Resetting a Compliance with a BIR Subpoena

Yesterday, I was informed that due to unavoidable events, the representative of the taxpayer who was summoned by the Bureau of Internal Revenue (Legal Division) came late and the revenue officer assigned to check and verify the documents being submitted in compliance with the subpoena duces tecum left early. Due thereto, the assigned revenue attorney (lawyer) decided to reset or reschedule the taxpayer's compliance to the said dangerous notice.

He (lawyer) wrote on his copy of the summons the new date and time but when asked to write the same info on the copy of the taxpayer, he, thrice, refused by way of justifying that he already wrote the same to his copy.

FOR YOUR INFORMATION, THIS IS AN ACT THAT YOU MUST LOOK FOR WHEN DEALING WITH REVENUE OFFICERS. It is called 'DELETION'. Its purpose is to deprive you to have a valid and relevant document that will help you defend yourself in case he (lawyer) filed a CRIMINAL COMPLAINT for failure to obey the BIR's summons against you at the Department of Justice. This is usual to many corrupt minded revenue officers and you should BE AWARE AND BEWARE of this malicious tactic and technique.

This may happen to you so www.emelinotmaestro.com is teaching you to bring a least two companions when meeting a revenue officer, jot down all the things that you said and what the revenue officer stated, prepare a written account after that, and then submit such written account to the BIR Chief, and the immediate supervisor of the said revenue officer.

IN THIS SCENARIO, YOU PREVENT A DANGEROUS TROUBLE TO CROP UP or in other word, you deny the corrupt and super corrupt minds to do harmful acts against you and your family.

To help and assist you with your electronic Letter of Authority, Letter Notice, Oplan Kandado, Tax Mapping and other serious tax cases, please email Katax at 09228010922@MaestroTaxation.org.

www.facebook.com/Kataxpayer

Ignorance is the basic foundation of graft and corruption. The BIR-corrupt brigade is maximizing its full potential and profitability. Fishes find strength, courage and competence in numbers. They had conquered their predators/enemies by grouping together in order to make them bigger than their enemies. You too can become bigger than the fear that lingered in your minds and hearts. Join 'JuanTALKS' now and share your knowledge and experiences to other Filipinos.

Thursday 29 January 2015

Friday 23 January 2015

What Kim Henares Wants You To Do Today?

“The recording and recognition of business transactions for financial accounting purposes, in a majority of situations, differ from the application of tax rules on the same transactions resulting to disparity of reports for financial accounting vis-a-vis tax accounting - Finance Secretary Margarito Teves’

“If there will be differences and conflicts in taxability of income and deductibility of expenses between what is contained in the Tax Code, and that of other standards approved and adopted by the Accounting Standards Council, the Tax Code shall prevail - BIR Chief Kim Henares.’

‘The cost of preparing generally accepted accounting principles basis financial statements is excessive and in many cases unnecessary. Translating tax return information into a financial statement format can be a cost effective strategy - The National Society of Accountants in the United States of America.’

