinar Type

CPA on Demand Orientation (Chip-in)

January 12, 2016, 1-5pm

University Hotel, UP Campus, QC

Conference-forum Type

Payroll Accounting, Documentation and Taxation

January 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Sunday 13 December 2015

CPA on Demand and Professional on Demand with Emelino T Maestro

BAGO AT KUMIKITANG NEGOSYO sa taong 2016.

para sa OFWs, bookkeepers, logistics, CPAs, lawyers, o kahit sinong gusto ng pera

...

CPA Unite. Create Synergy. Join CPA on Demand

#CPAonDemand #EmelinoTMaestro

3 year Residency Program:

I don't understand why a newly passed CPA needs to undergo a 3-year Residency Program from any company in order to be allowed to CPA-practice. Isn't it enough that this CPA passed the exams that the Professional Regulation Commission gave. Unfair... puede namang maging freelancer, o consultant o auditor kaagad ang bagong pasang CPA ... Bakit kailangang pahirapan pa sa pamamagitan ng pagiging empleyado sa ibang tao o dayuhan.... Akala ko ba ang policy ng Gobyerno ay development of Entrepreneurs.... ... Curtailment of business ata ang pinupuntahan nito.... Unconstitutional...

Poor CPAs became Poorer CPAs:

More than 100,000 CPAs na... Ang nagyayari ay marami na ang nagiging Certified Public Atsoy sa ibang bansa.. Pumamasok sila bilang caregiverd kasi alang opportunity daw dito sa Pinas... Namputsa naman kayo... Binababoy ninyo ang professionals...

CPA on Demand....

Mga CPA, di bale, ang pang aapi sa inyo ... gamitin natin para umulad tayo... Magtulungan na lang tayo... Gumagawa si #EmelinoTMaestro ng CPA on Demand para maibenta ang inyong CPA services sa loob at labas ng Pinas... Sama ka sa first orientation program.... P700/pax chip in tayo (light -am-snacks/lunch/pm-snacks)... Para malaman ng iba na may "INTEGRIDAD" ang CPAs... puede din sumama ang hindi nakapasang CPAs, mga OFWs o sinumang gustong makaroon ng NEGOSYO o iyong naghahanap ng NEGOSYONG ALANG MALAKING PUHUNAN. May meeting tayo sa University of the Philippines, January 8, 2015, 9am -5pm... To register, click this http://goo.gl/forms/AUpEm2JdfT (paki lagay after your name the word 'COD') para alam ni ETM sa CPA on Demand ka aattend... Finally, you must Share this onto your Facebook account so others may have a new NEGOSYO this year 2016.....You must email the screen-shot of your Sharing Act to ETM via go@taxaccountingguru.com. Thanks.

Mga CPA, di bale, ang pang aapi sa inyo ... gamitin natin para umulad tayo... Magtulungan na lang tayo... Gumagawa si #EmelinoTMaestro ng CPA on Demand para maibenta ang inyong CPA services sa loob at labas ng Pinas... Sama ka sa first orientation program.... P700/pax chip in tayo (light -am-snacks/lunch/pm-snacks)... Para malaman ng iba na may "INTEGRIDAD" ang CPAs... puede din sumama ang hindi nakapasang CPAs, mga OFWs o sinumang gustong makaroon ng NEGOSYO o iyong naghahanap ng NEGOSYONG ALANG MALAKING PUHUNAN. May meeting tayo sa University of the Philippines, January 8, 2015, 9am -5pm... To register, click this http://goo.gl/forms/AUpEm2JdfT (paki lagay after your name the word 'COD') para alam ni ETM sa CPA on Demand ka aattend... Finally, you must Share this onto your Facebook account so others may have a new NEGOSYO this year 2016.....You must email the screen-shot of your Sharing Act to ETM via go@taxaccountingguru.com. Thanks.

Please pay on or before January 6, 2016... Those who not pay on the said date shall pay P1,200/pax... Deposit your payment under Emelino T Maestro BPI-savings account number 9629 0045 96. Print your complete name on the BPI validated deposit slip. Finally, scan-email the said slip to 'go@taxaccountingguru.com' ASAP... You understand that your payment is not a payment for ETM professional services.... It shall be considered in a fiduciary account that will be used to propagate the cause herein stated.

para sa OFWs, bookkeepers, logistics, CPAs, lawyers, o kahit sinong gusto ng pera

...

