NO PAYMENT RETURNS, REFUSED, P1K PENALTY, IMPOSED

June 8, 2013, Saturday

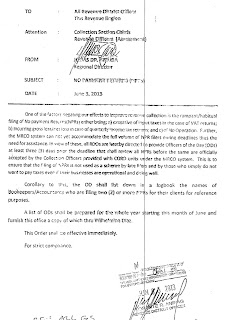

A copy of Regional Director Jonas Amora's Memorandum is shown herein wherein he instructed that the names of accountants and filers of No Payment Returns (NPR) shall be secured, kept, monitored and investigated.

He concluded that the NPR is being used to defraud the Philippine Government.

However, most of Revenue District Offices read his order differently and implemented it wildly.

Most of the Officers of the Day (OD) are doing the misfeasance and nonfeasance acts, viz;

1. soliciting the reason from the accountants and filers of NPR why the same is a no payment return which is contrary to law and public policy (Sections 13/270, NIRC)

2. failing and refusing to receive the NPR which is contrary to the Director's Memorandum, RR 2-98 and RA 9485

3. advising accountants/filers/taxpayers to replace the NPR with a With Payment Return (WPR) which is a direct intervention with their business affairs and the principle of solutio indebiti

Here is what you have to do in order not to be victimized, viz;

1. when filing a NPR, bring a witness

2. once rejected, prepare an incident report having the names of the OD, day, time and place and the exact exchanges of statements/talk

3. don't add any comment, opinion or anything that did not really happen

4. prepare a Legal Petition Notice addressed to the Director and BIR Commission (CIR) and attached thereto the NPR and Incident Report

5. file the LPN to the Office of the Director and CIR

According to the NIRC, the NPR is already considered received by the RDO having jurisdiction over the principal place of taxpayer's business if the above procedures had been complied completely.

Thanks for sharing your tax problems, Mr. Josel.

THE PICTURE OF THE BOOK CAN BE SEEN BY VIEWING THE POST 'AKLAT, LIBRE, PANLABAN, BIR CORRUPTION'

Good to remember that the objectives of a tax consultant is 1. to avoid criminal prosecution of his client, and

2. to reduce legally any existing and potential deficiency tax

Katax.ETM ...sawa na ... tinik sa dibdib... takot sa isip... tinanggap na.....tinanggal na.... lalabanan na ang kurap at kurapsiyon sa loob at labas ng BIR... gustong gusto na.... lumaya ..... sumaya..... maging mapayapa ang dibdib at isip sa blackmailing, bullying, bluffing, BIR...

Magsanib puwersa na tayo.. Mas marami.... May boses..Pinakikinggan... Sumali sa Taxpayer Club...

Balintawak event, June 28, 2013 .. To attend, please see the post "BIR, BRIBING, BAD"

Katax.ETM-mobile.... 0922 801 0922 o 921 6107

Email ..... kataxpayer@gmail.com

Salamat po.

No comments:

Post a Comment