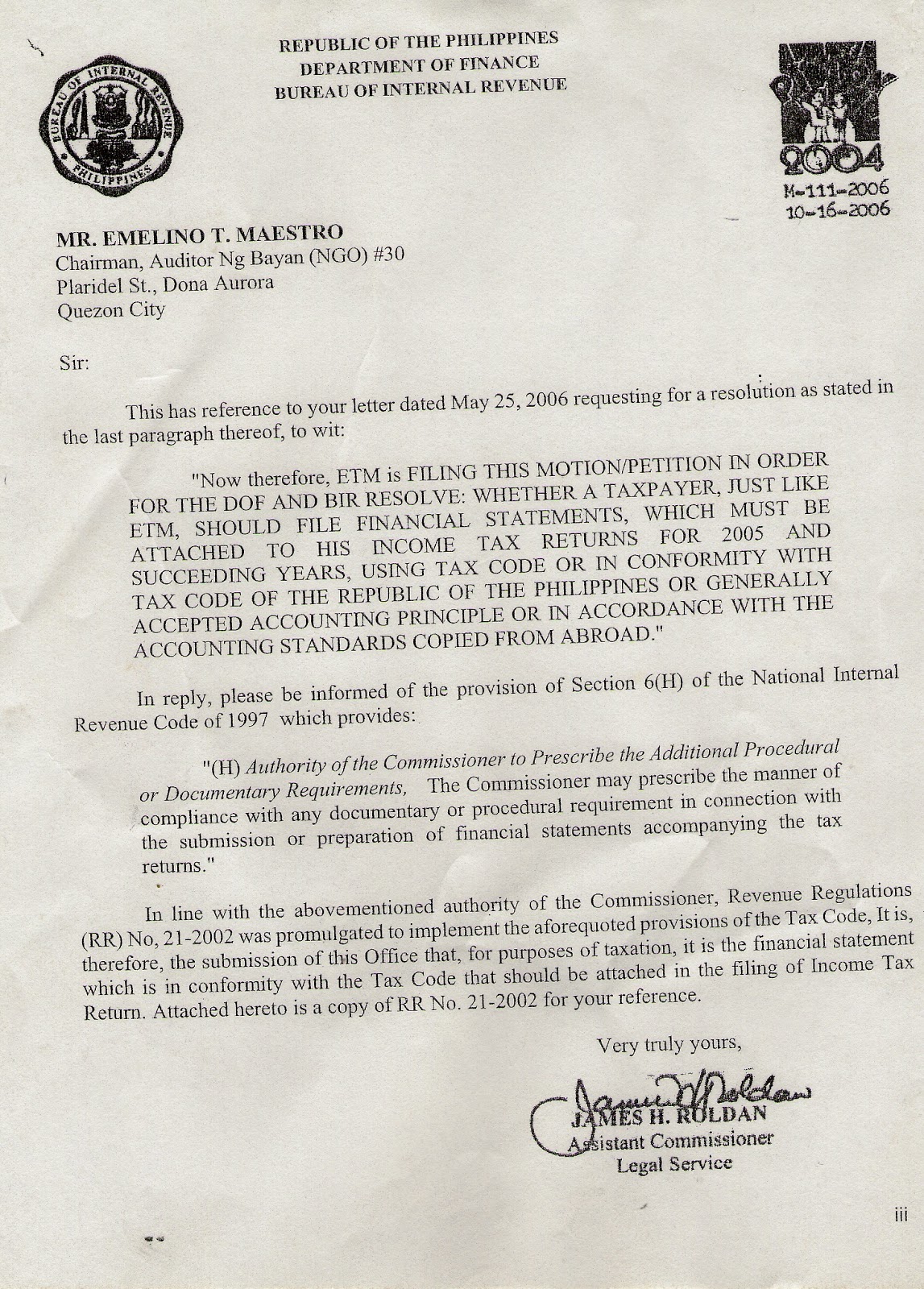

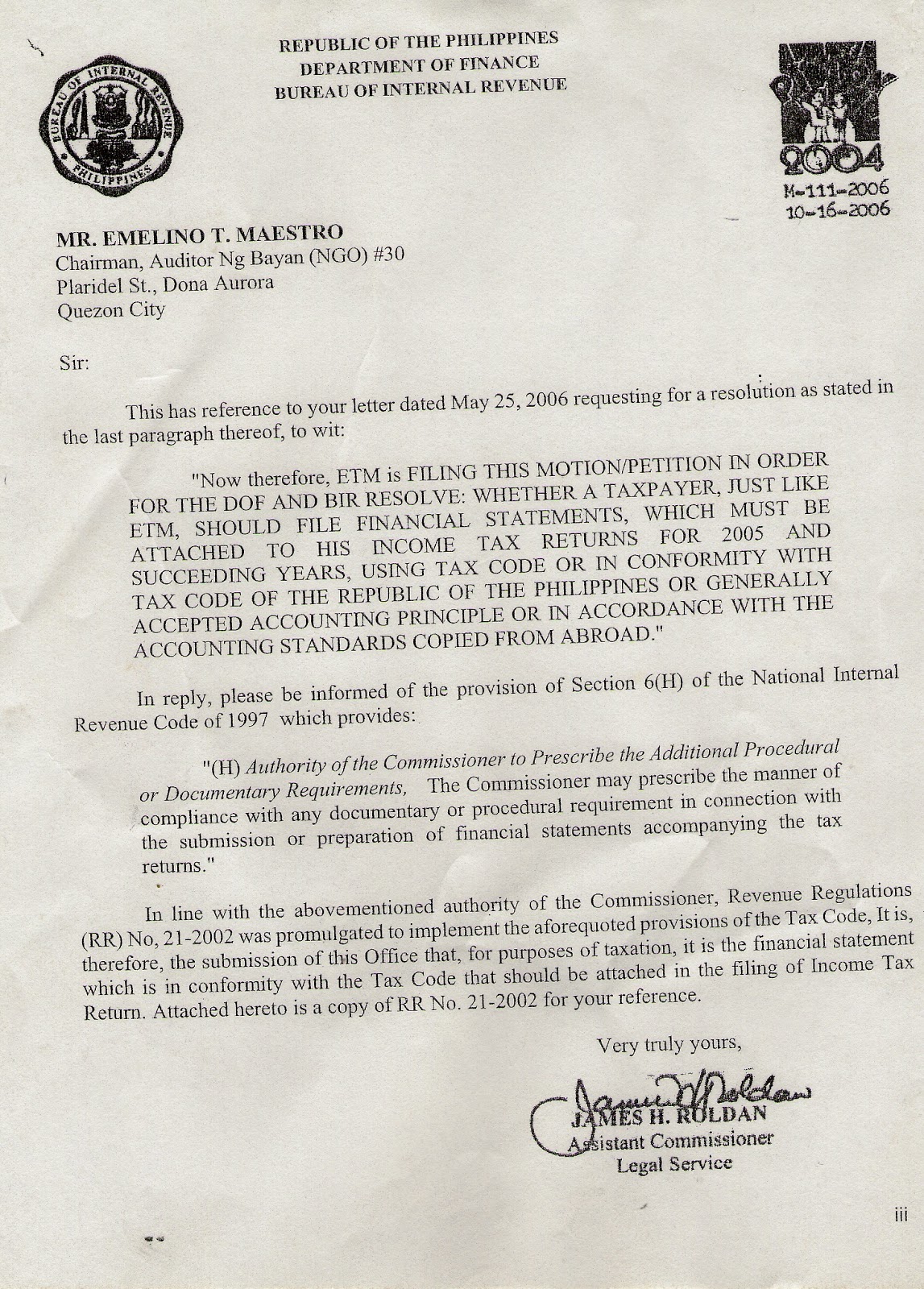

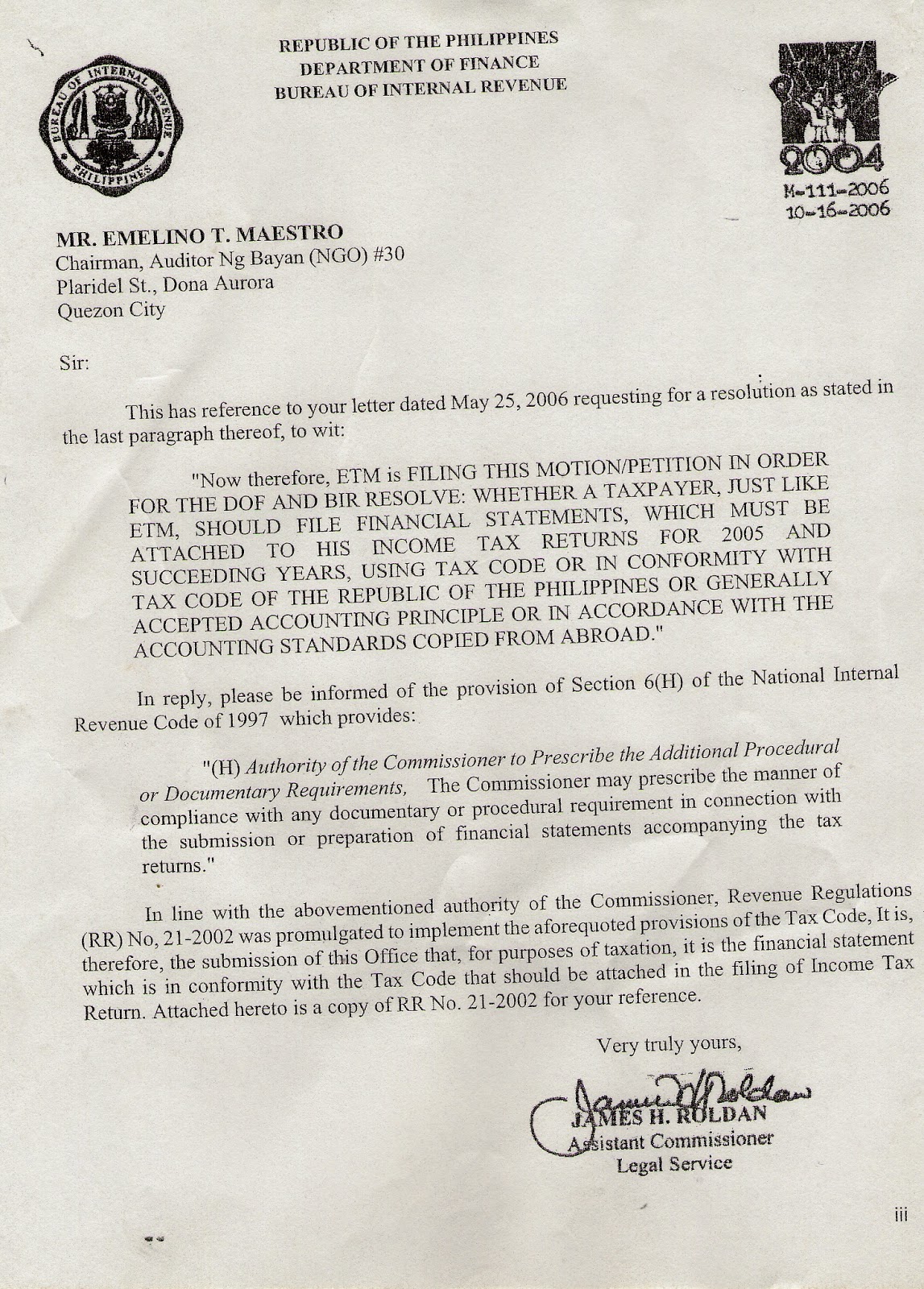

‘Therefore, it is the financial statements which are in conformity with the Tax Code that should be attached in the filing of income tax return - BIR’s Legal Service Commissioner, Mr James Roldan’

EmelinoTMaestro.com can't blame you if your personal attachment to the Financial Standards and Principles is too strong and too tight. And, you can't be stopped from using them in preparing your books of accounts and financial statements.. Don't worry. Because by doing so, it's common and you don't have a contagious disease. However, you have a very serious problem that may increase your chances of being BIR investigated this year.

EmelinoTMaestro.com can't blame you if your personal attachment to the Financial Standards and Principles is too strong and too tight. And, you can't be stopped from using them in preparing your books of accounts and financial statements.. Don't worry. Because by doing so, it's common and you don't have a contagious disease. However, you have a very serious problem that may increase your chances of being BIR investigated this year.

If you can't be stopped in using and issuing PFRS/GAAP basis financial statements, the BIR expects you that you will perform what you stated in the so-called 'STATEMENT OF MANAGEMENT'S RESPONSIBILITIES'. Because upon signing it, you bound yourself to have a reconciling book of accounts where the disparities and differences between your PFRS/GAAP (financial standards and principles) and the TAX ACCOUNTING RULES are recorded, reconciled, explained and kept.

If you don't have a reconciling book of accounts and don't know the ways in reconciling your PFRS/GAAP entries versus TAX ACCOUNTING ENTRIES, don't worry so much because www.facebook.com/Kataxpayer will help you extinguish your legal obligations to the Bureau of Internal Revenue.

According to the BIR Chief, the purposes of using the TAX ACCOUNTING RULES are to (1) avoid troubles and irritations between you and the revenue officers examining your tax returns and financial statements, and (2) help and assist the revenue officers to easily understand your books of accounts and the accounting entries therein.

In this view, there will be a TAX ACCOUNTING SHORT-COURSE to be held this month and you, including your friends and employees, are cordially invited to attend.

For the first 100 participants, the three-session event has an investment cost of 1,000 pesos plus 12% VAT. However, references materials, books and snacks to be used therein are optional to be bought.

Share, Register and Pay Now.

Please email your concerns to

09989793922@MaestroTaxation.org

so that a reply may come to you.

Please email your concerns to

09989793922@MaestroTaxation.org

so that a reply may come to you.