CPA Unite. Create Synergy. Join CPA on Demand

#CPAonDemand #EmelinoTMaestro

3 year Residency Program:

I don't understand why a newly passed CPA needs to undergo a 3-year Residency Program from any company in order to be allowed to CPA-practice. Isn't it enough that this CPA passed the exams that the Professional Regulation Commission gave. Unfair... puede namang maging freelancer, o consultant o auditor kaagad ang bagong pasang CPA ... Bakit kailangang pahirapan pa sa pamamagitan ng pagiging empleyado sa ibang tao o dayuhan.... Akala ko ba ang policy ng Gobyerno ay development of Entrepreneurs.... ... Curtailment of business ata ang pinupuntahan nito.... Unconstitutional...

Poor CPAs became Poorer CPAs:

More than 100,000 CPAs na... Ang nagyayari ay marami na ang nagiging Certified Public Atsoy sa ibang bansa.. Pumamasok sila bilang caregiverd kasi alang opportunity daw dito sa Pinas... Namputsa naman kayo... Binababoy ninyo ang professionals...

CPA on Demand....

Mga CPA, di bale, ang pang aapi sa inyo ... gamitin natin para umulad tayo... Magtulungan na lang tayo... Gumagawa si #EmelinoTMaestro ng CPA on Demand para maibenta ang inyong CPA services sa loob at labas ng Pinas... Sama ka sa first orientation program.... P700/pax chip in tayo (light -am-snacks/lunch/pm-snacks)... Para malaman ng iba na may "INTEGRIDAD" ang CPAs... puede din sumama ang hindi nakapasang CPAs, mga OFWs o sinumang gustong makaroon ng NEGOSYO o iyong naghahanap ng NEGOSYONG ALANG MALAKING PUHUNAN. May meeting tayo sa University of the Philippines, January 8, 2015, 9am -5pm... To register, click this http://goo.gl/forms/AUpEm2JdfT (paki lagay after your name the word 'COD') para alam ni ETM sa CPA on Demand ka aattend... Finally, you must Share this onto your Facebook account so others may have a new NEGOSYO this year 2016.....You must email the screen-shot of your Sharing Act to ETM via go@taxaccountingguru.com. Thanks.

Mga CPA, di bale, ang pang aapi sa inyo ... gamitin natin para umulad tayo... Magtulungan na lang tayo... Gumagawa si #EmelinoTMaestro ng CPA on Demand para maibenta ang inyong CPA services sa loob at labas ng Pinas... Sama ka sa first orientation program.... P700/pax chip in tayo (light -am-snacks/lunch/pm-snacks)... Para malaman ng iba na may "INTEGRIDAD" ang CPAs... puede din sumama ang hindi nakapasang CPAs, mga OFWs o sinumang gustong makaroon ng NEGOSYO o iyong naghahanap ng NEGOSYONG ALANG MALAKING PUHUNAN. May meeting tayo sa University of the Philippines, January 8, 2015, 9am -5pm... To register, click this http://goo.gl/forms/AUpEm2JdfT (paki lagay after your name the word 'COD') para alam ni ETM sa CPA on Demand ka aattend... Finally, you must Share this onto your Facebook account so others may have a new NEGOSYO this year 2016.....You must email the screen-shot of your Sharing Act to ETM via go@taxaccountingguru.com. Thanks.Please pay on or before January 6, 2016... Those who not pay on the said date shall pay P1,200/pax... Deposit your payment under Emelino T Maestro BPI-savings account number 9629 0045 96. Print your complete name on the BPI validated deposit slip. Finally, scan-email the said slip to 'go@taxaccountingguru.com' ASAP... You understand that your payment is not a payment for ETM professional services.... It shall be considered in a fiduciary account that will be used to propagate the cause herein stated.

Payroll Accounting, Documentation & Taxation by Emelino T Maestro

Bureau of Internal Revenue's rules and regulations that govern the proper way of documenting an employee-employer relationship are sometimes hard to understand and most of the times, are to implement. Erroneous interpretation and misunderstanding of the BIR rules and regulations lead to improper use of accounting titles and miscalculated entries in the books of accounts. The result of these unwelcome actions is sometimes devastating to the owners and officials of a company.

To remedy this tax trouble, HR Managers and their counterparts in the Finance Department who may be the Accounting Manager and Finance Director must understand the intricacies and complexities of complying with the procedural due processes that the law on taxation imposed.

You, your friends and business associates, investors, employees, suppliers and creditors are welcome to discuss your existing set up with Emelino T Maestro and his appointed person so that at this early stage, the appropriate correction or improvement of your situation may be made.

Please email 'go@taxaccountingguru.com', text 0998 979 3922, or call 02-439 3918.... PLEASE CLICK THIS REGISTRATION FORM AND AN ACCOUNTABLE FORM WILL APPEAR

Thanks for sharing this. Click this video about Payroll Accounting....

