- tomorrow at 9:00am. See post.

Success Story of a Real Estate Broker

by FACEBOOK.COM/EMELINOTMAESTRO

Real Estate Broker and Agent

Whenever you go, you will meet someone who will force you to look at him and get the flyer that he is handing out. Eerie and disturbing, Real Estate Brokers and Agents are here to stay as long as the Ayala, Sy, Gokongwei, Tan, Lopez, Villar, Paris Hilton, Trump, etc. keep on building condominium towers, subdivisions and townships.

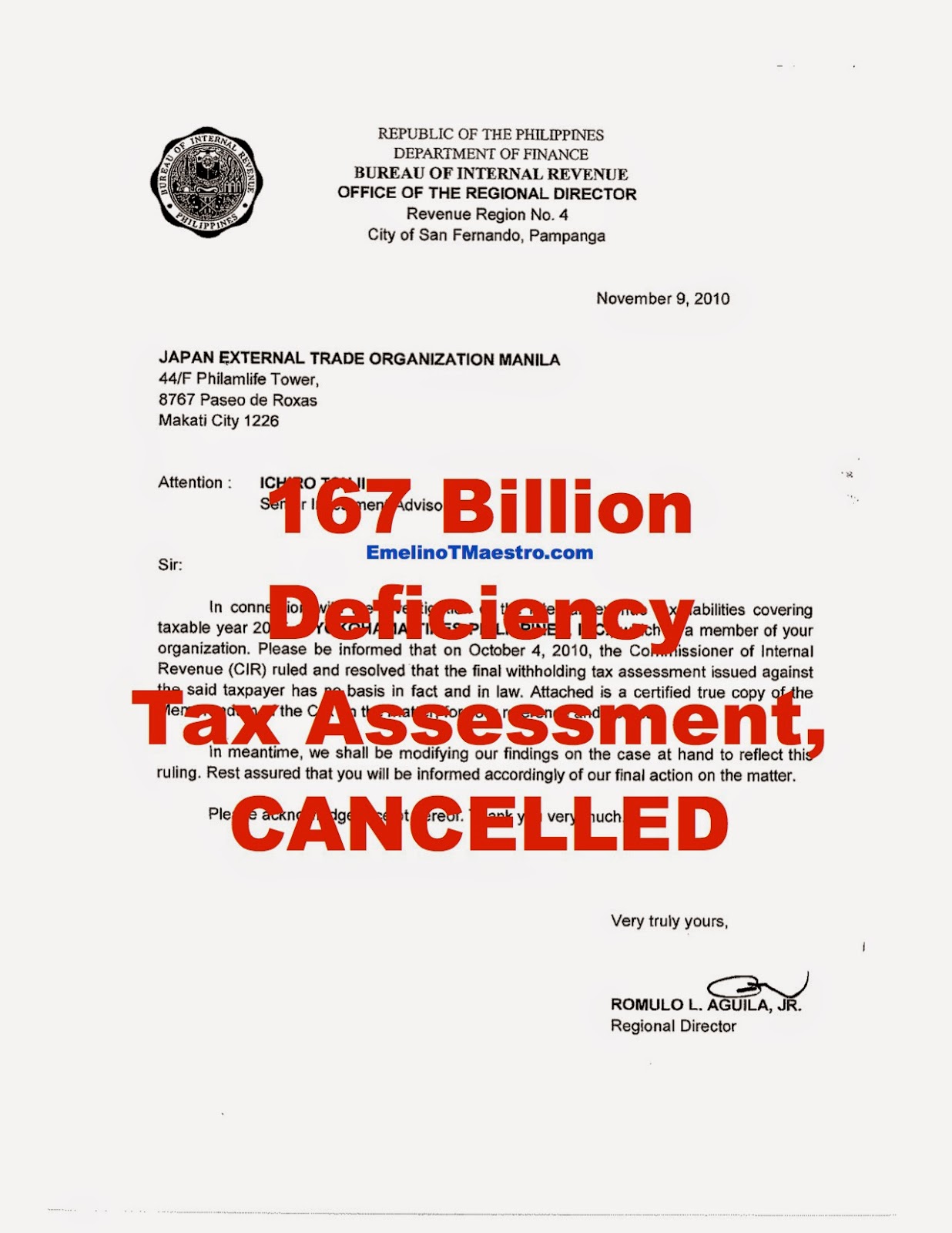

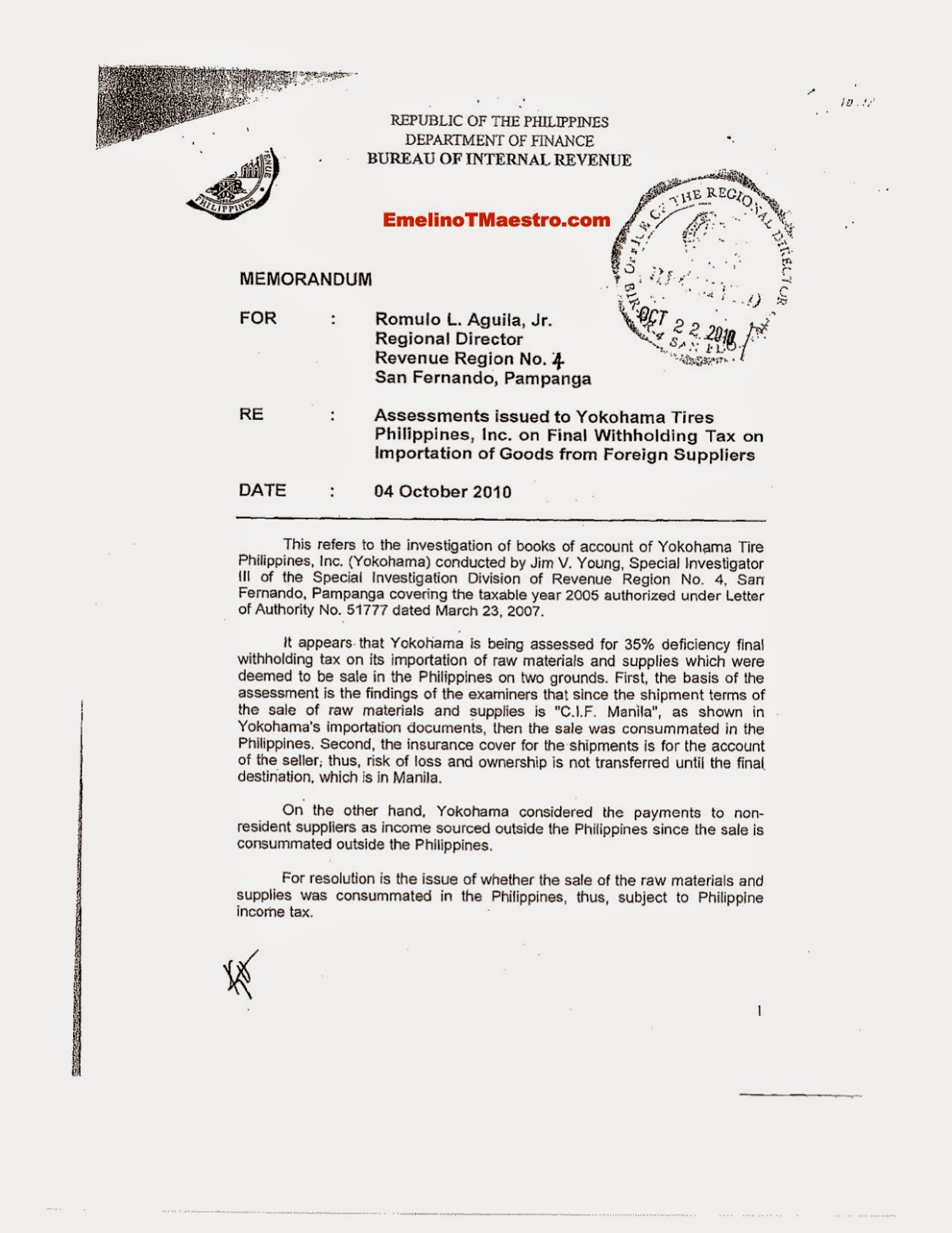

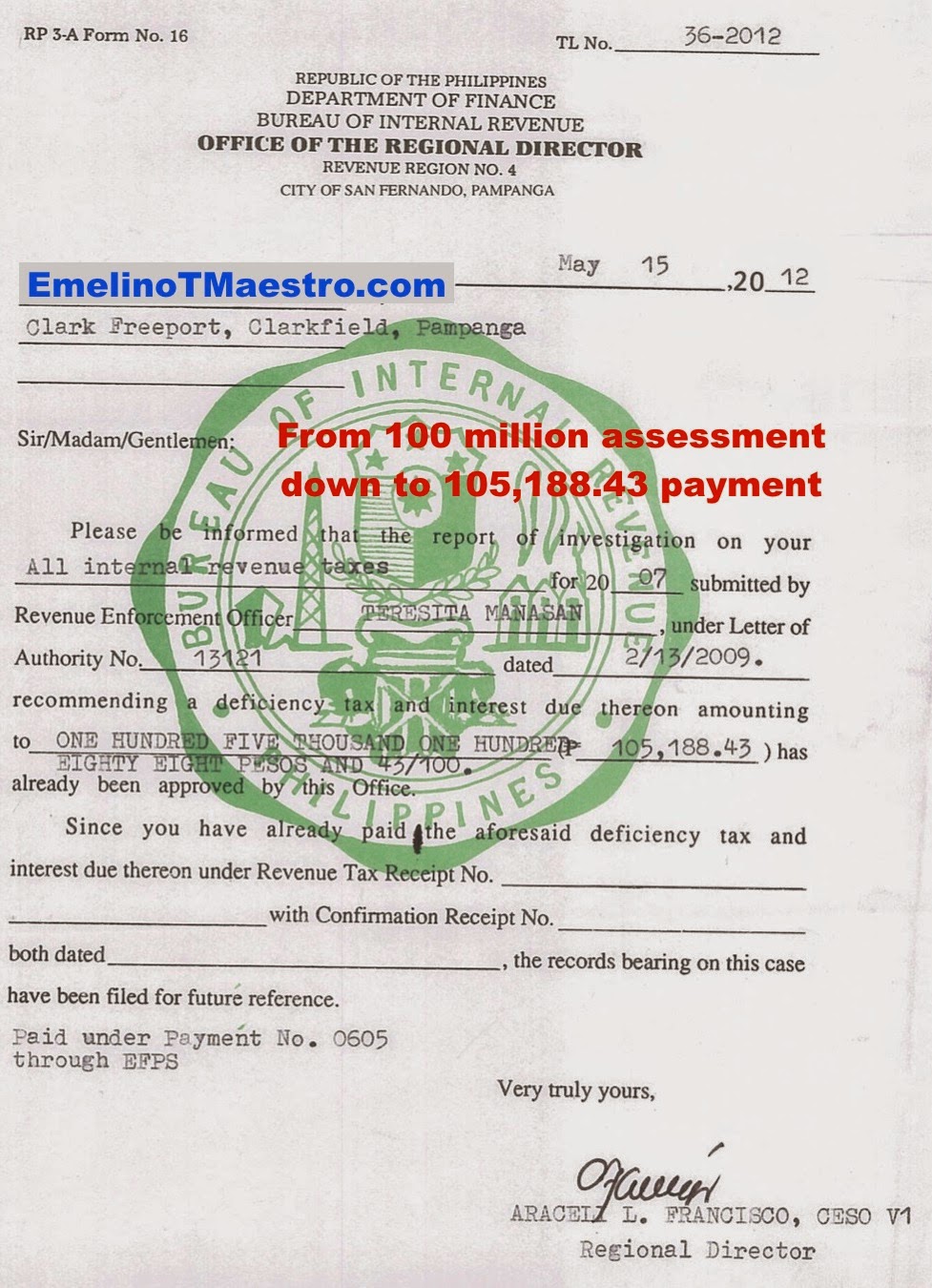

However, one Real Estate Broker and Agent stood out from the rest. He also, as he confessed, so dismayed and disappointed in giving out flyers to everyone even to a two-year old baby. And, one day, he met an individual who really wanted to buy a condo unit but his million pesos are tied up either to be given as a bribe to a revenue officer or to be paid to the BIR-deficiency tax assessment that this individual doesn't understand. This individual is just walking around that mall in order to relieve the stress and the pain that he is experiencing when they met and have a chat about this individual's tax problems. When he asked this individual if he has already consulted a lawyer or a CPA, he frustratedly state that his lawyer and CPA are recommending that he pay a little to the BIR and bribe more the enterprising revenue officer. Feeling that he can make a difference not only to the life of this individual and of course, his future in selling a condo unit to him, he challenged this individual that if he could untie the MONEY that is destined to be used as a bribe to a revenue officer or as payment of a deficiency tax that this individual doesn't understand, the portion of the freed MONEY will be used as a downpayment for a condo unit that this individual is so interested. Before they parted their ways, this individual agreed. NOW, having found the right formula in selling condo units, houses and lots, and township properties, this Real Estate Broker and Agent is meeting the needs of his family and beginning to have a cash savings for his retirement.