Thursday 22 January 2015

NO LETTER OF AUTHORITY FOR 2015 IF..... WWW EMELINOTMAESTRO.COM

Thank the Almighty God that local officials are now accepting and recognising that their antics of increasing, without the expressed consent, by 20% the local taxpayers' declared sales in illegal and immoral. Thus, they altogether stopped such questionable practice.

Now, an unconfirmed information roamed around that these local government officials are now employing a new tactics that is IF YOU WILL VOLUNTARILY INCREASE YOUR ACTUAL SALES FOR 2014 BY AT LEAST 30% (1,000,000 will be 1,300,000), YOU WILL BE SPARED OF BEING AUDITED FOR 2015.

This proposal is contrary to law (Section131(n), Local Government Code; Solution Indebiti, Article 213, Revised Penal Code). Acts executed against the dialect of the law is void AB INITIO. Thus, the above proposal and agreeing to such proposal are illegal from the beginning.

Please be reminded that you will not be audited for 2015 but how about for the next 4 years. Are you still be exempted from Letter of Authority? The authority to investigate you as far as local government taxes is concerned has a prescription period of 5 years. DON'T BE FOOLED BY THIS FALSE PROMISE. Please as a written confirmation from this local official and give it to ETM Tax Agent Office so that proper case may be filed against him at the Office of the Ombudsman.

Please pass this message to others.

0922 8010922 and 0998 9793922

Now, an unconfirmed information roamed around that these local government officials are now employing a new tactics that is IF YOU WILL VOLUNTARILY INCREASE YOUR ACTUAL SALES FOR 2014 BY AT LEAST 30% (1,000,000 will be 1,300,000), YOU WILL BE SPARED OF BEING AUDITED FOR 2015.

This proposal is contrary to law (Section131(n), Local Government Code; Solution Indebiti, Article 213, Revised Penal Code). Acts executed against the dialect of the law is void AB INITIO. Thus, the above proposal and agreeing to such proposal are illegal from the beginning.

Please be reminded that you will not be audited for 2015 but how about for the next 4 years. Are you still be exempted from Letter of Authority? The authority to investigate you as far as local government taxes is concerned has a prescription period of 5 years. DON'T BE FOOLED BY THIS FALSE PROMISE. Please as a written confirmation from this local official and give it to ETM Tax Agent Office so that proper case may be filed against him at the Office of the Ombudsman.

Please pass this message to others.

0922 8010922 and 0998 9793922

Wednesday 14 January 2015

Without Education, Tax Evasion. With Education, Tax Avoidance... -EmelinoTMaestro.com

WETE, WETA lang iyan...

facebook.com/EmelinoTMaestro

"If a man empties his purse into his head, no man can take it away from him. An investment in knowledge always pays the best interest. - Benjamin Franklin"

To all ETM staff and students, let us spread the new tax campaign slogan for TAXNOCRATs and those who are willing to be part of an emerging and profitable industry of teaching and helping taxpayers in coping with the challenges and opportunities in Philippine taxation.

Without Education, Tax Evasion. With Education, Tax Avoidance.

WETE, WETA lang iyan. Getz mo.

There will be a General Assembly of all ETM students which will be held in February 2015.. Please register early if you want to enormously be blessed with opportunities and clients.

facebook.com/EmelinoTMaestro

"If a man empties his purse into his head, no man can take it away from him. An investment in knowledge always pays the best interest. - Benjamin Franklin"

To all ETM staff and students, let us spread the new tax campaign slogan for TAXNOCRATs and those who are willing to be part of an emerging and profitable industry of teaching and helping taxpayers in coping with the challenges and opportunities in Philippine taxation.

Without Education, Tax Evasion. With Education, Tax Avoidance.

WETE, WETA lang iyan. Getz mo.

There will be a General Assembly of all ETM students which will be held in February 2015.. Please register early if you want to enormously be blessed with opportunities and clients.

Mayor's Permit, License Fee and City Tax ... Trust but Verify -- facebook.com/Kataxpayer

Double Taxation in Local Taxation

www.emelinotmaestro.com

A story has been told that many local officials are taking advantage of the lack of knowledge and knowhow of taxpayers who are renewing the Mayor's Permit and paying the so-called 'City Tax', 'License Fee' or 'Local Tax'

Here are their two (2) classic modus operandi. First, if you will declare a gross sale/receipt for the past year of P1,000,000, these local officials shall increase it to P1,200,000. Thus, you are paying the local government more than 20% that you really have to pay and the last is that when you have a branch or so, they will place a small 'City Tax' in your Branch bill although the same 'City Tax' has been incorporated and included in your Head Office bill.

If you know somebody who are being victimized by these local officials of any Local Government Unit such as Manila, Quezon City, Makati, etc., please help them and refer them to us so that we can help them on how to handle these malicious acts.

Our advise is FREE OF CHARGE.

Please call Dhen, Marice or Divine at 0922 8010922.

ETM Tax Agent Office

Unit 419 Corporate 101 Mother Ignacia Quezon City

Thanks for sharing this to others.

www.emelinotmaestro.com

A story has been told that many local officials are taking advantage of the lack of knowledge and knowhow of taxpayers who are renewing the Mayor's Permit and paying the so-called 'City Tax', 'License Fee' or 'Local Tax'

Here are their two (2) classic modus operandi. First, if you will declare a gross sale/receipt for the past year of P1,000,000, these local officials shall increase it to P1,200,000. Thus, you are paying the local government more than 20% that you really have to pay and the last is that when you have a branch or so, they will place a small 'City Tax' in your Branch bill although the same 'City Tax' has been incorporated and included in your Head Office bill.

If you know somebody who are being victimized by these local officials of any Local Government Unit such as Manila, Quezon City, Makati, etc., please help them and refer them to us so that we can help them on how to handle these malicious acts.