January 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Ways to Overcome an electronic Letter of Authority

Subpoena Duces Tecum and Letter Notice

February 10, 11 and 12, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

To remedy this tax trouble, HR Managers and their counterparts in the Finance Department who may be the Accounting Manager and Finance Director must understand the intricacies and complexities of complying with the procedural due processes that the law on taxation imposed.

You, your friends and business associates, investors, employees, suppliers and creditors are welcome to discuss your existing set up with Emelino T Maestro and his appointed person so that at this early stage, the appropriate correction or improvement of your situation may be made.

Please email 'go@taxaccountingguru.com', text 0998 979 3922, or call 02-439 3918.... PLEASE CLICK THIS REGISTRATION FORM AND AN ACCOUNTABLE FORM WILL APPEAR

Thanks for sharing this. Click this video about Payroll Accounting....

Attend and announce

Payroll Accounting, Documentation and TaxationJanuary 29-30, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Ways to Overcome an electronic Letter of Authority

Subpoena Duces Tecum and Letter Notice

February 10, 11 and 12, 2016, 1.30-5pm

University Hotel, UP Campus, QC

Seminar-workshop-training Type

Tuesday 1 December 2015

Bookkeeping Regulations (BIR RR V-1): Pay it Forward Principle

This is a PAY IT FORWARD Principles.

#EmelinoTMaestro #Bookkeepingregulations

No matter how loyal, trusted and effective your people are, their resignation, retirement and redundancy would eventually set in. When these people go, your secrets, policies and procedures leave also with them. Acquiring and hiring new personnel may bring chill and excitement but any experimentation in taxation is not strongly advised. Without mental reservation and purpose of evasion, all the tax compliance policies and procedures should always be ready/available; never to be compromised; and profoundly, must correctly/consistently be applied. This Republic is not under legal duty to equip you with what you need to know, comprehend and use. It had already laid down all the fundamentals in making you, including your suppliers and customers, to be law-abiding. In this view, a customised/updated “TAX ACCOUNTING SYSTEM” that would never resign, retire and be redundant is all you need.

#EmelinoTMaestro #Bookkeepingregulations

No matter how loyal, trusted and effective your people are, their resignation, retirement and redundancy would eventually set in. When these people go, your secrets, policies and procedures leave also with them. Acquiring and hiring new personnel may bring chill and excitement but any experimentation in taxation is not strongly advised. Without mental reservation and purpose of evasion, all the tax compliance policies and procedures should always be ready/available; never to be compromised; and profoundly, must correctly/consistently be applied. This Republic is not under legal duty to equip you with what you need to know, comprehend and use. It had already laid down all the fundamentals in making you, including your suppliers and customers, to be law-abiding. In this view, a customised/updated “TAX ACCOUNTING SYSTEM” that would never resign, retire and be redundant is all you need.

EMELINOTMAESTRO (ETM) will waive his right to earn in selling the Bookkeeping Regulations (RR V-1) book. This ebook will be emailed to you free of charge. Morally speaking, you are encouraged to forward-email it to as many friends that you have. The purpose is so simple that is HELP THEM UNDERSTAND THE LAW SO THAT THEY WILL NOT BECOME VICTIMS OF A VERY CONTAGIOUS DISEASE CALLED 'IGNORANCE'. No need to call or text his mobile number 0922 801 0922 or email him at go@taxaccountingguru.com or PM him at Kataxpayer Facebook or visit his Unit 419 Corporate 101 Mother Ignacia Quezon City office. IF YOU HAVE TIME AND MORE CARE TO OTHER PREYED TAXPAYERS, you are also encouraged to download any picture hereof and post it on your SocMed accounts such as Facebook, Instagram, Tweeter, etc. Thanks....

EMELINOTMAESTRO (ETM) will waive his right to earn in selling the Bookkeeping Regulations (RR V-1) book. This ebook will be emailed to you free of charge. Morally speaking, you are encouraged to forward-email it to as many friends that you have. The purpose is so simple that is HELP THEM UNDERSTAND THE LAW SO THAT THEY WILL NOT BECOME VICTIMS OF A VERY CONTAGIOUS DISEASE CALLED 'IGNORANCE'. No need to call or text his mobile number 0922 801 0922 or email him at go@taxaccountingguru.com or PM him at Kataxpayer Facebook or visit his Unit 419 Corporate 101 Mother Ignacia Quezon City office. IF YOU HAVE TIME AND MORE CARE TO OTHER PREYED TAXPAYERS, you are also encouraged to download any picture hereof and post it on your SocMed accounts such as Facebook, Instagram, Tweeter, etc. Thanks....

Subscribe to:

Posts (Atom)