Now, he is selling condo units by not selling them directly but asking all his potential buyers if they have BIR problems, estate tax problems, deficiency tax assessments, etc. and if they do, he offer his services to untie their MONEY therefrom with the conditions that the portion of the untied MONEY shall be used as a downpayment for their chosen properties. He has unleashed the power of ALLIANCE AND COOPERATION.

IF YOU'RE INTERESTED TO EARN MORE FROM YOU EXISTING BUSINESS, YOU MAY TAKE AN ALLIANCE WITH ETM TAX AGENT OFFICE SO THAT THE MONEY OF YOUR CUSTOMERS AND CLIENTS THAT IS ALREADY EARMARKED FOR UNNECESSARY EXPENSES MAY BE USED TO BUY GOODS OR SERVICES FROM YOU.

Yes, we can bundle our "Solutions to BIR Problems and Estate Planning" to the "Selling of Your Goods and Services" and in this case, condo units, houses and lots, and township properties.

Call Marice at 09228010922@MaestroTaxation.org

by FACEBOOK.COM/EMELINOTMAESTRO

Real Estate Broker and Agent

Whenever you go, you will meet someone who will force you to look at him and get the flyer that he is handing out. Eerie and disturbing, Real Estate Brokers and Agents are here to stay as long as the Ayala, Sy, Gokongwei, Tan, Lopez, Villar, Paris Hilton, Trump, etc. keep on building condominium towers, subdivisions and townships.

However, one Real Estate Broker and Agent stood out from the rest. He also, as he confessed, so dismayed and disappointed in giving out flyers to everyone even to a two-year old baby. And, one day, he met an individual who really wanted to buy a condo unit but his million pesos are tied up either to be given as a bribe to a revenue officer or to be paid to the BIR-deficiency tax assessment that this individual doesn't understand. This individual is just walking around that mall in order to relieve the stress and the pain that he is experiencing when they met and have a chat about this individual's tax problems. When he asked this individual if he has already consulted a lawyer or a CPA, he frustratedly state that his lawyer and CPA are recommending that he pay a little to the BIR and bribe more the enterprising revenue officer. Feeling that he can make a difference not only to the life of this individual and of course, his future in selling a condo unit to him, he challenged this individual that if he could untie the MONEY that is destined to be used as a bribe to a revenue officer or as payment of a deficiency tax that this individual doesn't understand, the portion of the freed MONEY will be used as a downpayment for a condo unit that this individual is so interested. Before they parted their ways, this individual agreed. NOW, having found the right formula in selling condo units, houses and lots, and township properties, this Real Estate Broker and Agent is meeting the needs of his family and beginning to have a cash savings for his retirement.

Now, he is selling condo units by not selling them directly but asking all his potential buyers if they have BIR problems, estate tax problems, deficiency tax assessments, etc. and if they do, he offer his services to untie their MONEY therefrom with the conditions that the portion of the untied MONEY shall be used as a downpayment for their chosen properties. He has unleashed the power of ALLIANCE AND COOPERATION.

IF YOU'RE INTERESTED TO EARN MORE FROM YOU EXISTING BUSINESS, YOU MAY TAKE AN ALLIANCE WITH ETM TAX AGENT OFFICE SO THAT THE MONEY OF YOUR CUSTOMERS AND CLIENTS THAT IS ALREADY EARMARKED FOR UNNECESSARY EXPENSES MAY BE USED TO BUY GOODS OR SERVICES FROM YOU.

Yes, we can bundle our "Solutions to BIR Problems and Estate Planning" to the "Selling of Your Goods and Services" and in this case, condo units, houses and lots, and township properties.

Call Marice at 09228010922@MaestroTaxation.org