Our advise is FREE OF CHARGE.

Please call Dhen, Marice or Divine at 0922 8010922.

ETM Tax Agent Office

Unit 419 Corporate 101 Mother Ignacia Quezon City

Thanks for sharing this to others.

Friday 9 January 2015

How to avoid criminal prosecution and payment of deficiency tax? - EmelinoTMaestro.com

Court of Tax Appeals

Facebook.com/EmelinoTMaestro

How to win a criminal case and not to pay the deficiency tax assessment?

Success and True Story

People of the Philippines vs. Katherine M. Lim and Edelyn Coronacion,

CTA, Crim. Case No.0-113, December 12, 2011

The taxpayer informed the Bureau of Internal Revenue (BIR) that it has decided to permanently close and cease operations effective September 2005. Tax Verification Notice was issued by the BIR to verify supporting documents and pertinent records relative to the taxpayer’s closure of business. The verification prompted the issuance of the assessment for alleged value-added tax (VAT) deficiency, which in turn, led to the filing of the case, against accused, as the alleged responsible officers of taxpayer. The accused asserted that they did not receive the Preliminary Assessment Notice (PAN) and Final Assessment Notice (FAN). Since accused supposedly never received any of the assessment notices, no willfulness could be attributed as such and in fact they were not even aware of the legal and factual bases of the tax assessment. The Court ruled that due process requires that the receipt of the PAN be proven by the prosecution for the accused to be held liable under Section 255 of NIRC. The accused should be acquitted because prosecution failed to prove beyond reasonable doubt the essential elements of the offense and also failed to show that the PAN was indeed personally received by the accused. Considering that the prosecution failed to prove that the PAN was received by the accused, the assessment made by the CIR is void. It is well-settled that a void assessment bears no fruit. Thus, no civil liability arises in this

case.

LEGAL LESSON. Inform the revenue officers including the BIR Chief that all notices and communications must personally be sent to and received by the you and no one in your organisation has the power and authority to represent and receive any notice or communication coming from the BIR Chief and any of her subordinates.

Facebook.com/EmelinoTMaestro

How to win a criminal case and not to pay the deficiency tax assessment?

Success and True Story

People of the Philippines vs. Katherine M. Lim and Edelyn Coronacion,

CTA, Crim. Case No.0-113, December 12, 2011

The taxpayer informed the Bureau of Internal Revenue (BIR) that it has decided to permanently close and cease operations effective September 2005. Tax Verification Notice was issued by the BIR to verify supporting documents and pertinent records relative to the taxpayer’s closure of business. The verification prompted the issuance of the assessment for alleged value-added tax (VAT) deficiency, which in turn, led to the filing of the case, against accused, as the alleged responsible officers of taxpayer. The accused asserted that they did not receive the Preliminary Assessment Notice (PAN) and Final Assessment Notice (FAN). Since accused supposedly never received any of the assessment notices, no willfulness could be attributed as such and in fact they were not even aware of the legal and factual bases of the tax assessment. The Court ruled that due process requires that the receipt of the PAN be proven by the prosecution for the accused to be held liable under Section 255 of NIRC. The accused should be acquitted because prosecution failed to prove beyond reasonable doubt the essential elements of the offense and also failed to show that the PAN was indeed personally received by the accused. Considering that the prosecution failed to prove that the PAN was received by the accused, the assessment made by the CIR is void. It is well-settled that a void assessment bears no fruit. Thus, no civil liability arises in this

case.

LEGAL LESSON. Inform the revenue officers including the BIR Chief that all notices and communications must personally be sent to and received by the you and no one in your organisation has the power and authority to represent and receive any notice or communication coming from the BIR Chief and any of her subordinates.

IF YOU NEED AN EXPERT ADVISE AND PLANNING ON HOW TO WIN A CASE OR AN ASSESSMENT NOTICE THAT THE BIR ISSUED TO YOU, PLEASE DON'T DELAY CALLING KATAX ETM @ 09228010922

or email him at 09989793922@MaestroTaxation.org.

Tuesday 6 January 2015

Abrupt 20% in Sales and Revenues Maliciously Performed by Local Officials of many Local Government Units

If this happened to you, please contact ETM Tax Agent Office and it will help and assist you without fee or favour in return.

Facebook.com/EmelinoTMaestro.com & EmelinoTMaestro.com & Facebook.com/Kataxpayer

After you executed a Tax Declaration Sheet or an Application for Mayor's Permit Renewal wherein you placed for example a sale of 1,000,000 pesos and are presenting the same to a local official (for example of Quezon City Local Government Unit) for validation and approval, you might be surprised that this local official will immediately increase your reported sales from 1,000,000 pesos to 1,200,000 pesos or higher. If you would ask him his reason, he would tell you that it is the policy and the instruction of the City Treasurer. Now, little knowledge in local taxation would dictate that you just following this type of oppression. Please be reminded that the City Treasurer has no legal or inherent right to increase what you declared. Please be reminded that your Tax Declaration Sheet or Application for Mayor's Permit Renewal are executed in the pain of PERJURY. If you will accept that their assessment is true and correct and your declaration is untrue and perjurious, then you will CRIMINALLY be charged later on in the Court of Law.

Don't let them make you STUPID. Fight for your right. This is your right ... Section 131(n), Local Government Code of 1991 (RA 7160).. "Gross Sales or Receipts" include the total amount of money or its equivalent representing the contract price, compensation or service fee, including the amount charged or materials supplied with the services and deposits or advance payments actually or constructively received during the taxable quarter for the services performed or to be performed for another person excluding discounts if determinable at the time of sales, sales return, excise tax, and value-added tax (VAT)"

Therefore, nobody, even the Mayor, has the legal or inherent right to change what your true and correct sales transactions tell you.

Just call or email Divine, Marice, Juliet and Dhen of ETM Tax Agent Office and they will help you.. Thanks for sharing this to others.

Facebook.com/EmelinoTMaestro.com & EmelinoTMaestro.com & Facebook.com/Kataxpayer

After you executed a Tax Declaration Sheet or an Application for Mayor's Permit Renewal wherein you placed for example a sale of 1,000,000 pesos and are presenting the same to a local official (for example of Quezon City Local Government Unit) for validation and approval, you might be surprised that this local official will immediately increase your reported sales from 1,000,000 pesos to 1,200,000 pesos or higher. If you would ask him his reason, he would tell you that it is the policy and the instruction of the City Treasurer. Now, little knowledge in local taxation would dictate that you just following this type of oppression. Please be reminded that the City Treasurer has no legal or inherent right to increase what you declared. Please be reminded that your Tax Declaration Sheet or Application for Mayor's Permit Renewal are executed in the pain of PERJURY. If you will accept that their assessment is true and correct and your declaration is untrue and perjurious, then you will CRIMINALLY be charged later on in the Court of Law.

Don't let them make you STUPID. Fight for your right. This is your right ... Section 131(n), Local Government Code of 1991 (RA 7160).. "Gross Sales or Receipts" include the total amount of money or its equivalent representing the contract price, compensation or service fee, including the amount charged or materials supplied with the services and deposits or advance payments actually or constructively received during the taxable quarter for the services performed or to be performed for another person excluding discounts if determinable at the time of sales, sales return, excise tax, and value-added tax (VAT)"

Therefore, nobody, even the Mayor, has the legal or inherent right to change what your true and correct sales transactions tell you.

Just call or email Divine, Marice, Juliet and Dhen of ETM Tax Agent Office and they will help you.. Thanks for sharing this to others.

Barangay Clearance or Certificate - Facebook.com/Kataxpayer

Before you may renew your Mayor's Permit and Business License from any Local Government Unit, it is a requirement that you must first secure a Barangay Clearance or Barangay Certificate where your place of office, plant or branch is located.

However, due to graft and corruption that already reached the Barangay level, officers and employees are now using the leverage of delaying your Barangay Clearance or Barangay Certificate in order for you to come across what they want you to do that is to BRIBE them.

Katax ETM or facebook.com/EmelinoTMaestro is here to help and assist you about the thing that you have to do in order to deprive and deny these public officers and employees do their immoral intentions. First, before going to your Barangay Hall, prepare a letter-request. Second, attach thereto your previous year's Clearance, and Finally, have these two documents stamped and signed 'received' by the concerned Barangay official.

If after the seven (7) working days lapsed, and the concerned Barangay official failed to issue you a valid Barangay Clearance or Certificate, your letter-request is a valid document that must be attached to your Application for Mayor's Permit Renewal.

For your information Section 152, Republic Act No. 7160 says that THE APPLICATION FOR CLEARANCE SHALL BE ACTED UPON WITHIN SEVEN (7) WORKING DAYS FROM THE FILING THEREOF, AND IN THE EVENT THAT THE CLEARANCE IS NOT ISSUED WITHIN THE SAID PERIOD, THE CITY OR MUNICIPALITY MAY ISSUE THE SAID LICENSE OR PERMIT.

Thanks for sharing this to other local taxpayers.

However, due to graft and corruption that already reached the Barangay level, officers and employees are now using the leverage of delaying your Barangay Clearance or Barangay Certificate in order for you to come across what they want you to do that is to BRIBE them.

Katax ETM or facebook.com/EmelinoTMaestro is here to help and assist you about the thing that you have to do in order to deprive and deny these public officers and employees do their immoral intentions. First, before going to your Barangay Hall, prepare a letter-request. Second, attach thereto your previous year's Clearance, and Finally, have these two documents stamped and signed 'received' by the concerned Barangay official.

If after the seven (7) working days lapsed, and the concerned Barangay official failed to issue you a valid Barangay Clearance or Certificate, your letter-request is a valid document that must be attached to your Application for Mayor's Permit Renewal.

For your information Section 152, Republic Act No. 7160 says that THE APPLICATION FOR CLEARANCE SHALL BE ACTED UPON WITHIN SEVEN (7) WORKING DAYS FROM THE FILING THEREOF, AND IN THE EVENT THAT THE CLEARANCE IS NOT ISSUED WITHIN THE SAID PERIOD, THE CITY OR MUNICIPALITY MAY ISSUE THE SAID LICENSE OR PERMIT.

Thanks for sharing this to other local taxpayers.

When dividend tax should be remitted to the BIR - facebook.com/EmelinoTMaestro

Reckoning Point to Remit Dividend Tax

Facebook.com/Kataxpayer

Facebook.com/Kataxpayer

Many unholy minded revenue officers insisted that a payment to a stockholder is a subject matter of DIVIDEND TAX (10%). Thus, the payor - the Corporation must remit it to the BIR not later than the 10th day of following month from its payment.

To stop this non-sense harassment, the Court of Tax Appeals, in the case of CIR vs. United Distribution Management, Inc., CTA EB No. 974, October 30, 2013, says that the following requisites must be present: (a.) The concerned corporation must have earnings or profits; (b.) Such corporate earnings or profits must be set aside, declared, and ordered by the directors to be paid to the stockholders, on demand or at a fixed time; and (c.) The distribution or payment of said corporate earnings or profits is in money or other property. Therefore, any money received by a stockholder, even if he is a stockholder of the corporation, does not automatically make the payment in the nature of dividends, if the said requisites are not present.

Please email Katax at 09228010922@MaestroTaxation.org for your inquiries and suggestions.

Facebook.com/Kataxpayer

Facebook.com/KataxpayerMany unholy minded revenue officers insisted that a payment to a stockholder is a subject matter of DIVIDEND TAX (10%). Thus, the payor - the Corporation must remit it to the BIR not later than the 10th day of following month from its payment.

To stop this non-sense harassment, the Court of Tax Appeals, in the case of CIR vs. United Distribution Management, Inc., CTA EB No. 974, October 30, 2013, says that the following requisites must be present: (a.) The concerned corporation must have earnings or profits; (b.) Such corporate earnings or profits must be set aside, declared, and ordered by the directors to be paid to the stockholders, on demand or at a fixed time; and (c.) The distribution or payment of said corporate earnings or profits is in money or other property. Therefore, any money received by a stockholder, even if he is a stockholder of the corporation, does not automatically make the payment in the nature of dividends, if the said requisites are not present.

Please email Katax at 09228010922@MaestroTaxation.org for your inquiries and suggestions.

What is TAXABLE INCOME in the eyes of an EMPLOYEE - Facebook.com/Kataxpayer

Taxable Income in the eyes of an Employee

facebook.com/EmelinoTMaestro

facebook.com/EmelinoTMaestro

Employee's taxable income is the difference between the gross compensation he received from his employer less his personal exemption (50k), additional exemption (max 100k for 4 kids), health premium (max 2.4k), SSS contribution, PHIC contribution, HDMF contribution, union due, de minimis, and 13th month pay & other incentives not exceeding the current threshold.

All CPA-board takers, who are willing to undergo comprehensive trainings to be either a TAXNOCRAT or TAXNICIAN, are invited to log their names, mobile number and email address in the space call 'Write a comment...' of the above facebook account.

facebook.com/EmelinoTMaestro

facebook.com/EmelinoTMaestroEmployee's taxable income is the difference between the gross compensation he received from his employer less his personal exemption (50k), additional exemption (max 100k for 4 kids), health premium (max 2.4k), SSS contribution, PHIC contribution, HDMF contribution, union due, de minimis, and 13th month pay & other incentives not exceeding the current threshold.

All CPA-board takers, who are willing to undergo comprehensive trainings to be either a TAXNOCRAT or TAXNICIAN, are invited to log their names, mobile number and email address in the space call 'Write a comment...' of the above facebook account.

Monday 5 January 2015

How to support your VAT-zero sales? Facebook.com/EmelinoTMaestro

"Fill up your mind. Free your heart."

Learn 'Intro to Tax Accounting' for Free

Feb 3, 4 and 5, 2015...

Register Now before Seats Run Out.

0998-9793922, 02-4393918

In the case of Chevron Holdings, Inc. vs. Commissioner of Internal Revenue, CTA EB Case No. 940, May 06, 2014, the Court of Tax Appeals has set up the requirements in proving a VAT-zero sales, "One of the requisites for sales of services to be VAT zero-rated is that the recipient of such services is doing business outside the Philippines. To be considered a non-resident foreign corporation doing business outside the Philippines, the entity must be supported by both SEC certificate of Non-Registration and Certificate/Articles of foreign incorporation/association or printed screenshots of US SEC website showing the state/province/country where the entity was organized."

Learn 'Intro to Tax Accounting' for Free

Feb 3, 4 and 5, 2015...

Register Now before Seats Run Out.

0998-9793922, 02-4393918

In the case of Chevron Holdings, Inc. vs. Commissioner of Internal Revenue, CTA EB Case No. 940, May 06, 2014, the Court of Tax Appeals has set up the requirements in proving a VAT-zero sales, "One of the requisites for sales of services to be VAT zero-rated is that the recipient of such services is doing business outside the Philippines. To be considered a non-resident foreign corporation doing business outside the Philippines, the entity must be supported by both SEC certificate of Non-Registration and Certificate/Articles of foreign incorporation/association or printed screenshots of US SEC website showing the state/province/country where the entity was organized."

Sunday 4 January 2015

I saw the SIGN and it OPENED my MIND TO A BETTER FUTURE - EMELINOTMAESTRO.COM

A Letter Notice's FLOD and FAN is enforceable even without Letter of Authority. - Facebook.com/EmelinoTMaestro

In the case of Medicard Philippines, Inc. vs. Commissioner of Internal Revenue, CTA Case No. 7948, June 5, 2014, a precedent case has been laid down, ... Taxpayer is engaged in the business of developing and promoting prepaid medical, heath maintenance, and related services (health maintenance organization; HMO). Finding discrepancies between its Income Tax and VAT Returns for the year 2006, the BIR issued to the taxpayer a Letter Notice (LN). This was followed by a Preliminary Assessment Notice (PAN) and later a Formal Assessment Notice (FAN) for deficiency VAT.

In the case of Medicard Philippines, Inc. vs. Commissioner of Internal Revenue, CTA Case No. 7948, June 5, 2014, a precedent case has been laid down, ... Taxpayer is engaged in the business of developing and promoting prepaid medical, heath maintenance, and related services (health maintenance organization; HMO). Finding discrepancies between its Income Tax and VAT Returns for the year 2006, the BIR issued to the taxpayer a Letter Notice (LN). This was followed by a Preliminary Assessment Notice (PAN) and later a Formal Assessment Notice (FAN) for deficiency VAT.

The taxpayer assailed the validity of the assessment by arguing that the assessment is a nullity on the ground that it was issued without Letter of Authority (eLA) authorizing the examination of taxpayer’s books of accounts and accounting records. The CTA ruled against the taxpayer. According to the CTA, to declare that the BIR should at all times necessarily issue an eLA is to deprive her of the vast powers given her by the National Internal Revenue Code (NIRC) to make assessments and collect the right amount of taxes. While the examination of taxpayers by a revenue officer working under an eLA is one way by which the BIR collects deficiency taxes under section 13 of the NICR, section 6 does not in any way limit the power of the BIR to determine tax deficiencies only through the issuance of eLA.

A BIR Ruling that mandates you to prepare and attach a TAX BASIS FINANCIAL STATEMENTS to your Income Tax Return is presented below. Please share this RELEVANT information to others.

FREE 'INTRO TO TAX ACCOUNTING' WORKSHOP SEMINAR

to learn more the availment procedures, please click this link http://kataxclub.blogspot.com/2015/01/sign-symbol-signal-that-tax.html

Thanks Katax

The term Katax means a street-smart taxpayer (just like you)

In the case of Medicard Philippines, Inc. vs. Commissioner of Internal Revenue, CTA Case No. 7948, June 5, 2014, a precedent case has been laid down, ... Taxpayer is engaged in the business of developing and promoting prepaid medical, heath maintenance, and related services (health maintenance organization; HMO). Finding discrepancies between its Income Tax and VAT Returns for the year 2006, the BIR issued to the taxpayer a Letter Notice (LN). This was followed by a Preliminary Assessment Notice (PAN) and later a Formal Assessment Notice (FAN) for deficiency VAT.

In the case of Medicard Philippines, Inc. vs. Commissioner of Internal Revenue, CTA Case No. 7948, June 5, 2014, a precedent case has been laid down, ... Taxpayer is engaged in the business of developing and promoting prepaid medical, heath maintenance, and related services (health maintenance organization; HMO). Finding discrepancies between its Income Tax and VAT Returns for the year 2006, the BIR issued to the taxpayer a Letter Notice (LN). This was followed by a Preliminary Assessment Notice (PAN) and later a Formal Assessment Notice (FAN) for deficiency VAT.The taxpayer assailed the validity of the assessment by arguing that the assessment is a nullity on the ground that it was issued without Letter of Authority (eLA) authorizing the examination of taxpayer’s books of accounts and accounting records. The CTA ruled against the taxpayer. According to the CTA, to declare that the BIR should at all times necessarily issue an eLA is to deprive her of the vast powers given her by the National Internal Revenue Code (NIRC) to make assessments and collect the right amount of taxes. While the examination of taxpayers by a revenue officer working under an eLA is one way by which the BIR collects deficiency taxes under section 13 of the NICR, section 6 does not in any way limit the power of the BIR to determine tax deficiencies only through the issuance of eLA.

A BIR Ruling that mandates you to prepare and attach a TAX BASIS FINANCIAL STATEMENTS to your Income Tax Return is presented below. Please share this RELEVANT information to others.

FREE 'INTRO TO TAX ACCOUNTING' WORKSHOP SEMINAR

to learn more the availment procedures, please click this link http://kataxclub.blogspot.com/2015/01/sign-symbol-signal-that-tax.html

Thanks Katax

The term Katax means a street-smart taxpayer (just like you)

Saturday 3 January 2015

Sign, Symbol, Signal that Tax Weaknesses are Present - Facebook.com/EmelinoTMaestro

by Facebook.com/Kataxpayer

January 3, 2015 by EmelinoTMaestro,

Tax Accounting Guru

Happy New Year to You and Your Family!

This new beginning may bring you closer to your best dreams and morally upright desires.

Katax ETM guarantees you that there is no guarantee that your business may not be BIR-investigated. But, he assures you that there is certain thing that you can do to soften the impact of a BIR audit investigation.

For the past 100 years, the BIR relied heavily on what you're submitting to it. And, it may be shocking to someone that the financial statements based on what your Certified Public Accountant or bookkeeper prepared for your signature and approval are the ONLY DATA that the BIR and its behaviourally challenged revenue officers need to check and verify if you're competent in handling your business transactions in accordance with the TAX CODE.

The only Sign, Symbol and Signal that the BIR and its personnel are looking is a statement that your financial statements are prepared using THE PHILIPPINE FINANCIAL REPORTING STANDARDS or Generally Accepted Accounting Principles. Once they've checked and verified such, then, they presumed that you're incompetent and an easy prey or victim to their unholy rituals and assaults.

It's you who are responsible for turning them from SERVANTS into SAINTS by the way you handle and manage them.... giving gifts, providing huge discounts, treating them as very important persons... (please be reminded that these people are your servants and not your bosses, managers, investors, bankers, and popes).

In order to STOP their harassment and maltreatment of you, Katax is giving you a chance to defend yourself, business and family and fight for what is morally right and legally correct.

Only few will be accepted... If you're a member of the Board, owner of a business, an accountant, a freelance bookkeeper, a lawyer, and a taxpayer who REALLY WANT TO MAKE A CHANGE ONCE IN YOUR LIFE and NEEDED SO URGENT that such change happens this year, Katax is willing to teach you "INTRO TO TAX ACCOUNTING"...

The 3-session seminar-training

The 3-session seminar-trainingis FREE OF CHARGE.

Just reimburse for the things

you shall be consuming such as

WT 653

VAT 144

Meals 500

Book 2,500

Room rental 200

Manpower used 500

Those who will register and pay before January 25, 2015, 5pm shall surely get reserve seats. Starting January 26, the regular rate of P20,000/pax shall be collected.

Seats are limited. Register and Pay NOW.

Event shall be on

Feb 3, 4, and 5, 2015,

2-5 pm

Subject to change

without notice and obligation,

and terms and conditions.

"Fill up your mind. Free your heart."

Subscribe to:

Posts (Atom)